Interesting times:

- The Senate has passed the $280 billion chips bill and the House will soon follow. Keep in mind that it's actually about $80 billion for chips and $200 billion to fund 20 "regional technology hubs" for general research into artificial intelligence, robotics, quantum computing and other cool-sounding futuristic stuff. Also keep in mind that this spending stretches over ten years, so it's really only about $30 billion per year, about half a percent of the federal budget.

- Joe Manchin has finally reached an agreement for a bill with three components: about $400 billion in spending on climate change; a mandate for Medicare to start negotiating prescription drug prices; and about $700 billion in new taxes. Details to come.

- We seem to be close to a bipartisan agreement to pass the Electoral Count Reform Act. It's not a comprehensive election bill, but it's a good step forward. Rick Hasen explains: "It not only would confirm what we’ve already known—that a vice president has no unilateral power to accept or reject election results. It would also raise the threshold for senators or representatives to object to valid electoral college votes, eliminate the chance that a state legislature could rely on that 'failed election' language to send in alternative slate of electors, and provide a mechanism for federal judicial review of any action by a rogue governor to send in a fake slate of electors. These are all positive developments."

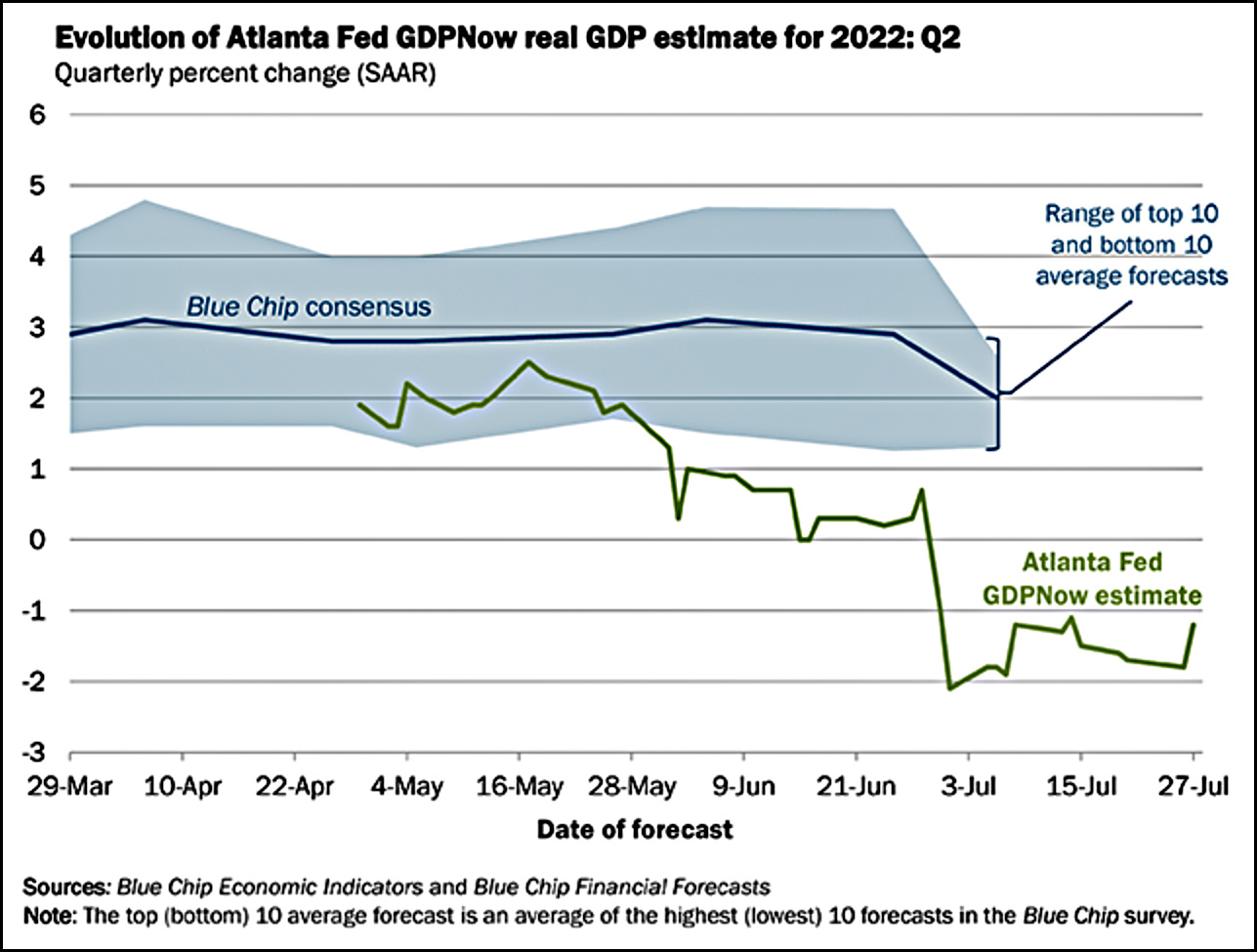

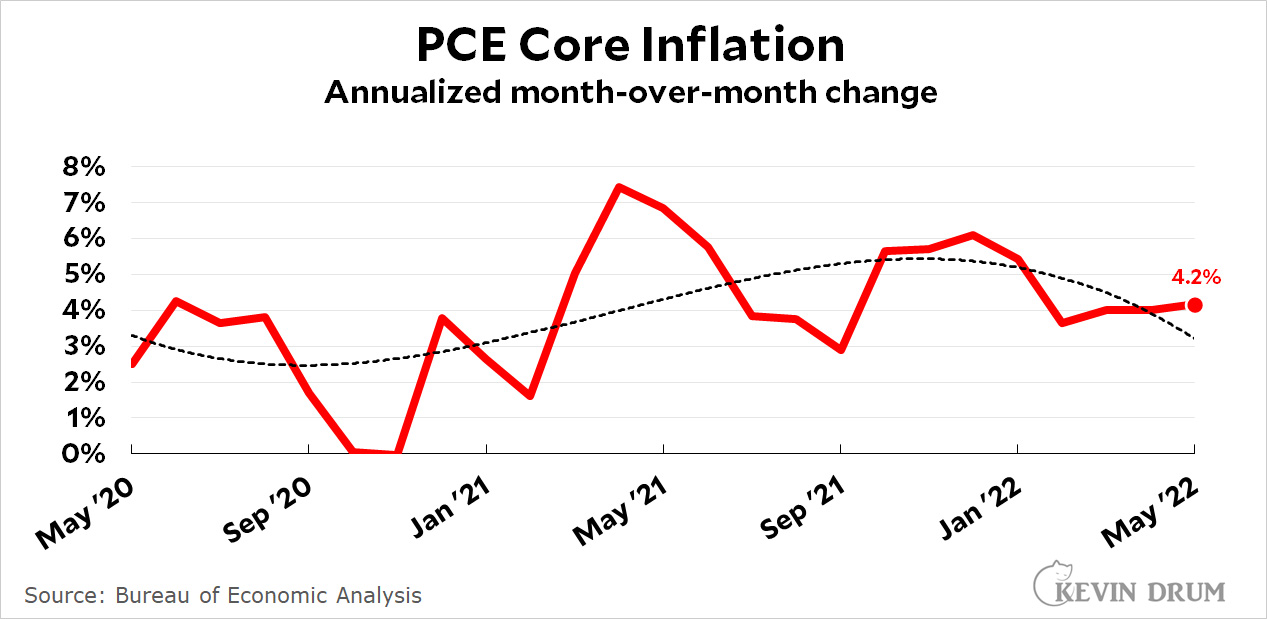

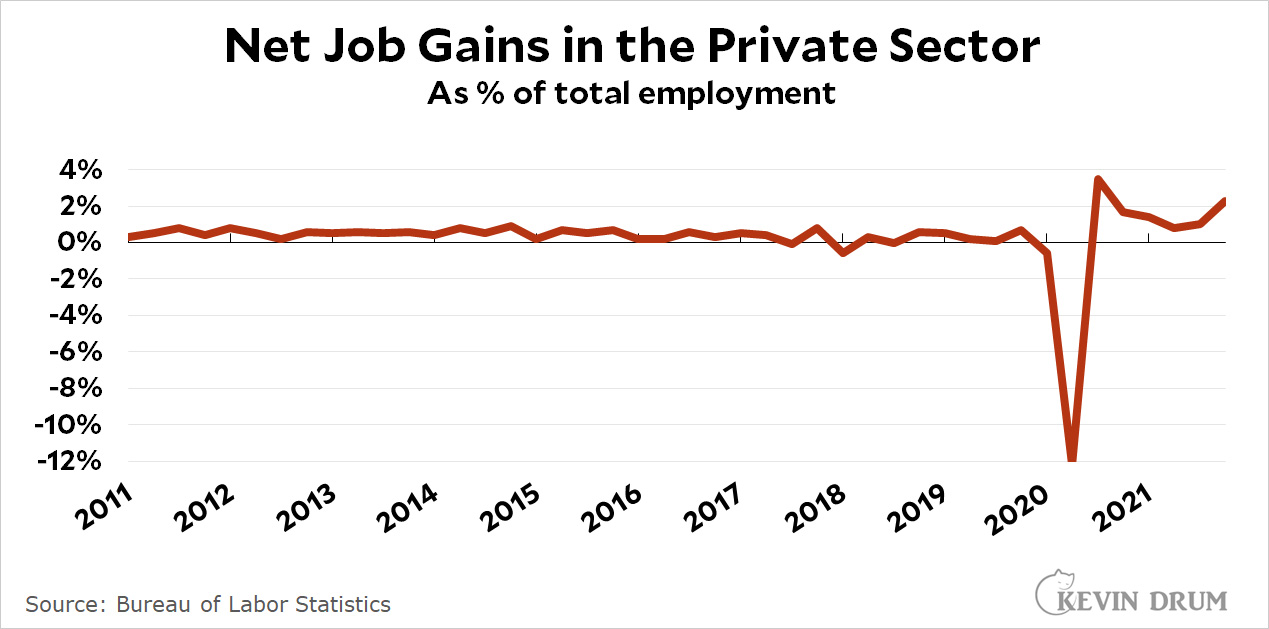

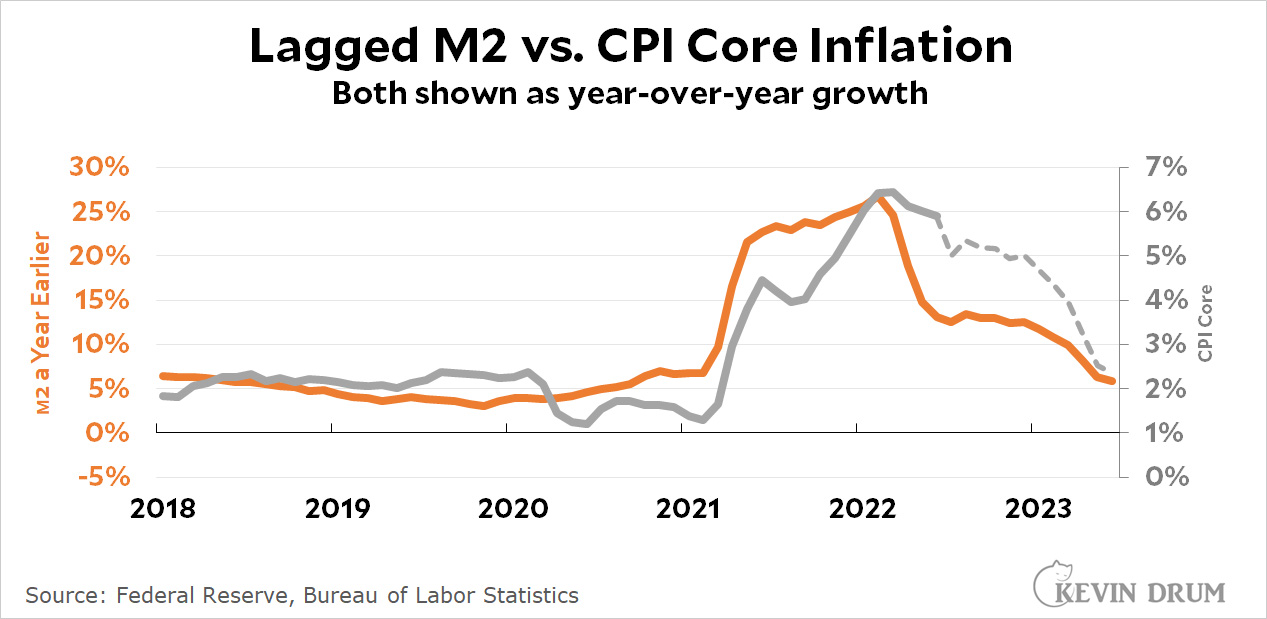

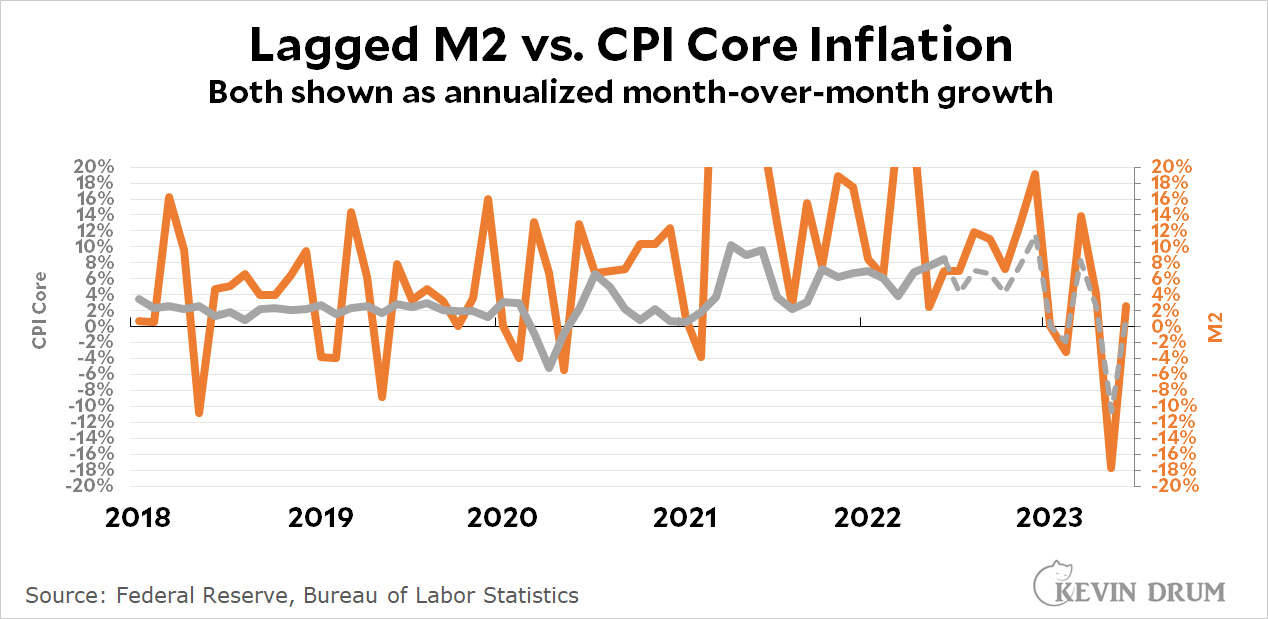

- The Fed raised short-term interest rates another three-quarters of a point today. Idiots.

- A bill to codify same-sex marriage nationwide—just in case the Supreme Court gets itchy to overturn Obergefell—got a surprising amount of Republican support in last week's House vote. Now there's some optimism that it could get ten Republican votes in the Senate, enough to overcome to a filibuster. I remain pessimistic about this, but you never know. I suspect that most Republicans, even if they won't say so publicly, don't really oppose same-sex marriage anymore, having seen that nothing much has happened over the past seven years since it became legal nationwide.

It's almost as if a sudden desire to actually do stuff has broken out in Washington DC. Amazing.