A starry-skied memorial for Brad on Highway 62 about 50 miles east of Twentynine Palms.

Cats, charts, and politics

The Fed and the Treasury Department have announced a plan to make sure that all depositors at Silicon Valley Bank are made whole. Whatever the ultimate cost turns out to be, it will be funded by a levy on banks. Thus, there's no cost to taxpayers.

There's a little more to the plan, mostly to make it a little easier for other midsize regional banks to borrow money if jittery depositors start a run. On the upside, this is a fairly aggressive response which sends a message that financial authorities were concerned about contagion and wanted to put a hard stop to it. On the downside, it also sends a message that financial authorities are always going to bail out depositors regardless of whether their deposits are insured.

Without commenting on the justice of either of these messages, I want to add a couple of notes:

Finally, as an aside of sorts, people sometimes wonder how it is that Fed interest rate hikes slow down the economy. Sending big banks into receivership isn't the textbook answer, but it's not all that far away either. Lots of things are sensitive to interest rates—hurdle rates for new investment, home loans, auto loans, etc.—and higher interest rates slow them down and have a ripple effect throughout the economy. A bank that made a big bet on interest rates staying low is just a somewhat more dramatic example of this.

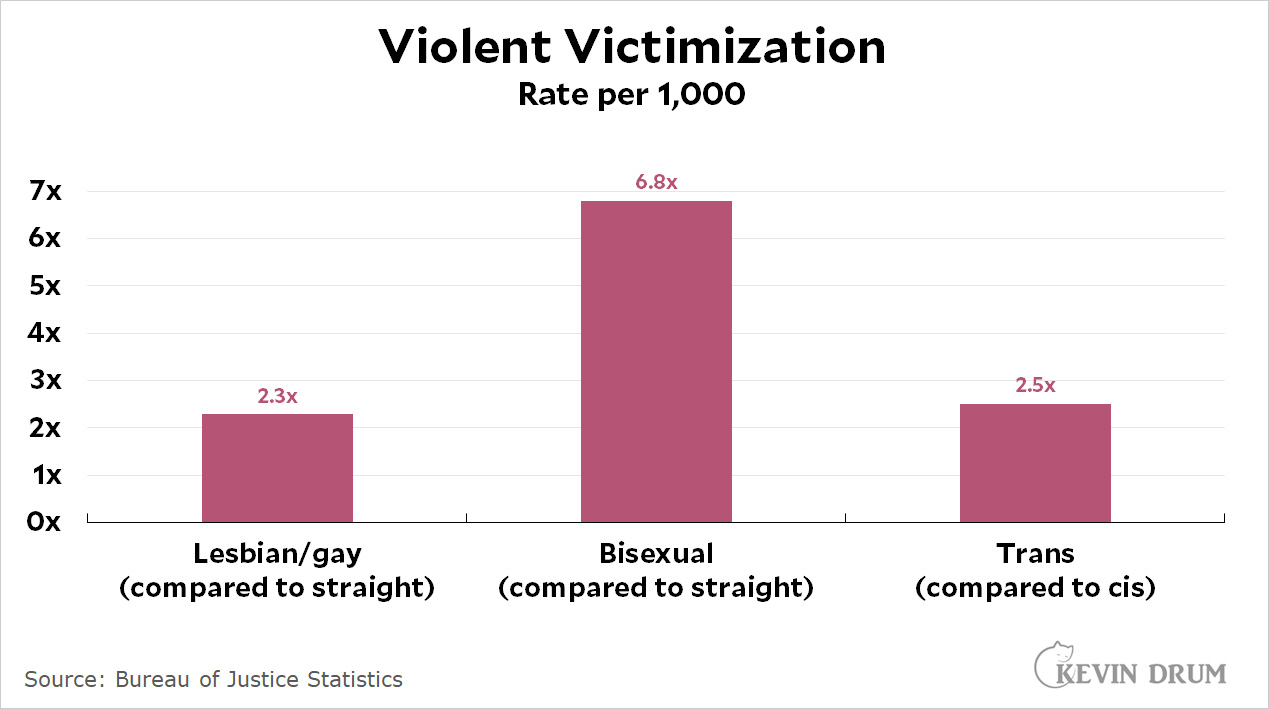

This is from a recent report written by the Bureau of Justice Statistics:

All of this is appalling, but why is crime against bisexual people so astronomically high? Why, for example, are bisexual people 8.7x times more likely to be robbed than straight people? Can someone school me?

