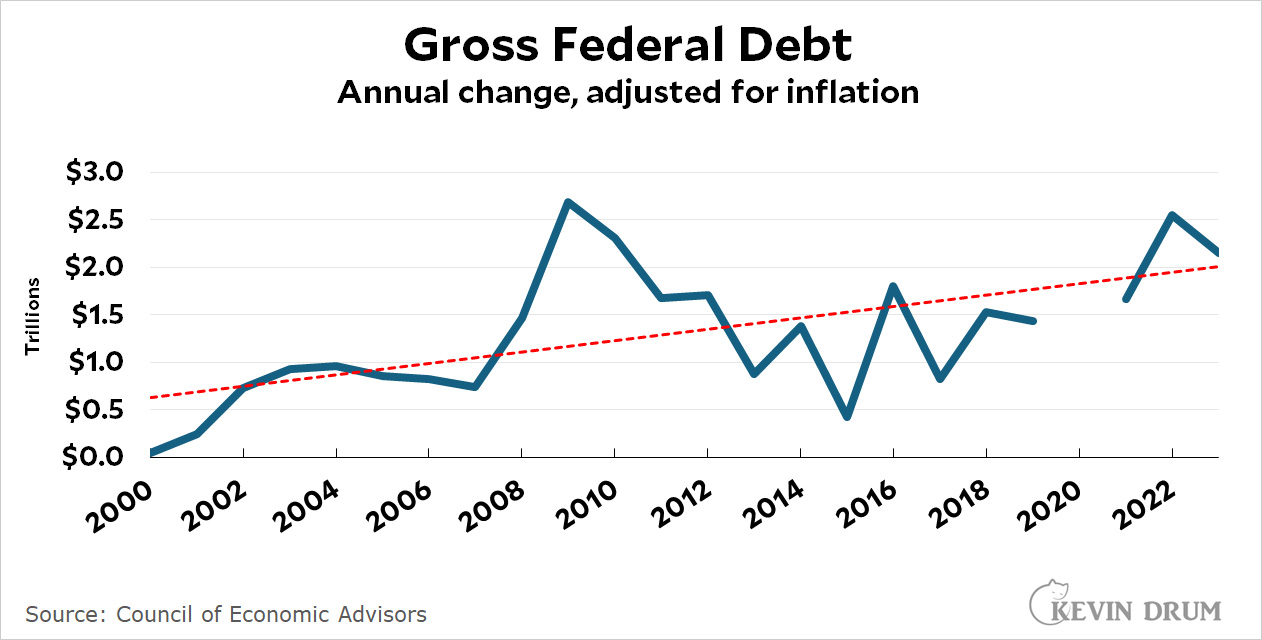

David Brooks has a remarkable column in the New York Times today dedicated to one thing: our rising national debt. The reason it's remarkable has nothing to do with the subject matter. I'm not a big deficit hawk, but the long and steady rise in the national debt is at least concerning:

Even after removing the pandemic spike, the trendline is pretty clear: the national debt is now growing $2 trillion per year and shows no particular sign of slowing down.

Even after removing the pandemic spike, the trendline is pretty clear: the national debt is now growing $2 trillion per year and shows no particular sign of slowing down.

This is not sustainable forever, so it's hardly remarkable that Brooks is worried about it. What's remarkable is that in the entire column he mentions tax increases only once and in passing. Then there's this:

Ultimately responsibility lies with the voters. In the 1990s, Americans saw how high government debt was raising their interest rates. Voters put tremendous pressure on politicians to get the fiscal house in order. Along came Ross Perot and deficit reduction plans under Presidents George H.W. Bush and Bill Clinton. Voters today have not yet made that connection. When they do, I suspect the political landscape will shift massively.

Again, no mention that these "deficit reduction plans" both involved higher taxes. But everyone who's not merely shilling for Republicans knows this is the only way to rein in the deficit. You could completely eliminate Medicaid and the entire domestic budget and half the defense budget.......and you still wouldn't cut the annual deficit to zero.

Everyone knows this. Federal spending isn't rising because Congress is out of control. It's rising because we have to spend more money on old people, something we've known forever. There's nothing anyone can do about this.

So if you're worried about the mounting national debt—and you should be, at least a little bit—there's only one way to reduce it: tax hikes. Not huge ones, but not tiny ones either. That's just the way it is. No one serious can avoid it.

