Over at National Review, Dominic Pino says the woes of the IRS are its own damn fault:

The agency answers only 11 percent of incoming calls, takes 45 days to turn around correspondence, and finished the 2021 tax season with a backlog of 35 million returns.

....The IRS is clearly a poorly run organization, and poorly run organizations should not be rewarded with more money....The bureaucrats who run the agency will always tell Congress that they don’t have enough money, and there’s a certain amount of institutional learned helplessness that goes into that. If the agency actually improved its processes and better served taxpayers, its case for funding increases would weaken.

I admire the brass on display here. Whatever institutional problems the IRS might have, the proximate cause of its problems is that conservatives have been hellbent on gutting the agency over the past 25 years:

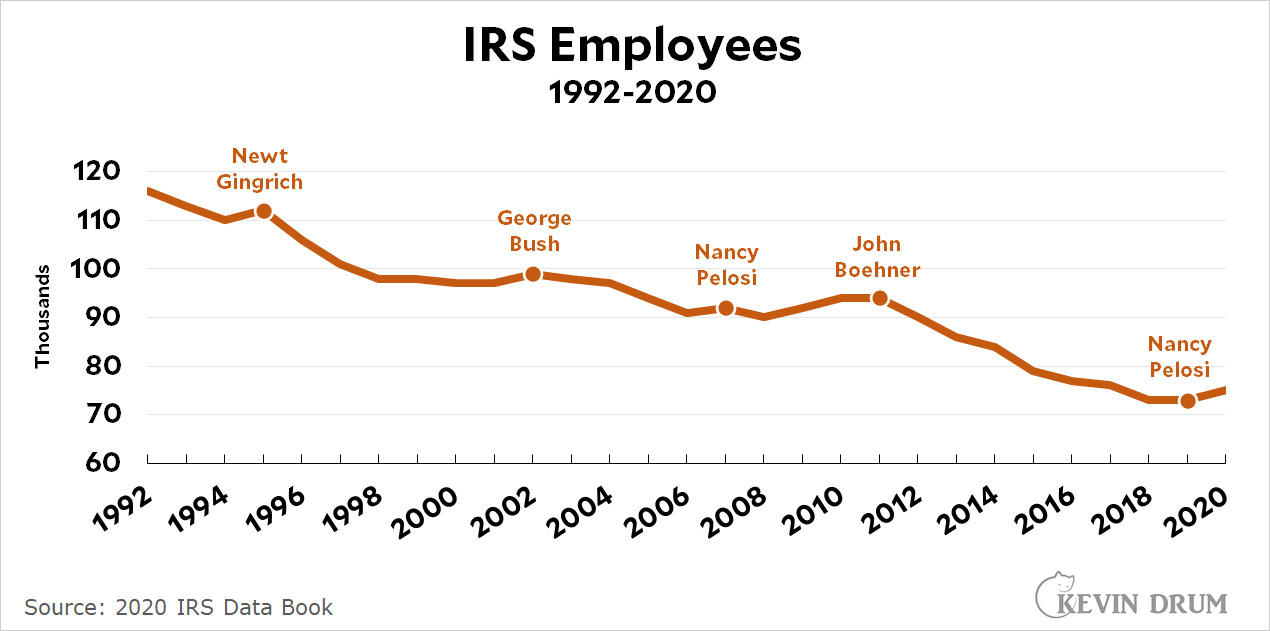

It started in 1995 when Newt Gingrich took control of the House. Within four years he had slashed 14,000 employees from the IRS.

It started in 1995 when Newt Gingrich took control of the House. Within four years he had slashed 14,000 employees from the IRS.

Gingrich was on his way out after four years, but in 1998 Sen. William Roth kept the flame alive by holding a week of hearings in which witnesses were hidden by black curtains and had their voices altered. Everyone was searched before entering the room. Republicans lined up to denounce the IRS as “Gestapo-like” and a law was quickly passed that handcuffed agents and slashed the budget for audits and enforcement, especially against high-income taxpayers.

In 2001 George Bush became president and Republicans were once again free to do as they wished with the IRS. Over the next six years they cut another 5,000 employees, stopping only when they lost control of the House to Nancy Pelosi and control of the presidency to Barack Obama.

In 2011 Republicans took control of the House and slashed another 20,000 employees by bargaining with Obama over things he cared more about.