All of this is appalling, but why is crime against bisexual people so astronomically high? Why, for example, are bisexual people 8.7x times more likely to be robbed than straight people? Can someone school me?

The Wall Street Journal explains today how panic about Silicon Valley Bank spread throughout Silicon Valley last week:

On Wednesday, the bank announced it had sold a chunk of its holdings at a loss and would sell a slug of stock to raise cash....Slack and WhatsApp groups lit up across the startup scene.

....“For startups, all roads lead to Silicon Valley Bank,” said Varun Badhwar, chief executive of Endor Labs....Mr. Badhwar had paid little attention to the bank’s situation until Thursday morning when, at around 10:30 a.m. California time, an employee noted on Endor’s Slack channel that SVB’s shares were in free fall.

....On Thursday morning, founders and CEOs were posting tweets about SVB’s financial woes in private Slack channels. Mr. Rizqi decided to move a portion of his money, but the online banking portal wasn’t working. He spent a few hours furiously refreshing his browser. By afternoon, Slack was buzzing with messages from people moving all their money out of SVB.

I tried to warn you that Slack was dangerous and uncontrollable, and now look what happened. It destroyed Silicon Valley's favorite bank. Now will you listen to me?

A lot of people are becoming instant experts this weekend on the subject of deposit insurance, including the question of what to do if you have cash in excess of the $250,000 FDIC limit.

There are ways to deal with this, including (obviously) opening multiple bank accounts. But that's not really the answer. The real answer is that people and corporations with lots of cash don't keep it in a bank account in the first place. They invest it.

Apple Corp., for example, famously has nearly $200 billion in "cash"—i.e., undistributed profits. Here's where that money is held:

As you can see, 90% of their $178 billion is held in mutual funds, treasurys, commercial paper, etc. And this is true of all corporations big enough to have substantial amounts of cash. They put it to work, while keeping around only enough to fund routine daily operations.

So Apple has "only" about $18 billion in actual cash (or equivalents). I don't know what they do with it, but there are plenty of fairly simple options for making sure it's safe, the most obvious of which is to keep it in multiple accounts at multiple banks.

This is corporate finance 101 and it's what large depositors at Silicon Valley Bank have done. That is, it's what they've done unless their CFOs are idiots, in which case they deserve to take a bath just as a way of teaching them a lesson.

Beyond that, SVB may be in receivership now, but that doesn't mean it lost everything. In fact, it was pretty well capitalized and its remaining assets are probably enough to cover something like 90-100% of their deposits. So folks with large amounts of money in SVB will almost certainly be made whole, or very close to it.

And beyond even that, the FDIC will make a large share of deposits (probably 50% or more) available at start of business on Monday. This is enough for everyone to make payroll, buy more paperclips, and so forth. So to summarize:

If the entire banking system were in some kind of systemic trouble, as in 1997 or 2008, that would be one thing. But it's not—or at least, it doesn't seem to be.¹ This is just a single bank failure, and it's likely that virtually no one will lose more than a small amount of money.

So calm down.

¹And if it is, we have way bigger things to worry about than SVB.

Relations between Saudi Arabia and Iran have been on a roller coaster for the past four decades. Relations were bad after the Iranian Revolution but improved during the Gulf War. They soured again when Iran began pursuing a nuclear program and then again after an Iranian plot to assassinate the Saudi ambassador to the US was uncovered. Finally, Saudi Arabia cut off diplomatic relations with Iran in 2016 after Iran executed a Saudi cleric and then ransacked the Saudi embassy. Relations have remained tense during the long war in Yemen, which featured brutal fighting between Saudi and Iranian proxies.

Then, yesterday, the two countries announced they were restoring diplomatic ties. This was unexpected but not surprising. It's hardly the first time they've agreed to bury the hatchet, after all.

