Buckle up, I've got an exciting post for you today!

As you know, Gross Domestic Product is the size of the economy. It's calculated by adding up the value of all the goods and services produced in the United States.

But you can calculate the same number by adding up all the income needed to produce this stuff. That's called Gross Domestic Income, or GDI.

Here's a table that shows the main components of GDP and GDI:

| GDP | GDI | |

|---|---|---|

| Personal consumption expenditures | Wages | |

| Fixed residential investment | Taxes | |

| Fixed nonresidential investment | Subsidies | |

| Inventory change | Interest | |

| Exports | Net business transfer payments | |

| Imports | Proprietors' income | |

| Government expenditure and investment | Rental income | |

| Corporate profits | ||

| Government surplus | ||

| Consumption of fixed capital | ||

| Total for Q1 of 2022 | $24.4 trillion | $25.2 trillion |

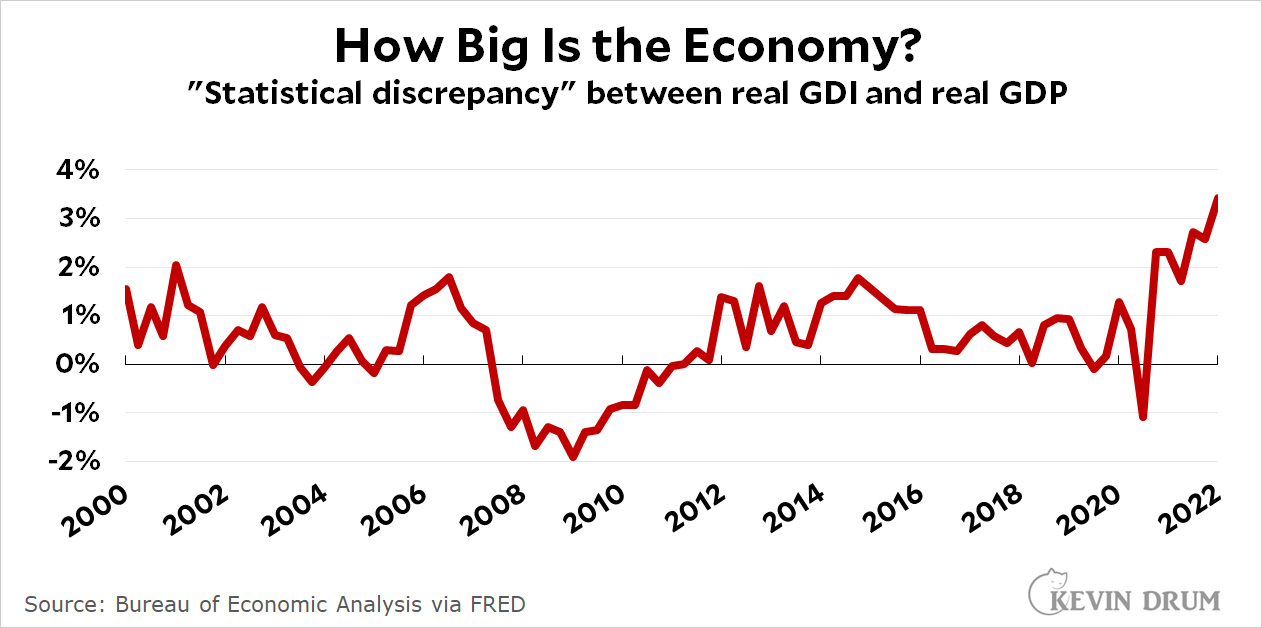

Hmmm. If these are supposed to be the same thing, why is GDP only $24.4 trillion compared to GDI at $25.2 trillion? As you'd guess, it's impossible to measure all the components of GDP and GDI precisely, so there's always a statistical discrepancy. Here's what that looks like over the past few years:

The statistical discrepancy is usually on the order of 1-2%, but for the past year it's been rising well above its norm. In Q1 of 2022, it hit 3.4%. In other words, GDI was 3.4% bigger than GDP.

The statistical discrepancy is usually on the order of 1-2%, but for the past year it's been rising well above its norm. In Q1 of 2022, it hit 3.4%. In other words, GDI was 3.4% bigger than GDP.