In 2019 Democrats took control of the House and the hemorrhaging stopped.

Bottom line: over the course of the past three decades, Republicans have cut the IRS workforce by nearly 40,000. Even when you add back the small numbers that Democrats have won, the IRS workforce is still down by over a third since 1992.

But that's not all. It would be simple for the IRS to simply calculate your taxes for you if you have a simple return. This would save tens of millions of taxpayers a huge amount of grief and would take a lot of pressure off of IRS help lines. So why not do it? Roughly speaking, the answer is that Intuit, the maker of TurboTax, has lobbied relentlessly to prevent it. And who supports Intuit? Mostly Republicans. If they supported free IRS tax prep, the vast majority of Democrats would join them.

In other words, Republicans have spent the past three decades committed to the very things that hamstring the IRS most effectively: stripping it of workers and refusing to let it adopt an obvious labor-saving reform. There are two reasons for this:

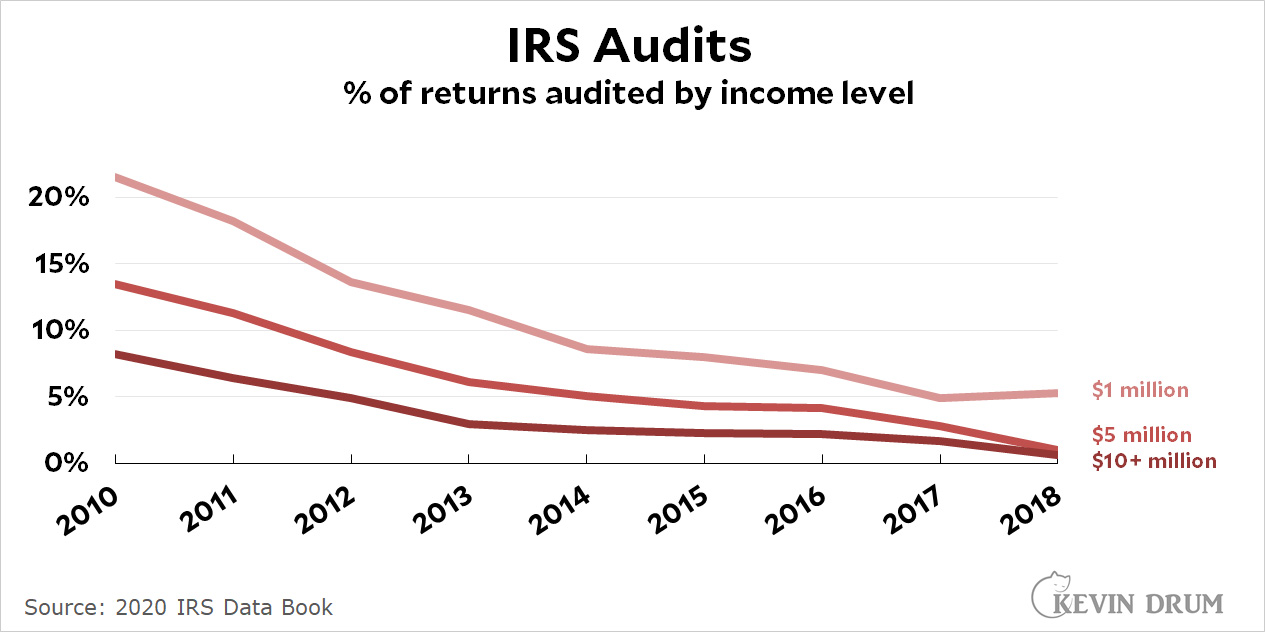

- They want people to tear their hair out during tax season. It helps make taxes unpopular.

- They want to gut the IRS of the resources to audit rich people—and they have. I assume this needs no explanation.

Recently, of course, the IRS has been in even worse shape. But this is because of temporary staffing shortages due to COVID-19, not IRS incompetence. Even an NRO writer ought to know that.

Pingback: Hiltzik : Pourquoi le fisc est-il si mauvais en matière de service client ? - Nouvelles Du Monde

Pingback: Hiltzik: Why is the IRS so bad at customer service? - Breaking News, Latest News, Headlines ...

Pingback: Hiltzik: Why is the IRS so bad at customer service? - News07trends

Pingback: Column: Don't blame the IRS for its lousy service. Blame Congress - News Bit