News reports based on leaks from the Fed have said that Silicon Valley Bank was called out in 2021 for some poor governance practices but that warnings about financial risk didn't come until late 2022. However, testimony yesterday by Michael Barr, the Fed's vice chair for supervision, paints a slightly different picture:

Near the end of 2021, supervisors found deficiencies in the bank's liquidity risk management, resulting in six supervisory findings related to the bank's liquidity stress testing, contingency funding, and liquidity risk management. In May 2022, supervisors issued three findings related to ineffective board oversight, risk management weaknesses, and the bank's internal audit function.

In the summer of 2022, supervisors lowered the bank's management rating to "fair" and rated the bank's enterprise-wide governance and controls as "deficient-1." These ratings mean that the bank was not "well managed" and was subject to growth restrictions under section 4(m) of the Bank Holding Company Act.

In October 2022, supervisors met with the bank's senior management to express concern with the bank's interest rate risk profile and in November 2022, supervisors delivered a supervisory finding on interest rate risk management to the bank.

In this account, we still have the governance issues raised in May 2022 and the warnings about interest rate risk in October and November.

However, the very first warning, at the end of 2021, is now said to be about SVB's liquidity risk management. This raises a few big questions:

- How serious were the warnings? Barr goes to the trouble of including a footnote explaining the difference between an MRA (matters requiring attention) and an MIRA (matters requiring immediate attention) but doesn't say which ones were issued at this time.

- There were apparently no further warnings about liquidity. Does this mean that SVB resolved its problems?

- To deal with warnings from the Fed and a downgrade threat from Moody's, SVB bulked up its cash reserves and announced a capital raise. Was this what the Fed had recommended? Did they know about it?

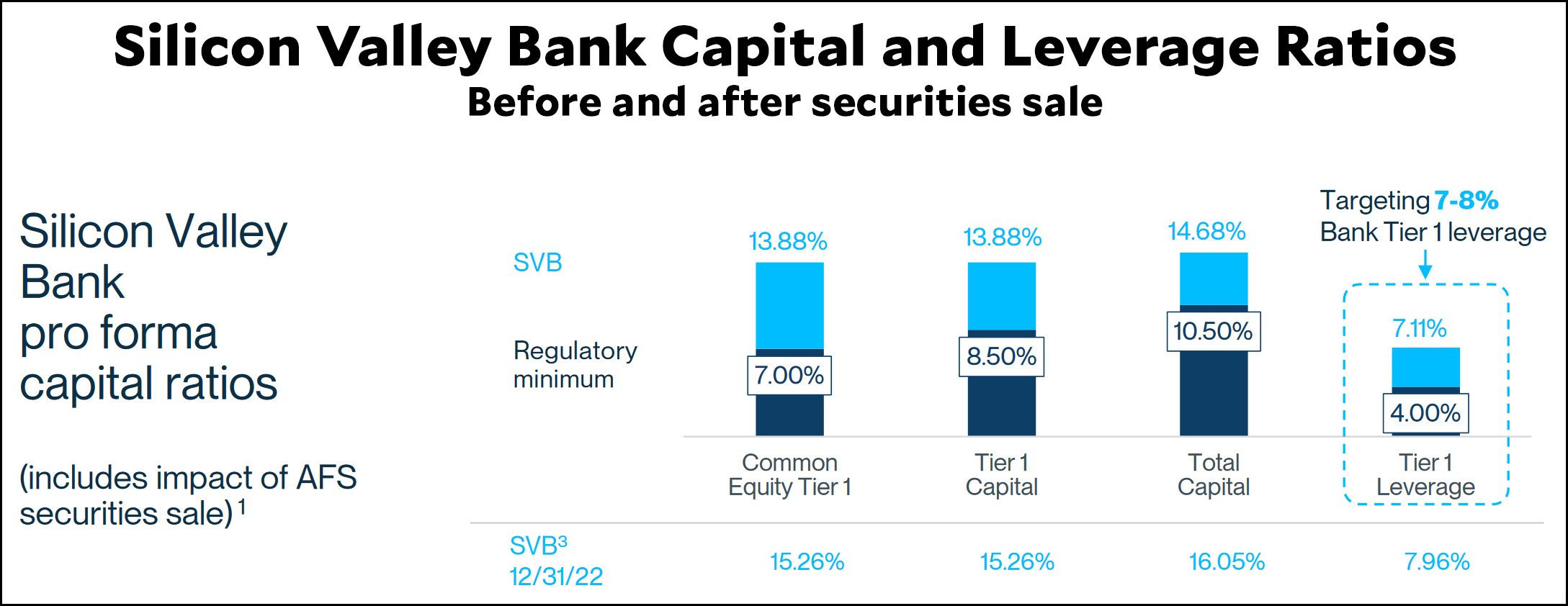

When SVB sold securities to generate cash, this still left it well above the minimum required capital and leverage ratios:

Ironically, it was SVB's announcement of this action, which was precisely the right thing to do, that sparked the run the next day. After that, it had only a few hours left to live.

Ironically, it was SVB's announcement of this action, which was precisely the right thing to do, that sparked the run the next day. After that, it had only a few hours left to live.