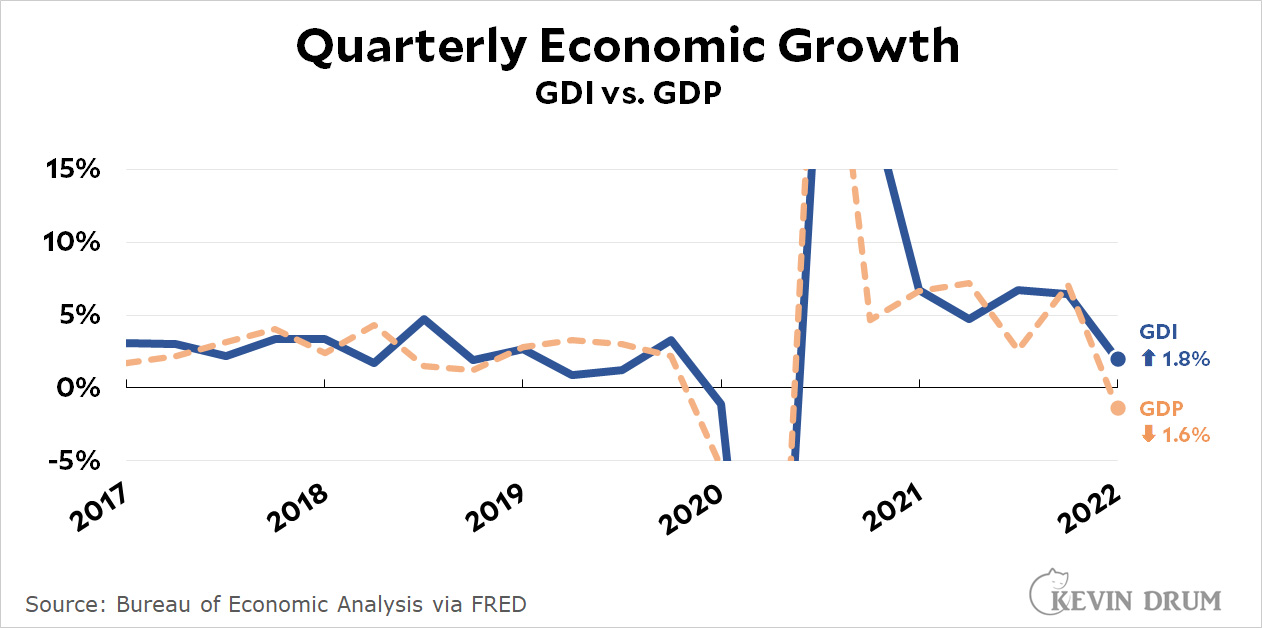

So which one is right? GDP is normally considered the more reliable measure because its components are easier to measure. Still, a discrepancy of 3.4% is a lot, and it affects what we think of economic growth. Take a look:

According to GDP, the economy shrank last quarter at an annual rate of 1.6%. According to GDI, it grew at an annual rate of 1.8%.

According to GDP, the economy shrank last quarter at an annual rate of 1.6%. According to GDI, it grew at an annual rate of 1.8%.

So why did I go through all this? Just to give you the background to a recent set of remarks from James Bullard, president of the St. Louis Fed. He believes that GDI is more consistent with other economic indicators at the moment, which means the economy isn't slowing down all by itself. It's growing at a normal rate.

And that, in turn, means that we can't count on a slowing economy to rein in inflation. We need to take more aggressive action, like the big rate increase the Fed announced a few weeks ago.

Is he right? That's above my pay grade, and only future revisions of GDI and GDP will tell us which one was actually more accurate. I'm just passing it along to help us all understand some of the thinking that goes on in the Eccles Building these days.

> He believes that GDI is more consistent with other economic indicators at the moment, which means the economy isn't slowing down all by itself.

Maybe he does. But I don't think that explains the Fed's behavior. That's much easier.

Bullard would rather ensure a recession than try a soft landing. Which reflects the preferences of his peers and (more importantly) rich people who allow him his job.

I don't know if increasing the likelihood of handing congress back to Republicans is a primary goal for him, but is at least a happy side effect. Of course the few remaining sane, low-information Republicans have started noticing what happened to their party, so it may not be enough.

Come September, if Bullard is still pounding the table, we will know which it is.

Not the way it works. Any ridiculous move will lead to nullification of the independent fed. Rate hikes will cease by order and the board will be purged.

I don't know if increasing the likelihood of handing congress back to Republicans is a primary goal for him, but is at least a happy side effect.

High inflation means there's a 98% change Republicans capture the House. Rising unemployment means there's a 97% chance Republicans capture the House. A Goldilocks economy means there's a 95% chance Republicans capture the House.

I'm far more concerned about 2024 at this point.

Where does unrealized gain fall? If people are cashing out of the stock market now, their income may be higher (even after recent drop off, stocks are up a bit over the past 5 years or so), but that should affect GDP(?). Indeed, churn in my mutual funds will mean I'll have more "income" declared even if the overall investment is now worth less and I've not cashed out.

Whatever is the case, it looks like GDI rate is dropping, just lagging GDP a little. As for the effect of the Fed rates, that will still take time to work through the system. Plus the unwinding of QE-nth.

Rates are still historically low (pre-Great Recession), but no more raises needed now. External shocks are affecting gas and food prices, market madness affecting some commodities (just read about cotton futures market)--so beyond control of the Fed for the most part.