If you put the military budget, benefits for retired military, debt service on money borrowed for military adventurism (e.g. Iraq/Afghanistan), bomb work at DOE, clandestine services and ops at the NSA/CIA, special appropriations for bombs/ammo for foreign countries like Ukraine and Israel, etc etc. into a big pile, what fraction of the federal budget does this make? Please don't include Social Security / Medicare, etc, which are directly funded from payroll taxes. If the feds "need more money" then this is why.

The taxes on the wealthy have dropped like a rock over the last decades, but I don't see this being reversed any time soon despite a little lip service from the White House. If taxes are going to be raised, it'll be the taxes on the 99%.

"The taxes on the wealthy have dropped like a rock over the last decades"

Insofar as the Feds can't/won't tax wealth, as opposed to income, they've never taxed the wealthy.

Kind of a semantic argument. Everyone knows that there is no federal wealth tax, and likewise everyone knows that the wealthy tend to have high incomes.

Getting rid of the carried interest loophole and the stepped-up basis loophole and taxing large inheritances would be a good start.

It's a semantic argument that's baked into the Constitution.

Exactly right. TANSTAAFL

But Russell Long had the accurate take: https://quoteinvestigator.com/2014/04/04/tax-tree/

Honest question; is US debt growing as a proportionof GDP. If it isn't, then it is much less of a problem. Large companies can carry more debt than small companies. Rich people can carry more debt than poor people. Large countries, that are growing can carry more debt than smaller,slow growth countries.

FRED at the St Louis Fed says gross federal debt was stable 1992-2007 at about 61% of gdp, rose during and after the financial crisis to more or less level out by 2016 at a little over 100%, rose a few points and then continued drifting up after the trump tax cuts, leaped in 2020 to 126%, and has been stable at about 120% of gdp for the three years since then. https://fred.stlouisfed.org/series/GFDGDPA188S

That 120% is about half Japan's level of debt, about the same as Barbados, a little more than France, Spain, Portugal, and Canada, and a lot more than Germany (Wikipedia says the EU has a target of about 60% debt-to-gdp, but that's obviously just an admonition). https://en.wikipedia.org/wiki/List_of_countries_by_government_debt (citing IMF data).

But..but...Bowles-Simpson said we had only two years to get our debt situation under control before catastrophe hit...in 2010. I'm not completely down with everything the MMT people are saying, but I think they're 90% right. Once you understand why government debt is not like household debt, things get much clearer.

It is only an emergency when a D is in power.

The MMT people looked a lot smarter back when interest rates were close to zero. The debt is a bigger problem now that they have gone up.

FRED at the St Louis Fed says gross federal debt...

No. Use debt held by the public for these discussions:

https://fred.stlouisfed.org/series/FYGFDPUN

Or, better yet use debt held by the public as a percentage of GDP:

https://fred.stlouisfed.org/series/FYGFGDQ188S

That 120% figure you cite counts the bookkeeping used for intra-government accounts.

Per FRED, the money the United States actually owe to creditors is about 95% of GDP. That's an eight percentage point decrease since the height of the pandemic, in mid 2020.

Debt relative to gdp is falling. Debt grew by less than 5% and the gdp grew by a lot more than 5%. (Note Kevin's deficit numbers are completely wrong in the accompanying graph.

Honest question; is US debt growing as a proportionof GDP.

The deficit was $1.5 trillion in 2023 (not sure where Kevin gets his "two trillion" figure...maybe that's the projection for fiscal 2024?). I just looked it up.

That represents 5.5% of GDP. But nominal GDP (and yes, this is one of those times you want to use nominal figures) increased by about 6.3% in 2023 (real growth + the inflation rate).

So, per my quick math, our debt/GDP ratio declined last year.

I agree it bears watching, but, like Kevin, I'm not a deficit hawk. Still, given our unemployment rate, I think we should ideally be seeing out debt/GDP ratio coming down more swiftly than that.

(One might get slightly different figures when harmonizing fiscal and calendar years).

Also, David Brooks is one of the worst columnists in the history of journalism, if not the worst.

Kitties say: tax the rich MORE!!!That's were all the Kibble is. Kitties know.

Is that so? 🤔

"the national debt is now growing $2 trillion per year and shows no particular sign of slowing down.

This is not sustainable forever..."

------

This is completely wrong. The debt number by itself is meaningless and we all know it.

