On Thursday night I finally declared victory in my long twilight struggle with my telescope. It is now 100% functional.

The final hurdle was getting autoguiding to work. The telescope mount already has a motor that tracks the rotation of the earth, but it's not perfect. With just the mount tracking, I can do a 30 second exposure with my 900mm telescope, but that's about it. Anything longer and the stars look like streaks because the mount isn't tracking the sky perfectly.

Enter autoguiding. An autoguider is a separate small camera controlled by software that looks for a suitable star and then locks onto it. The camera is on a continuous loop, and whenever the star gets slightly away from where it's supposed to be, the software sends a pulse to the mount to put it back on a perfect track. With autoguiding on, I can do a 300-second exposure or more.

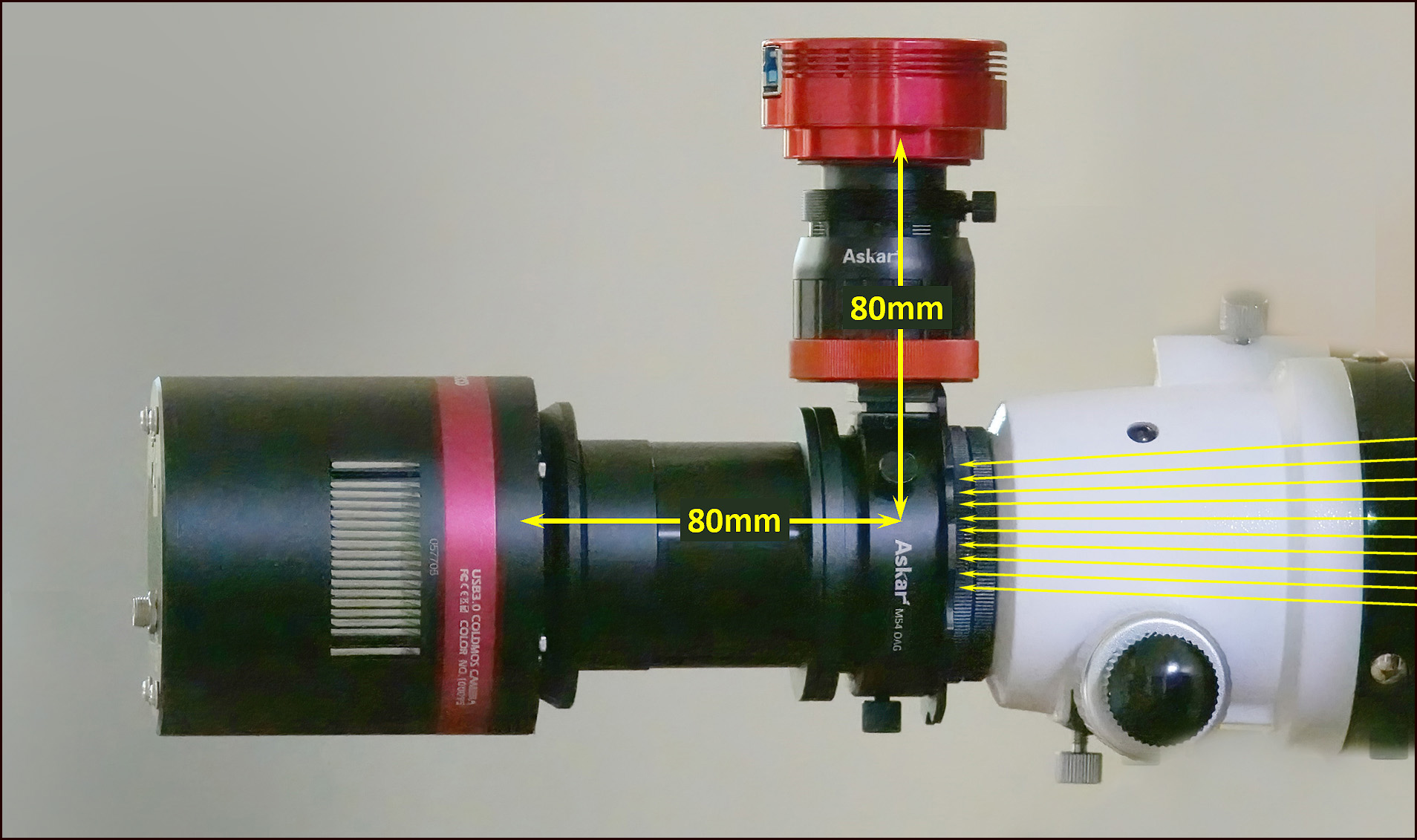

But it didn't work! All I got was snow and static and lousy calibration and no effect on the image at all. Until, finally, a light bulb went on in my head and I realized I had everything set up wrong. Here's an annotated picture of my optical train:

I use a device called an off-axis guider, which contains a small prism that sends a bit of light upward into the guiding camera. What I realized is that in order for everything to be in focus—both the main camera and the guide camera—the light path had to be same length both ways. I had read about this but not paid attention, and that was my problem.

I use a device called an off-axis guider, which contains a small prism that sends a bit of light upward into the guiding camera. What I realized is that in order for everything to be in focus—both the main camera and the guide camera—the light path had to be same length both ways. I had read about this but not paid attention, and that was my problem.

The light path from the prism up to the guide camera was about 80mm. This means that the light path from the prism to the main camera also needed to be about 80mm, which in turn meant that I needed 60mm of extension tubes. As it happens, these are neither cheap nor easy to find. But in a stroke of amazing luck, I already had some long extension tubes for a different project that I had abandoned. I put in one of those along with another extension that came with the OAG, and voila! I was able to get perfect focus in both cameras.