Core inflation will be dropping below 4% soon and maybe even 3% in a month. But I don't see any real decrease in prices--so the 10% or so jump over the past year will probably hold.

Stocks are running at the 2013 trendline. There is no bear market.

“According to GDP, the economy shrank last quarter at an annual rate of 1.6%. According to GDI, it grew at an annual rate of 1.8%.”

So then.

If GDP is the number we are officially in a recession.

If GDI is the number we are not.

Am I right?

Gdp was a shitty made up number which is irrelevant. Totally based on exports which was simply untrue decline.

No. A recession is the end of a business cycle. Negative real GDP is not a sign that we're in a recession, noted by the continued increase in employment and the Fed's actions to increase the central bank rate.

If GDP is the number we are officially in a recession

The old school definition of a recession (one still cited by a lot of people) is two consecutive quarters of GDP shrinkage.

I believe the Atlanta Fed's NOW forecast speculates we have already entered recession, for what it's worth, though this isn't widely bought into yet.

My own take is that I'd be mildly surprised if the US economy hasn't entered recession by year's end.

With a U3 at 3.6%, there must hundreds of “extra” billions out there preventing a real contraction. This should be viewed as a positive in contrast to raising rates which will increase unemployment, increase social spending, increase debt financing and as such increase the deficit. As has been noted here and other places, inflation is already coming down and the factors that lead to it are outside the Fed’s control. More to the point, inflation in the US is lower than the rest of the G20 so whatever the US is doing (strong dollar is part of it), we have weathered inflation rather well, not that it was too big to begin with. The point is that the Fed is going to mess up things if they keep increasing rates. Now concerning oil, the price has already fallen to less than $100 per barrel but no doubt the Ukrainian war has a real effect. But there is plenty of oil out there if we soften our approach to Iran, Venezuela, Saudi Arabia,etc. The reality is that oil still exists in abundance and as soon as prices go too high there will be pressure the other way, it just takes time.

Nope. The Fed wants to quickly normalize rates. My june begins the yry drop. Opec quietly doubling production until all quotas are caught up and boosting the permanent quotas up to 650b's is bearish for the current price and future gas prices.

The Fed is irrelevant. Normal basis points rates should be 250-350 points. Where is the issue drum?. Nothing about YOU say between gdi or gdp matter to inflation or future Fed moves.

Larry Summers says we may need to push unemployment up to 10 percent for a year!

https://slate.com/business/2022/07/larry-summers-massive-unemployment-fed-inflation.html

That is dead. Inflation is running at 4% ex energy. His whole point is wrong.

That is dead. Inflation is running at 4% ex energy

4.5% IIRC, not 4%.

Summers's reasoning (which, though I suspect is a bit on the extreme side of things, can't be written off as self-evidently crazy) is that US NAIRU is currently 5%, and the sacrifice ratio (the rise in unemployment needed to reduce inflation by a single point) is 2:1.

IF we posit a need to get inflation back to 2% (questionable, what's wrong with 3%?), and we have to reduce inflation by 2.5 total points (4.5-2=2.5) we're left with a total needed increase in unemployment (over the course of a year) of five points above NAIRU, or 10%. According to Summers, a smaller spike for a longer time period (say, 7.% over two years) would have the same effect.

A NAIRU of 5% sounds ludicrously high to this layperson's ears (inflation pre-pandemic was subdued for an extended period with unemployment hovering around 4% or lower). But I don't have a PhD in the dismal science.

"Summers says we may need to push unemployment up to 10%"

Oh well, Summer's kids won't go hungry.

This is a misreading of what Bullard is saying. As I wrote a couple of months ago, real GDP is misleading right now. There is robust growth hidden by very high temporary inflation. Real GDP has fooled a lot of people into thinking that we're entering a recession. That's ridiculous, given that employment remains positive.

GDI shows that the economy has a lot of room to accommodate big Fed rate hikes. Time will tell if he's right, but I think he is.

GDP this, GDP that. Gross Do-mestic Product.

How cramped and restrained. I long for the days when this country strode the planet with authority and vigor and ... measured its strength by Gross National Product. That's right, Gross *NATIONAL* Product. And damn proud of it. [furiously waves Old Glory]

In recent decades, meek, apron-wearing economists have preferred to go Domestic, which excludes what Americans abroad are doing. To hell with that. Get out of the kitchen and face the world! Gross National Product is international in scope and scale and not bound by geography.

The GNP of the United States is $250 billion higher than its GDP due to the high number of production activities by U.S. citizens in overseas countries, so why not use the larger value? It's like how tall you are. Every little bit helps if you want to impress others and feel good about yourself.

Patriotic Americans don't ignore fellow citizens that happen to be away for a while. When it comes to economic statistics,

it should always be,

GNP.

So the amount of spending is equal to the amount of income. Who'd of thought?