Is $100 per year of additional debt sustainable for a person? $1,000? $10,000? $500,000? Obviously it all depends on the persons income and assets. $500,000 of additional debt is very sustainable for many extremely wealthy people.

US GDP is around $28,000 Billion per year, new public debt is $2 B/year. Very similar to a family making $2.8 million per year having a yearly deficit of $200. That seems very sustainable.

Kevins post went off the tracks before it even got underway.

"US GDP is around $28,000 Billion per year, new public debt is $2 B/year. Very similar to a family making $2.8 million per year having a yearly deficit of $200. That seems very sustainable."

Um, not $2 billion per year, $2 trillion. So, that's a thousand times more than in your analogy.

Which isn't a great analogy, anyway, since a "family" making $2.8 million a year will someday experience the parentals retiring and dying, unlike the U.S. government/economy, which is theoretically and functionally immortal.

And the family analogies also fall apart because, for instance, no family I know of has the ability to create additional money by fiat or get loans from people at very low interest rates seemingly without end.

Rich people have no problem getting loans from people at very low interest rates seemingly without end.

"The US needs more taxes"-- yes, many people are saying so, even some big strapping guys with tears in their eyes.

But the only people whose voices really count-- right-wing gazillionaires-- have vetoed any prospect of ever raising new tax money from them in whatever guise they take, as individuals or business entities, and will only accept tax cuts. Which is kind of a shame seeing that they seem to be amassing an ever-increasing share of both national wealth and national income and have no intention of contributing anything for the national benefit even if their refusal destroys the nation's fabric and infrastructure.

If memory serves, John Adams was worried about just this kind of thing way back when.

If the US has enough money to give hundreds of billions in debt forgiveness to people who studied junk majors with no hope of generating a decent income in later life, who dropped out of college, or who never bothered to work in a field where they could make enough money to pay back their loans (Hello Joel Lambdin! - https://www.businessinsider.com/how-to-get-student-loan-forgiveness-income-driven-repayment-genx-2024-4) then it does not need more money out of my pockets.

Are you talking about the people running the banks and in the financial sector back in 2007?

Actually, for most of them their equity was wiped out.

They rescued GM as a giveaway to the UAW. GM should have been forced into a normal bankruptcy like Delphi.

As everyone (except David Brooks) knows, national debt is not the same as private debt. National debt is like owing money to yourself. Except of course when the national debt is owed to somebody else. Britain had debt of about 250% of GDP at the end of the Napoleonic wars and had no problems until after WW I when it owed a lot to the US. Japan now has about the same level of debt.

Countries have got in trouble when a lot of their debt was held in other countries and they couldn't make payments. The US has a long way to go to be like Greece in 2008. Its debt is in its own currency, mostly held domestically, and there is no threat of its being unable to make payments for economic reasons.

Hello MMT!

It only matter that our debt is in our own currency if you plan to pay it off by inflating our currency. We can cut the debt in half with 12% inflation for 6 years... want that?

If people (including Americans) decide to stop buying Treasuries the US hits a brick wall damned fast. At that point what will you do? Require everyone with an IRA to put 50% of it into US Treasuries? The resulting riots will make Jan 6 and BLM look like a walk in the park.

At the end of the day, our problem is that government spending (including debt service) keeps increasing as a percentage of GDP. At a certain point people will refuse to turn over an ever increasing percentage of their annual income to the government. When that happens, everything falls apart.

On a larger scale, the Repubs never need a reason to cut taxes, since cutting taxes for them is more like a faith than a policy.

On the Dem side, no one "likes" to raise taxes so the standard policy reasons are (a) national debt and (b) fairness.

Unfortunately, the two Dem policy reasons can be overridden by other situations.

So what we have, broadly, is this.

1. Regan/Bush I, tax cuts.

2. Clinton, tax increases

3. Bush II tax cuts (see 2001 act).

4. Obama forced to leave majority of Bush II cuts in place due to the fact that the great recession overrode the two Dem classic policy concerns.

5. Trump more cuts, essentially on top of Bush II cuts.

6. Biden , term one, no chance for major overhaul due to Covid.

7. Biden term 2, = a chance. Not this year, obviously.

The above is the history of major bills, typically in the summer following the first year of a switch in party. It does not happen in year 2 of any presidency as all of the House is running for re-election. It often does not happen in years 3 or 4 since opposing party often controls the House.