On Thursday I took this out to test it, and after a bit of dithering around everything worked great. Focus was good; signal-to-noise ratio was fantastic; calibration was spot-on; and the software was sending pulses out to the mount with great precision.

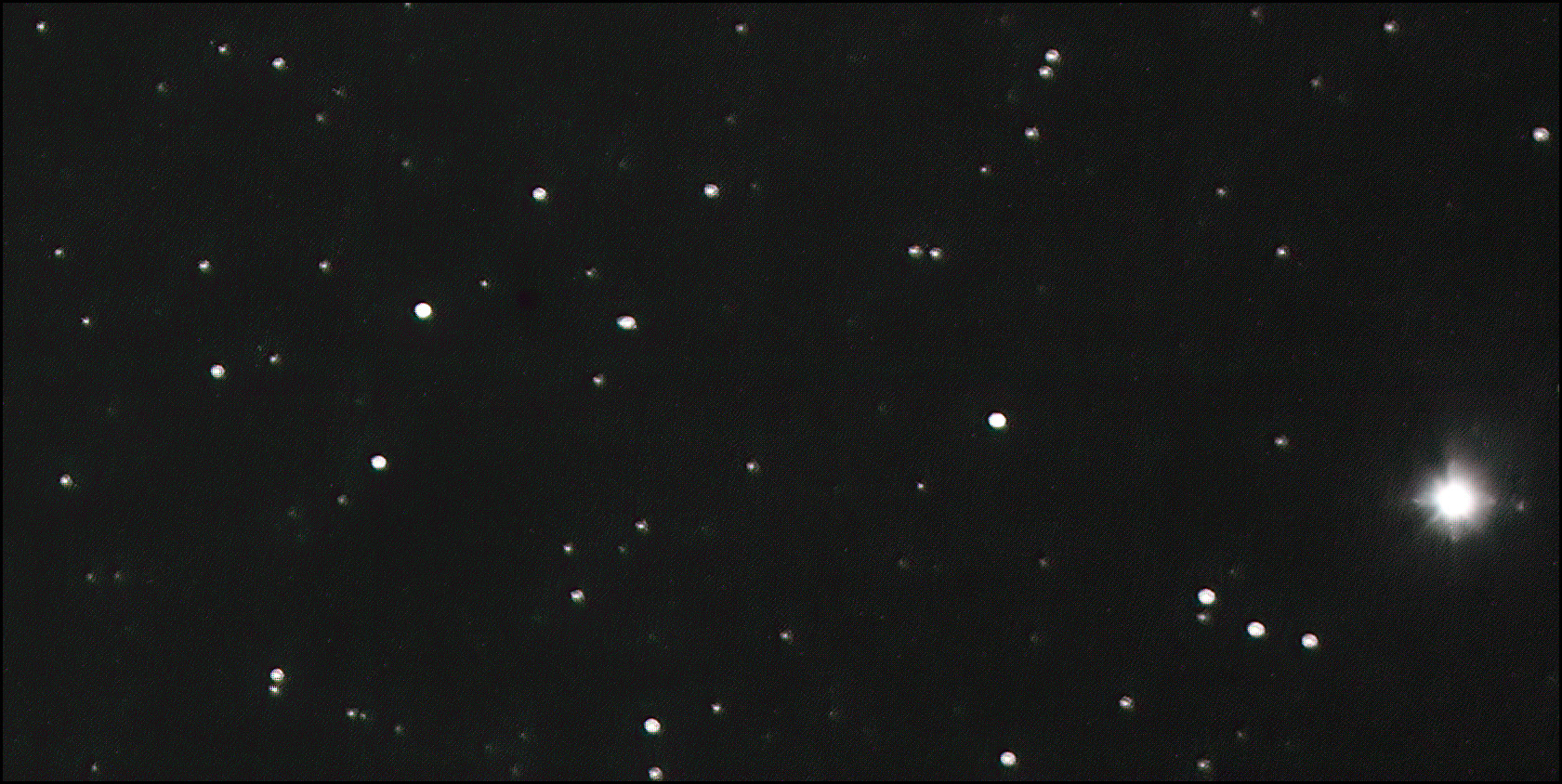

I tested this on a 150-second exposure and it looked great. Here's a cropped section of the sky:

The stars are all nice little circles, not stretched or streaked. That's just how it should be.

The stars are all nice little circles, not stretched or streaked. That's just how it should be.

Unfortunately, the camera giveth and the camera taketh away. You may notice that some of the smaller stars seem to have a bit of a halo around them. It turns out that after weeks of high heat, Thursday was actually a bit chilly. So my telescope dewed up. This had never happened before and I had vaguely assumed it only happened to people unlucky enough to live in places other than Southern California.

But no. Even after I had wiped off the lens as best I could, some of the fogginess stayed around and ruined the pictures.

But that's a minor problem. I went home and bought a dew heater that promises to make dew a problem of the past. It should come today and I will once again be in good shape.

Except . . . I had a wee accident. There are a few little pieces of dust on my camera sensor, so I went in yesterday to clean them off. Unfortunately, the instructions for getting access to the sensor are extremely unclear, so I ended up removing the wrong doodad. It was pretty stupid of me. Ironically, this doodad turned out to be a built-in dew heater for the piece of glass that protects the sensor, and I broke the wires connecting it to power. Will that matter? I'll find out soon enough. If it does, I'll have to send the whole camera in for repair.

But even given this little piece of idiocy, I think I'm now 100% functional and finally ready to study up and go beyond functional. I shall report back whenever the skies are clear and I can go out again.