I've seen a number of people express astonishment about how we decide when recessions start. It turns out that the answer has nothing to do with two consecutive quarters of GDP decline and it never has. Rather, a group of gnomes who work for the National Bureau of Economic Research stir a bunch of stuff into a pot and eventually pick a date.

This raises a question: What the hell is going on? Who decided on this squirrely procedure? And why does this NBER outfit get to do it?

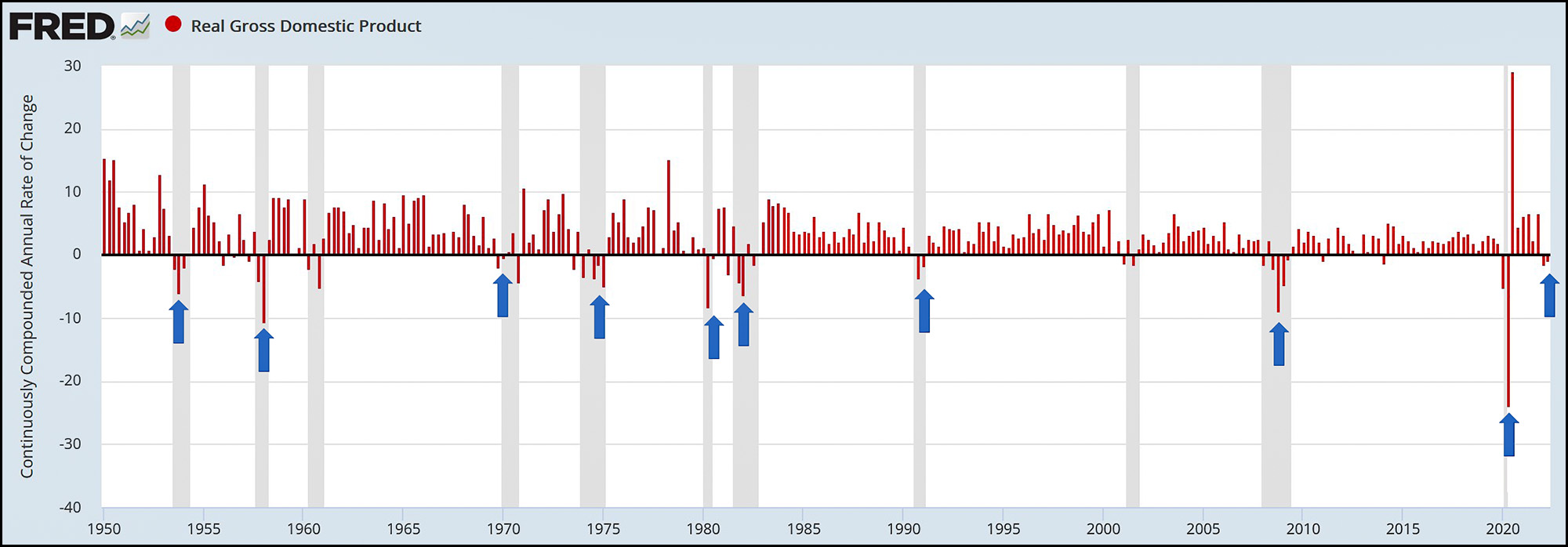

That's an interesting story, and I'll get to it shortly. First, though, here's a chart of the US economy over the past 70 years:

