Here is the Wall Street Journal today:

Worker Pay and Benefits Grow at Record Pace, Pressuring Inflation

Compensation for American workers grew rapidly in the first quarter, as a tight labor market put more money in workers’ pockets while also keeping pressure on inflation.

Business and government employers spent 4.5% more on worker costs in the first quarter compared with the same period a year earlier, without adjusting for seasonality, the Labor Department said Friday. That marked the fastest increase in records dating to 2001, and the gain eclipsed 4.0% annual growth in the fourth quarter.

Compensation for workers also accelerated on a quarterly basis, rising a seasonally adjusted 1.4% in the first quarter compared with a 1.0% increase in the fourth quarter. The growth reflected strengthening wages, salaries and benefits.

I assume I'm not keeping you in too much suspense about the real story here? Hold onto your hats, here it is:

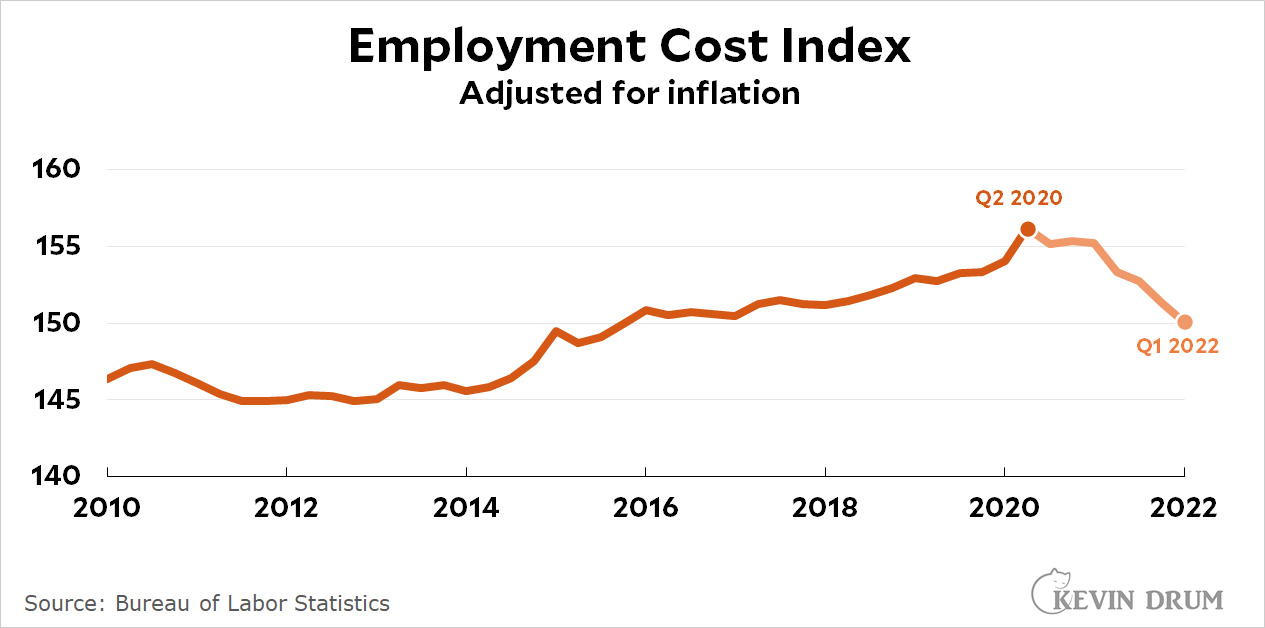

Yes, in one of the great surprises of economic reporting this century, the Journal has presented nominal numbers instead of taking a minute or two to adjust them for inflation. When you do that, you can see that ECI is down about 4% since mid-2020 and down 3-4% over the past 12 months.¹

Yes, in one of the great surprises of economic reporting this century, the Journal has presented nominal numbers instead of taking a minute or two to adjust them for inflation. When you do that, you can see that ECI is down about 4% since mid-2020 and down 3-4% over the past 12 months.¹

All of this is front and center in the BLS press release, so it's not hard to figure out. Right now, the real cost of employing someone—wages, benefits, Social Security, office space, etc.—is at about the same level it was at in 2016. In what way this is "keeping pressure on inflation" is a mystery to me.

¹The exact amount depends on which measure of inflation you favor, and I'm embarrassed to admit that I can't figure out which one BLS uses. I get -3.3% using ordinary old CPI; they get -3.7% using something else.