But the announcement got more than the usual attention because it was brokered by China. China! Why not the US? Were we losing our historic influence over the Middle East?

I wish. The reason we didn't broker the agreement is because we have no diplomatic relations with Iran. US diplomats aren't allowed to talk or interact with their Iranian counterparts in any way. They can't so much as say hello during coffee breaks at the UN. That makes us a poor choice of go-between.

And that's why the US wasn't involved in this latest bit of micro-negotiation in the Middle East.

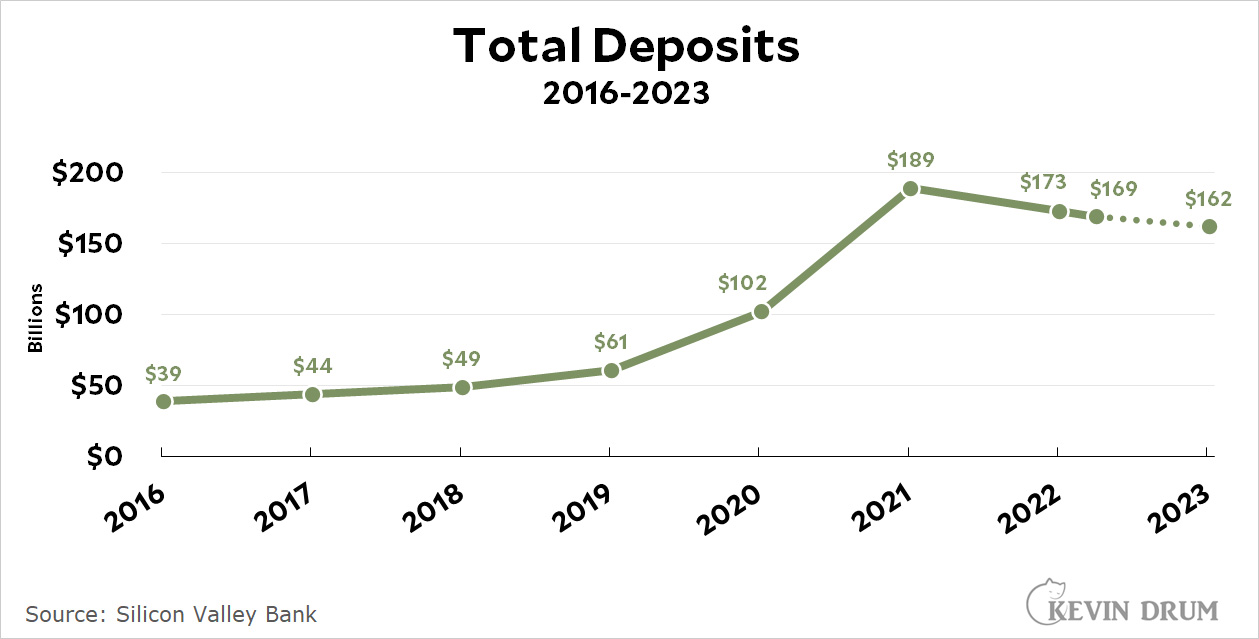

I don't mind saying that I'm a little confused about the collapse of Silicon Valley Bank. Here's some basic financial history:

After a huge runup during the tech boom of 2020-21, deposits slowly fell back to earth in 2022, reaching $169 billion in February 2023.

After a huge runup during the tech boom of 2020-21, deposits slowly fell back to earth in 2022, reaching $169 billion in February 2023.

Since the start of 2022, SVB has seen withdrawals of $76 billion in client funds (through February of 2023).

SVB's stock performance skyrocketed during the deposit boom and then reverted to trend in 2022. Their stock price recovered a bit in January and then fell slightly in February.

All of this looks bad but not disastrous. In addition, SVB had $91 billion tied up in long-term bonds that had lost about $15 billion thanks to the Fed's recent surge in interest rates. However, those bonds were marked as Hold to Maturity, which means the loss didn't show up on SVB's accounts—and wouldn't for many years.¹

All of this was well known at the beginning of March. However, although the portfolio loss made people nervous, neither investors nor regulators seemed to be panicking. But then things started to roll downhill.

