This is a lovely day on Paris's Left Bank taken from the Pont Saint-Michel. The Île de la Cité is on the right.

Cats, charts, and politics

Tainted cinnamon applesauce pouches that have sickened scores of children in the U.S. may have been purposefully contaminated with lead, according to FDA’s Deputy Commissioner for Human Foods Jim Jones.

....The agency and the Centers for Disease Control and Prevention have collaborated with state and local health authorities as well as Ecuadorian authorities to trace the origin of the cinnamon in the applesauce pouches, which is believed to be the source of the lead contamination.

The FDA believes this wasn't just a matter of poor hygiene at the factory. The lead was deliberately added to the cinnamon. They say it was "economically motivated," a way of making the cinnamon cheaper.

This is remarkable. A pouch of applesauce contains something like one gram of cinnamon, which costs less than a quarter of a cent on the global market. But it's cheaper to use less cinnamon and make up the weight with lead?

What's even worse is that the FDA suspects this is a routine practice—but only for cinnamon shipped to poor countries. It was only caught this time because the cinnamon supplier screwed up and accidentally delivered a tainted batch for applesauce that was destined for the US, where we have the ability to detect lead contamination. Everyone else is out of luck.

The only thing left now is to figure out if the applesauce manufacturer is shocked by this or "shocked" by it. After all, how would the cinnamon supplier know which batch was going where unless they had the connivance of the applesauce maker?

The Wall Street Journal says that the world's central bankers have won their long, brutal battle against inflation:

You know, if central banks are declaring victory for getting inflation down, then they must have done something wrong to make inflation go up in the first place. Maybe they should hold off on the hosannas.

You know, if central banks are declaring victory for getting inflation down, then they must have done something wrong to make inflation go up in the first place. Maybe they should hold off on the hosannas.

Alternatively, they had nothing to do with inflation going up and nothing to do with inflation going down. It was all supply chain pressure and stimulus spending from legislatures. Central banks could have just snoozed through the whole thing with not much harm done.

The BEA released price levels by state today for 2022. Here's how your state stacks up:

This includes housing costs, so it's no surprise that DC and California top the list. Conversely, your dollar goes the furthest in Arkansas and Mississippi. Keep this in mind when you're deciding where to retire.

This includes housing costs, so it's no surprise that DC and California top the list. Conversely, your dollar goes the furthest in Arkansas and Mississippi. Keep this in mind when you're deciding where to retire.

Note that virtually all the cheap states are Republican and virtually all the expensive ones are Democratic. There are nonpartisan reasons for some of this (rural vs. urban, coastal vs. inland), but it still tells you something about the state of American politics. When Republicans say the economy isn't very good, at least part of this is because it isn't very good in their states.

Here's an interesting chart from Brian Schaffner. It's a little hard to parse, so take a look and I'll explain it below:

Take a look at the left panel, for Democrats. Then, at the bottom, move over to the right to the line for people whose incomes increased $40K or more. It shows that about 10% of these people said their income had gone down (magenta line) while 50% said it had gone up (green line). It's surprising that so many people could be off when their actual incomes had increased so much, but at least it's directionally right. Way more people know their incomes went up than think it went down.

Take a look at the left panel, for Democrats. Then, at the bottom, move over to the right to the line for people whose incomes increased $40K or more. It shows that about 10% of these people said their income had gone down (magenta line) while 50% said it had gone up (green line). It's surprising that so many people could be off when their actual incomes had increased so much, but at least it's directionally right. Way more people know their incomes went up than think it went down.

Now look at the same spot on the right panel, for Republicans. Even among people whose income had increased $40K, only about 22% said it had gone up compared to 27% who said it went down.

This is crazytown. $40,000 is a lot of money. How is it that among Republicans who had gained that much income, more said their incomes were down than up?

For what it's worth, the accuracy of self-reported income was no great shakes for anyone. Democrats who had lost income were more optimistic than they should have been. Still, this is yet another indication of just how resistant Republicans are to economic good news in the Biden era. Even when things are going great, they just can't bring themselves to believe it. Is it any wonder that when you average everyone together opinions about the economy seem so sour?

A couple of days ago I asked, "Where are all the tunnels?" A reader points me to a recent Wall Street Journal article that includes this map:

This makes things even more mysterious. The Journal's map is several years old, but it comes from the Israeli military and presumably they have more current ones. But if this map is actually accurate, it suggests that Israel has no need to hunt for tunnels or to destroy vast swaths of Gaza looking for them. The IDF already knows exactly where they are.

This makes things even more mysterious. The Journal's map is several years old, but it comes from the Israeli military and presumably they have more current ones. But if this map is actually accurate, it suggests that Israel has no need to hunt for tunnels or to destroy vast swaths of Gaza looking for them. The IDF already knows exactly where they are.

This jibes with the news that the IDF is getting ready to flood the tunnels. You can hardly do that unless you know where they are.

So this redoubles my question: If Israel already knows where most of the tunnels are, why are they razing entire city blocks hunting for them? And where are the huge caches of guns and bombs and food and fuel? Do they really know where the tunnels are but are unwilling to actually go into them?

Mysteriouser and mysteriouser.