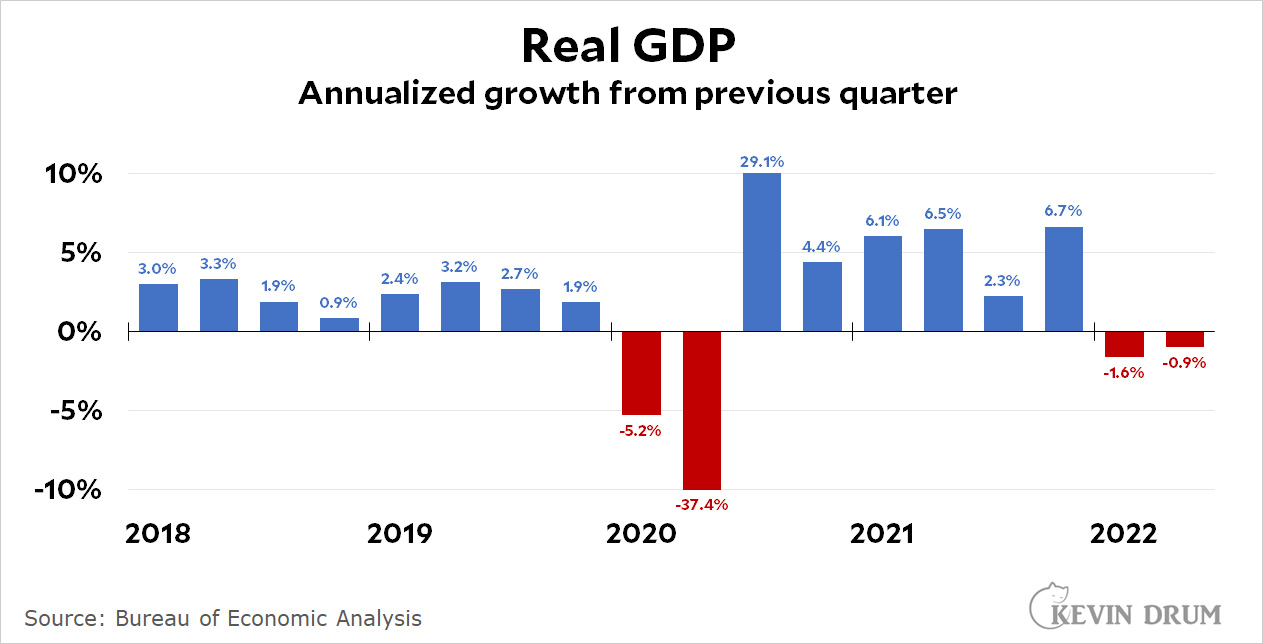

The blue arrows indicate all ten times that we've had two consecutive quarters of GDP decline. In every single one of those cases, NBER eventually declared a recession. This makes it highly likely that NBER will do the same this time.

The blue arrows indicate all ten times that we've had two consecutive quarters of GDP decline. In every single one of those cases, NBER eventually declared a recession. This makes it highly likely that NBER will do the same this time.

Or does it? One thing you'll also notice is that our current GDP decline is the smallest of the ten. So . . . maybe it's not a recession? How do we know? This is where our story starts.

Back in the early 20th century an economist named Wesley Clair Mitchell decided to devote his life to the empirical study of business cycles. Mitchell believed that modern industrial economies ran in irregular cycles of expansion and contraction, and these cycles affected nearly all economic activity. This was an important insight, and of course he turned out to be right—not just about the existence of the business cycle, but its importance.

Mitchell built on this insight by trying to precisely define and date business cycles. To do this he set out to gather time series of anything he could. He didn't have the BLS or the BEA or FRED, so he had to make do with whatever he was able to come up with at the time: pig iron production, bank clearing volumes, freight receipts, unemployment numbers, anecdotal evidence from business barons, dodgy business activity indexes, and anything else that might be a good indicator of economic health. Two things resulted from this: (a) a big ol' book on business cycles and (b) the creation of NBER.

Mitchell was a founder of NBER in 1920 (see Christina Romer's paper here, video version here) and its initial director of research. In that position he continued his search for data and turned NBER into a bustling hub of research into business cycles. In 1929 he published, almost as an aside, his first comprehensive dating of business cycles from 1855 to 1921.

Now, pig iron and freight receipts are all very fine, but why didn't Mitchell use GDP as one of his measures of the business cycle? The answer is simple: Simon Kuznetz, a student of Mitchell's and an economist working at NBER, hadn't invented it yet. It wouldn't be until after World War II that GDP was refined into a useful measure of economic activity.

So this is the story: business cycle dating was basically invented at NBER in the 1920s, and it didn't rely on GDP because GDP didn't exist back then. However, Mitchell was a pragmatist, and he was willing to adopt new economic measures if they turned out to be reliably correlated with other measures of business activity. If we now whisk ourselves to the present day, we'll find that after decades of changes NBER currently uses the following six metrics to date business cycles:

- Real personal income less transfers (PILT)