March 8: SVB releases a mid-quarter update stating that withdrawal activity had remained heavy and they had therefore sold $21 billion worth of their ATS holdings² at a loss of $2 billion. This provided them with $19 billion in cash and a paper loss that would impact earnings. At the same time they announced a small capital raise of about $2 billion.

March 9: Moody's downgrades SVB from A3 to Baa1. This is technically a small downgrade, but the change from A to B restricts the ability of many funds to hold SVB's stock. Shortly after this, Peter Thiel's VC fund, along with others, recommends that clients pull their money from SVB. This results in a $42 billion bank run.

March 10: SVB is closed by the FDIC and put into receivership.

The question is this: Was SVB management reckless in putting a huge amount of their reserves into a single basket (long-term government and mortgage bonds) that were technically safe but sensitive to interest rates, even while knowing that their deposit base was very homogeneous (tech startups) and therefore volatile?³

Or was this a reasonable decision that did poorly in the short term but didn't affect SVB's books and left them in fairly good health? If this is the case, the real problem was an insane bank run on Thursday of a size that no bank could survive.

But there's more. Even if SVB didn't make any big mistakes, did they screw up their mid-quarter review and end up spooking everyone? If so, what exactly did they do wrong? And why did they bother with the capital raise, which has a whiff of panic to it but wouldn't have produced enough money to really matter?

I remain up in the air about this. As near as I can tell, SVB was very well capitalized in general and there's no reason to think that stricter regulations would have changed anything. It seems as if there's something missing here that would help explain what really happened. I guess I'll just have to wait.

¹In fact, maybe never. The bonds will regain their value when the Fed eventually lowers interest rates, and if that happens before the redemption date of the bond then the bond portfolio will end up just fine.

²ATS = Available to Sell, which is just what it sounds like. Assets that are designated ATS are marked to market every quarter, so their gains and losses immediately affect the bank's balance sheet.

HTM = Hold to Maturity. The bank intends to hold these assets to maturity, so short-term changes in value don't affect the balance sheet. Gains or losses are recorded only when the bonds mature and are redeemed.

³For example: If the tech sector slumped—which it did—then flows of VC money into new startups would decline—which they did—and therefore fewer startups would have big chunks of cash to deposit into SVB—which also happened—and in addition, since VC funding had dried up, startups would need to withdraw money from SVB to make payroll and cover all their normal expenses.

If you're highly exposed to a single industry, you need to be prepared for a slump in that industry. It's not clear if SVB was.

Sid Pandiya, a 22-year-old student at UCLA, has discovered that remote work "can get really isolating and boring.” His answer:

Pandiya came up with Kona, a software application aimed at making Slack more than a chatroom focused on tasks and

deadlines. Kona greets its users every day with a pop-up that asks a simple yet radical question: how are you feeling?

Employees select a red, yellow or green heart, and are encouraged to expand on their response with words that their teammates can see. Fellow workers can commiserate or offer one another help. Managers gain insight into the challenges that members of their team are facing. HR is able to review an anonymized, aggregated version of the data, ideally with the aim to provide solutions.

Well, that's it: the American workplace is now officially a hellscape. As if Slack weren't bad enough by itself, Kona now promises to turn it into a 24/7 bitch session about whether you really feel like working today. If your cat died or your roommate left a sink of dirty dishes for you to clean, your fellow workers can now spend the morning commiserating and trying to make you feel better.

I'm sure this will do wonders for everyone's mental health. Alternatively, of course, we could all dump Slack and make everyone come into the office in person, where work won't be isolating in the first place.

But nah. That's crazy talk.

Let's give the furballs a break this week and instead bring in a foreign star to gawk at. I found this little guy in a tiny little park in Les Andelys, France, where he was puttering around and begging for attention. He allowed me to provide that attention, but eventually got bored and curled up on the picnic table in the background.

Hey, remember that Cochrane meta-study showing that masks don't work? The Cochrane folks have apologized and explained what the study really showed:

Got that?