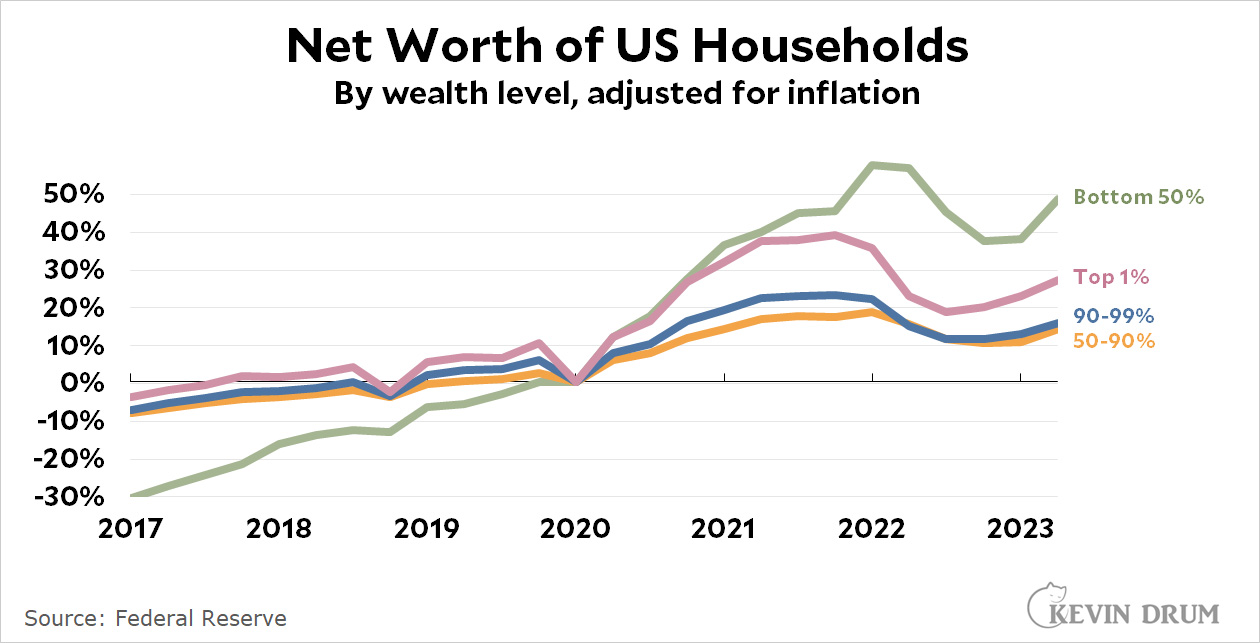

How are people feeling about their personal finances? Income is one way of looking at this, but balance sheets are another. That is, how much wealth do households have? Are their savings accounts flush? Are they relatively free of debt? Net worth is the simplest way of looking at this:

Since the start of the pandemic in 2020, net worth has increased at all economic levels. First, there was a big increase in 2020-21 thanks to pandemic benefits, which had a bigger impact on the poor than the rich. Then, starting in 2022, net worth fell. But in 2023 it started rising again.

Since the start of the pandemic in 2020, net worth has increased at all economic levels. First, there was a big increase in 2020-21 thanks to pandemic benefits, which had a bigger impact on the poor than the rich. Then, starting in 2022, net worth fell. But in 2023 it started rising again.

In other words, you can tell almost story you want here. The good news is that net worth is up since 2020. The bad news is that everyone started spending down their savings throughout 2022. But then there's more good news: that turned around and net worth rose in 2023 even though there were no new benefits and home prices were dropping.

Overall, should this make people happy or sour? I'd say happy, but it's sort of a toss-up. At the very least, though, you can say that household balance sheets are basically in good shape at all income levels and getting better. This shouldn't be causing a lot of angst about the economy.

I was fiddling around with some numbers this afternoon and came up with something interesting.

As you know, the BLS reports earnings for all employees and for non-managerial employees, who make up about 80% of the workforce. This makes it easy to also calculate earnings for the managerial workforce. Right now, for example, wages for the managerial workforce average about $53 per hour ($106,000 per year) while non-managerial workers average about $29 per hour ($58,000 per year). This assumes full-time work.

Of course, you can also easily calculate the total number of managerial and non-managerial workers. Here it is:

Managerial positions fell only slightly during the pandemic and quickly caught up to their previous level. Non-managerial positions dropped dramatically and have only recently made back those losses.

Managerial positions fell only slightly during the pandemic and quickly caught up to their previous level. Non-managerial positions dropped dramatically and have only recently made back those losses.

In other words, US companies have plenty of managers but they've had a hard time attracting worker bees. Here's what that means for wages:

The 2020 spike is a bit artificial, so ignore that. The bigger point is that from the start of the pandemic to now, the average wage for all employees has been close to flat. But that hides a big difference. Non-managers have seen their wages rise about 3%. Managers have seen their wages fall about 3%.

The 2020 spike is a bit artificial, so ignore that. The bigger point is that from the start of the pandemic to now, the average wage for all employees has been close to flat. But that hides a big difference. Non-managers have seen their wages rise about 3%. Managers have seen their wages fall about 3%.

I don't have any big insights to offer about what this means except that it might be part of the answer to why people are sour on the economy. Managers are sour because their earnings have plummeted since 2021. Non-managers are sour because their earnings have been flat since 2021. I don't know if this explains a lot, but it might explain a little bit.