- Nonfarm payroll employment

- Real personal consumption expenditures

- Manufacturing (wholesale) and trade (retail) sales adjusted for price changes

- Employment as measured by the household survey

- Industrial production

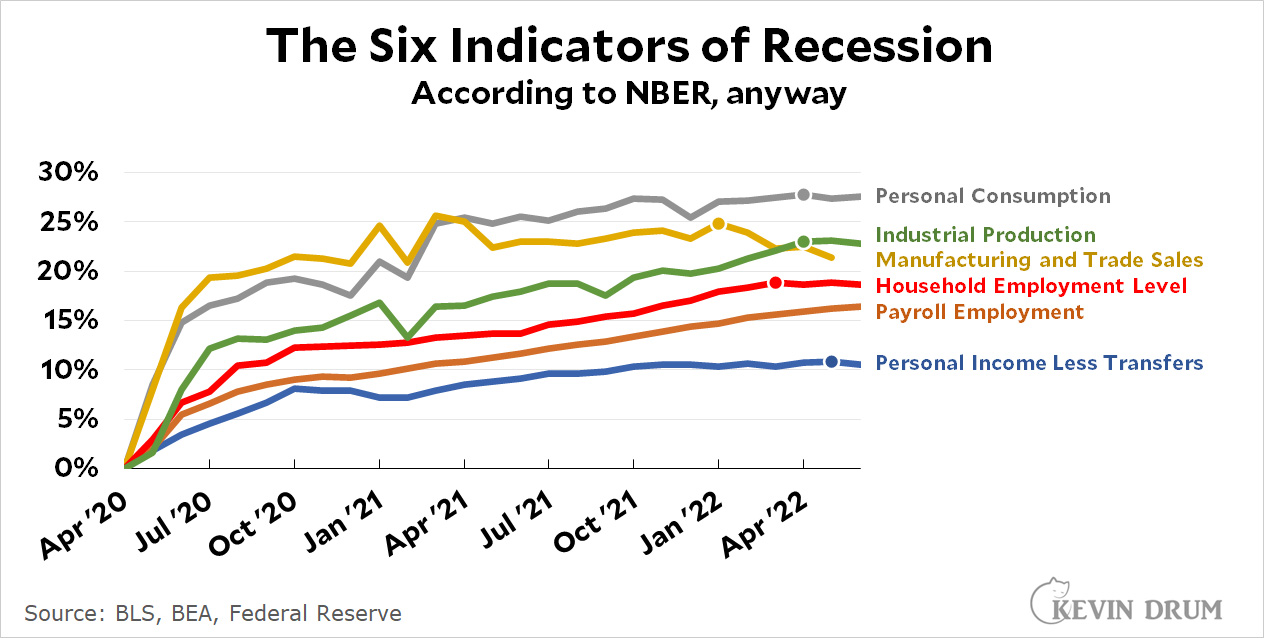

Here's what those six things look like over the past couple of years:

I've placed a marker on each line indicating its recent maximum. Those might also represent the peak of the current business cycle. But it's hard to say, isn't it? Personal consumption is basically flat. Manufacturing and trade sales are on a clear downslope, while industrial production and personal income are just slightly down. Will they tick back upward or keep going down? And payroll employment hasn't peaked at all. It's still heading steadily upward.¹

I've placed a marker on each line indicating its recent maximum. Those might also represent the peak of the current business cycle. But it's hard to say, isn't it? Personal consumption is basically flat. Manufacturing and trade sales are on a clear downslope, while industrial production and personal income are just slightly down. Will they tick back upward or keep going down? And payroll employment hasn't peaked at all. It's still heading steadily upward.¹

There's no reason you can't play this game at home. If you average out the markers, you'd probably figure that the economy peaked and then started to slow around April of this year. Are you willing to make that call? Or . . . maybe it doesn't look entirely clear?

This is why NBER often waits a while to announce when a recession has started. They don't care much about headlines in newspapers or even in recessions per se. This is just a technical exercise of dating business cycles.

And why do we let NBER do this? Because they got there first and developed a solid reputation for doing a good job. I suppose, also, that no one else really wanted to do it.

Nickel summary:

NBER decides on recession dating because they started doing it a long time ago and no one ever tried to take the job away from them.

They've never used GDP as one of their indicators of economic activity. One of the reasons, oddly enough, is that their dating is done by month and GDP is only produced every quarter.²

They currently use the basket of metrics listed above to decide when the economy has reached a peak (end of expansion and start of recession) and a trough (end of recession and start of next expansion).

It takes them a while to announce recession dates because they want to be sure. And the only way to be sure is to have plenty of hindsight to work with.

¹I should add that there's no formula here. The folks who sit on the dating committee are allowed to stare at the numbers until their eyes hurt and then make their own judgments based on whatever heuristic seems best to them.

²This is going to sound crazy, but NBER also dates turning points by quarter. For that, they add real GDP as one of their measures. Or more accurately, an average of GDP and GDI.