There it is.

I think your general timetable is right, but the recap leaves out two major R tax hikes, HW Bush's in 1990 and Reagan's payroll tax hike after the Greenspan Commission on pre-funding Social Security for baby boomers. Bush's about-face arguably cost him the election in 1992 and certainly cemented the R identity of being dead set against raising taxes (except on people who have no way to avoid paying them, ie mostly ones who get hourly wages on W-2s).

LBJ is famous for telling his people after the 1964 election to push things through as fast as they could-- "hurry, boys, hurry-- get that legislation up to the hill and out. 18 months from now old Landslide Lyndon is going to be Lame Duck Lyndon" and wouldn't have a prayer of moving anything. The first year is when almost anything big has to happen, popular or not.

I did leave out Bush I's bill.

The massive ignorance of Reagan's payroll tax hike never ceases to get my blood up, so I probably left that off the list just for that reason.

Every time someone talks about "saving" SS or Medicare and how the "trust fund" will be (gasp!) exhausted I feel like screaming that it was a Greenspan plan to substitute a progressive tax cut with a regressive increase to fund a program that it not strictly tied to payroll tax inflows and outflows anyway.

It all, of course, went to the general fund anyway. The "trust fund" is an inter-governmental accounting item.

It's all good, though-- the accounting item has been safe and snug in its lockbox all along.

You need to align this with GDP per Capita, not just inflation - because if you have more income or capital, you can carry more debt. And spending (and debt) should rise as there's more people to spend it.

So it needs to be divided by people.

Graph is mislabeled -- trillions should be billions. And you need to adjust for population growth as well -- debt as a fraction of GDP per capita. And then compare to other industrialized countries.

But yeah, we need to claw back some of the Reagan, Bush, and Trump tax giveaways to the wealthy and corporations. Quite simply they are not paying their fair share and haven't been for a while.

Vertical scale title on the graph is obviously in error. This is *annual change* in debt, so the magnitude is around $2 trillion per year, as Kevin stated, not "$2000 trillion" as the scale would imply.

All that aside, as has been pointed out above, debt-to-GDP ratio is the really significant metric. Lately (post-COVID) the US GDP has increased at a rate of $1.8 trillion per year, so a $2 trillion debt increase is *roughly* on par with GDP; one can argue about the details and the statistics, but it's not grossly out of balance. Using inflation-adjusted dollars for a period as short as post-COVID to present is arguably problematic for multiple reasons. Plus, inflation rewards borrowing.

I would argue that deficit spending for infrastructure, technology and science, manufacturing capacity, and the environment, to name a few off the top, constitute investments. These are my own value judgements, and others can argue about them. But broadly, it's reasonable to borrow to invest if the investment carries the prospect of reward.

State governments, with their constitutional requirement to not run deficits don't include any infrastructure spending in their budgets.

This is a pretty irresponsible post.

The deficit for 2023 was 1.5 trillion and it's projected at 1.5 trillion for 2024. That means the debt would be growing at less than 5% a year while nominal gdp grows at over 5%, i.e. the deficit level is easily sustainable for ever.

This is a long-term problem which has been easily harnessed by the Right for their preferred policy agenda, and therefore they should not be listened to about it.

The good news is, raising taxes on the upper, say, 10% wouldn't only fix this problem, but a few others as well, with very little downside except to that 10% who are doing just fine.

It's not the top 10%. It's more the top 0.1%. History shows that economic growth is higher when marginal tax rate on top incomes is highest. The US had its highest GDP growth rate when there was a 90% marginal tax rate on high incomes and corporations paid close to 50% of their profits as taxes. There are lots of good sound economic reasons for this. If nothing else, wealthy people buy prestige goods that don't do anything for the economy as a whole. Less wealthy people buy goods and services, so people get better jobs, and there is pressure to operate more efficiently.

"This is not sustainable forever"

Why not?

I'm all for raising taxes, but it has little to do with the national debt, which we owe to ourselves.

"we owe [it] to ourselves"

Well, about 77% of it.

No. We do not owe the debt to ourselves. Other than the portion held by the Federal Reserve, we owe the debt to the specific people who are holding treasury bonds. That is not the same thing.

