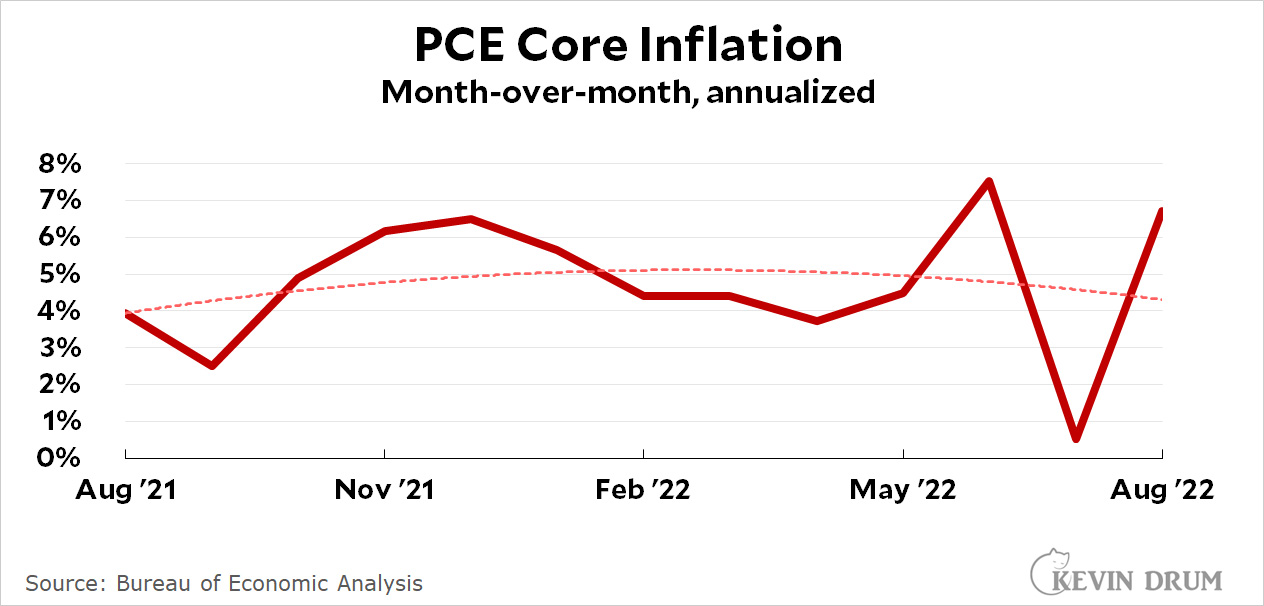

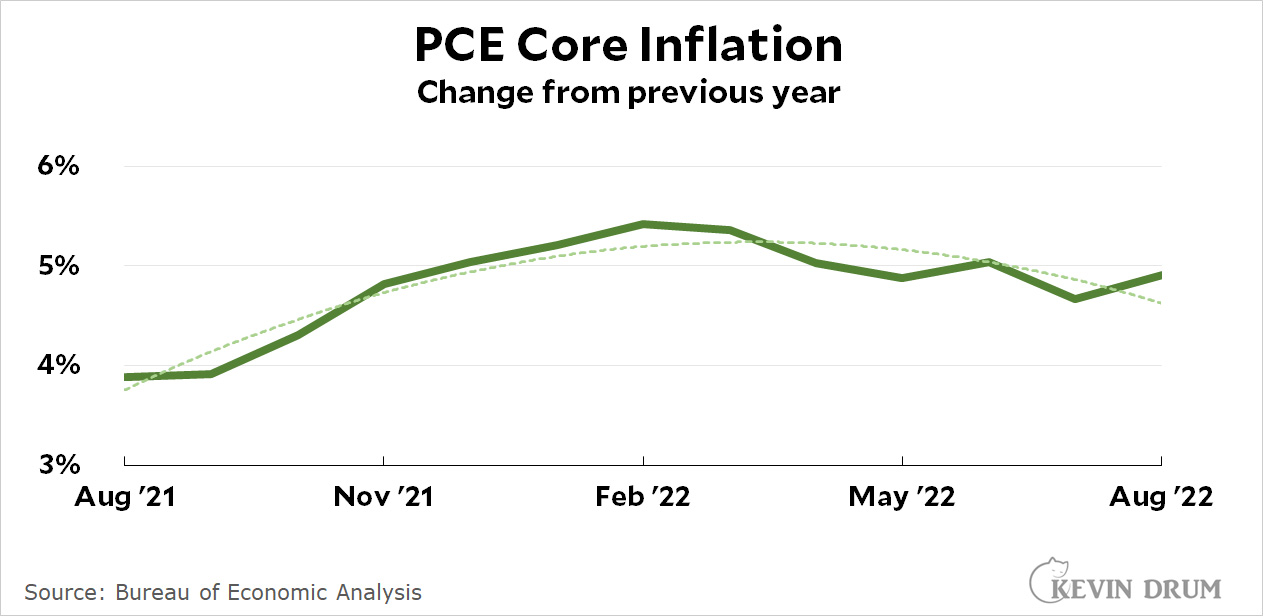

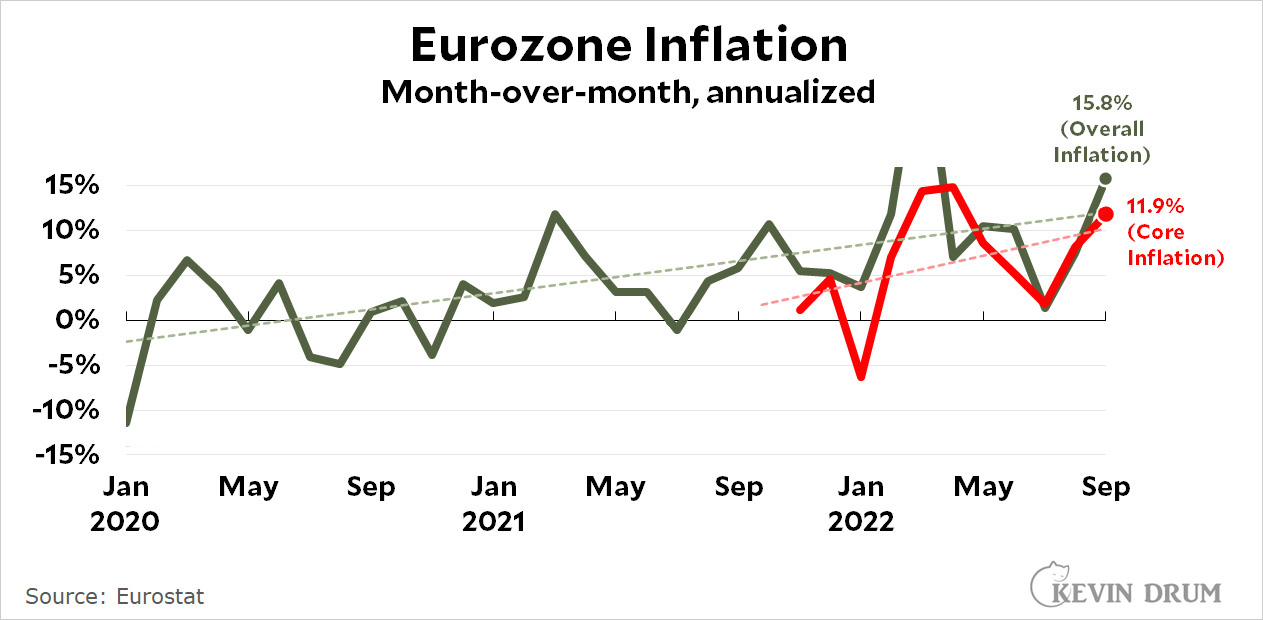

The Europeans are always ahead of us with their inflation data because they're willing to release "flash" estimates before the month is even over. For September, Eurostat reported annual inflation of 10%, which is bad enough, but that's year-over-year and doesn't capture their recent big increase. If you look instead at the monthly data, inflation for the Euro area hit a stunning 15.8%:

A lot of this increase is due to huge jumps in energy costs, but even core inflation is at 11.9% for September. Inflation is just sky high no matter how you look at it.

A lot of this increase is due to huge jumps in energy costs, but even core inflation is at 11.9% for September. Inflation is just sky high no matter how you look at it.

As usual with monthly data, though, September could be a fluke. So pay attention to the trendline. The good news is that the trendline shows "only" about 12% overall inflation and 10% core inflation right now. The bad news is that the trendlines are heading steadily up and show no signs of having peaked.

Also, Eurozone inflation is not high just because there are a few outlier countries driving up the average. The annualized September rates are high all over the place. Finland is at +8.7%. Portugal is at +16.7%. Italy is at +22.4%. Germany is at +29.8%. The Netherlands is at +40.9%.

The best performers in September were Ireland and Spain, at 0%, and France, which was down -5.9%. (Though all three still had high year-over-year inflation rates.)

NOTE: The figures for core inflation go back only 12 months because that's all Eurostat provides for core inflation. I have no idea why, but that's Eurostat for you.