Taxes serve 4 purposes: reducing the supply of dollars in circulation and thereby maintaining the value of those dollars; allocating certain costs to certain users, as when gas taxes are allocated to highway construction; discouraging or encouraging certain economic activities like gambling or charitable giving; and expressing public purpose in the distribution of wealth and income.

The Government finances spending by dollar creation, not by taxes, and the National Debt, which is payable with dollars created out of thin air, will never be a problem. The real reason for taxing wealth is that inequality is crushing the middle and lower classes.

High government debt doesn't have anything to do with interest rates. Interest rates on risk-free US Government liabilities are entirely at the discretion of one Jerome Hayden Powell.

Paying interest on government bonds is a relic of the gold standard. If you are the manager of a currency that is convertible to gold, your prime directive is to not run out of gold. There are two ways to do this: limit the amount of currency you issue, and pay people not to present their currency for conversion. The canonical way to pay not to convert is to swap convertible currency for non-convertible bonds. This takes the convertible currency out of circulation temporarily, and precludes the possibility that it will be presented to the Treasury for conversion. The interest paid on the bonds is motivation and compensation for bond buyers assuming the risk that the Treasury will run out of gold before the bond matures, and the rate demanded is dependent on the market assessment of that risk. Since convertibility is not offered for the US dollar, neither constraint applies and the Government can issue as much currency as it wants and pay interest or not as it chooses.

Paying interest on risk-free US Government liabilities is just giving money to people because they already have money. That's a trillion dollars in interest paid this year. Inflationary? You bet.

You understand that as of 1971, dollars are no longer convertible into gold (Nixon Shock). When Treasury bonds mature, and when the interest coupons are paid, you get US dollars. There is not option to get gold.

If Treasury bonds and Treasury bills did not earn interest, who the hell would buy them? The GOP members in US Congress has proved that US Treasury securities are no longer risk free (S&P credit rating of AA+, Finch at AA+, and Moody's at AAA with a negative credit watch)

He was speaking historically. The tip of, the use of the word "relic".

"What's remarkable is that in the entire column he mentions tax increases only once and in passing."

That's not remarkable. Not for David Brooks.

Just call the sandmen? …

As a proud receiver of government handouts (Medicare and social security), I resent the implication that I should be put out on a piece of ice, and floated out to sea.

Like the Tea Party signs said, "keep your Goddamn government hands off my Medicare"

But if we ever operate the government "Like a Business" they would put you out to sea. You are unproductive. Needing a permanent layoff. Soylent Green?

Federal spending isn't rising because Congress is out of control. It's rising because we have to spend more money on old people, something we've known forever. There's nothing anyone can do about this.

I'm sure there is something we can do about that. The anti-vaccine, anti-mask "I've got mine, fck you" Trump Party would be perfectly happy tossing the old people who need Social Security or Medicare out in the street. Frees up more hospital rooms and stuff for the old people who "earned" their private retirement plans, real estate capital gains, etc.

Think of your HOA. If you want the landscaping, the curbs smooth, the road surface uniform...hell, if you want to live in a pleasant place, you've got to foot the bill.

If you want to live in an empire, and most of us do whether willing to admit it or not, you've got to pay for the legions. Business barons will squeal until profits are encroached upon, and then they'll pay.

It is simple, you must pay.

As Kevin notes, Americans don't pay enough in taxes. Thus, we are now in the club of 17 countries with public debt over 100% of GDP.

In the US, just 27.1% of GDP is paid in taxes. 56 countries have higher taxes as a % of GDP than the US. Below are examples of ten countries.

France 46.2

Sweden 44.0

Italy 42.4

Austria 41.8

Germany 37.5

Poland 33.9

United Kingdom 33.3

Canada 32.2

Japan 30.6

Switzerland 28.5

Australia 27.8

All this shows is that more people really need to study MMT. MMT might not be 100% right, (as opposed to all of the other economic approaches, which of course are) but it describes the fiscal situation a lot more accurately than pretty much every comment here.

How many decades has the debt been labeled "unsustainable"? How many generations of grandkids have been doomed to pay for it?

It's all ridiculous.

What will it take for you folks to catch on?

let's try this differently.

what exactly will happen when the debt becomes unsustainable? exactly what needs to be sustained? and why won't we be able to sustain it?

and always keep in mind the one thing MMT is undoubtedly correct about. tax money is not used nor needed to pay for anything at the federal level.

Just admit we can't tax the rich more than us. That proposal would never get by K-St