Over at National Review, Dominic Pino says the woes of the IRS are its own damn fault:

The agency answers only 11 percent of incoming calls, takes 45 days to turn around correspondence, and finished the 2021 tax season with a backlog of 35 million returns.

....The IRS is clearly a poorly run organization, and poorly run organizations should not be rewarded with more money....The bureaucrats who run the agency will always tell Congress that they don’t have enough money, and there’s a certain amount of institutional learned helplessness that goes into that. If the agency actually improved its processes and better served taxpayers, its case for funding increases would weaken.

I admire the brass on display here. Whatever institutional problems the IRS might have, the proximate cause of its problems is that conservatives have been hellbent on gutting the agency over the past 25 years:

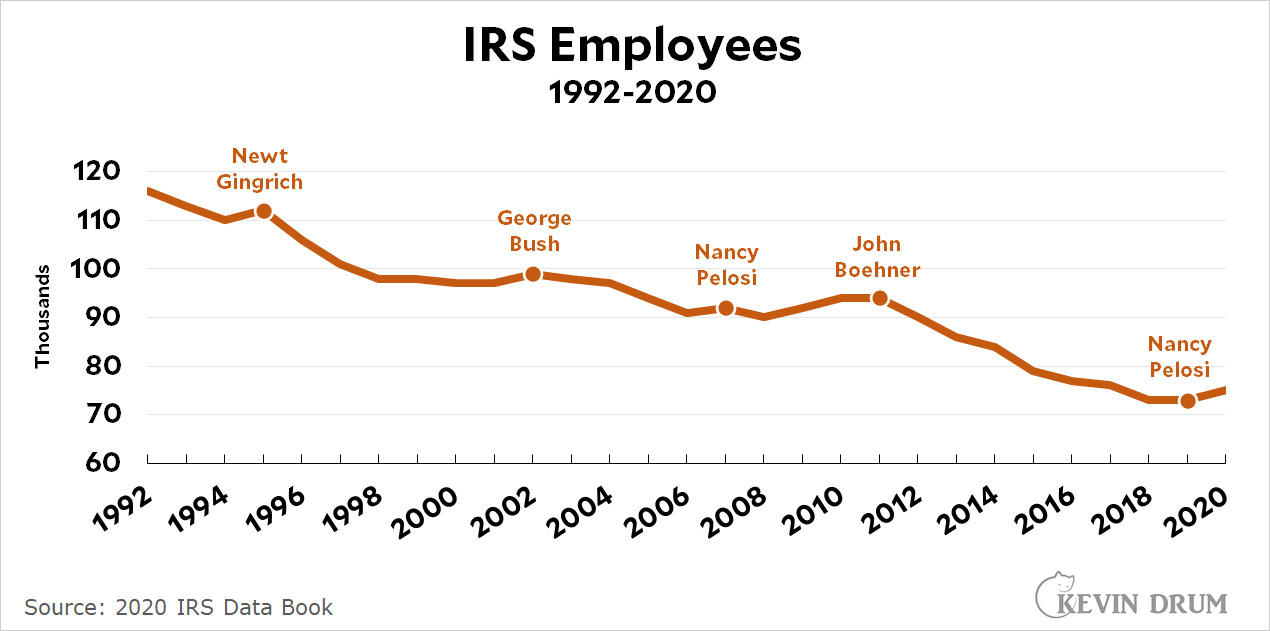

It started in 1995 when Newt Gingrich took control of the House. Within four years he had slashed 14,000 employees from the IRS.

It started in 1995 when Newt Gingrich took control of the House. Within four years he had slashed 14,000 employees from the IRS.

Gingrich was on his way out after four years, but in 1998 Sen. William Roth kept the flame alive by holding a week of hearings in which witnesses were hidden by black curtains and had their voices altered. Everyone was searched before entering the room. Republicans lined up to denounce the IRS as “Gestapo-like” and a law was quickly passed that handcuffed agents and slashed the budget for audits and enforcement, especially against high-income taxpayers.

In 2001 George Bush became president and Republicans were once again free to do as they wished with the IRS. Over the next six years they cut another 5,000 employees, stopping only when they lost control of the House to Nancy Pelosi and control of the presidency to Barack Obama.

In 2011 Republicans took control of the House and slashed another 20,000 employees by bargaining with Obama over things he cared more about.

In 2019 Democrats took control of the House and the hemorrhaging stopped.

Bottom line: over the course of the past three decades, Republicans have cut the IRS workforce by nearly 40,000. Even when you add back the small numbers that Democrats have won, the IRS workforce is still down by over a third since 1992.

But that's not all. It would be simple for the IRS to simply calculate your taxes for you if you have a simple return. This would save tens of millions of taxpayers a huge amount of grief and would take a lot of pressure off of IRS help lines. So why not do it? Roughly speaking, the answer is that Intuit, the maker of TurboTax, has lobbied relentlessly to prevent it. And who supports Intuit? Mostly Republicans. If they supported free IRS tax prep, the vast majority of Democrats would join them.

In other words, Republicans have spent the past three decades committed to the very things that hamstring the IRS most effectively: stripping it of workers and refusing to let it adopt an obvious labor-saving reform. There are two reasons for this:

- They want people to tear their hair out during tax season. It helps make taxes unpopular.

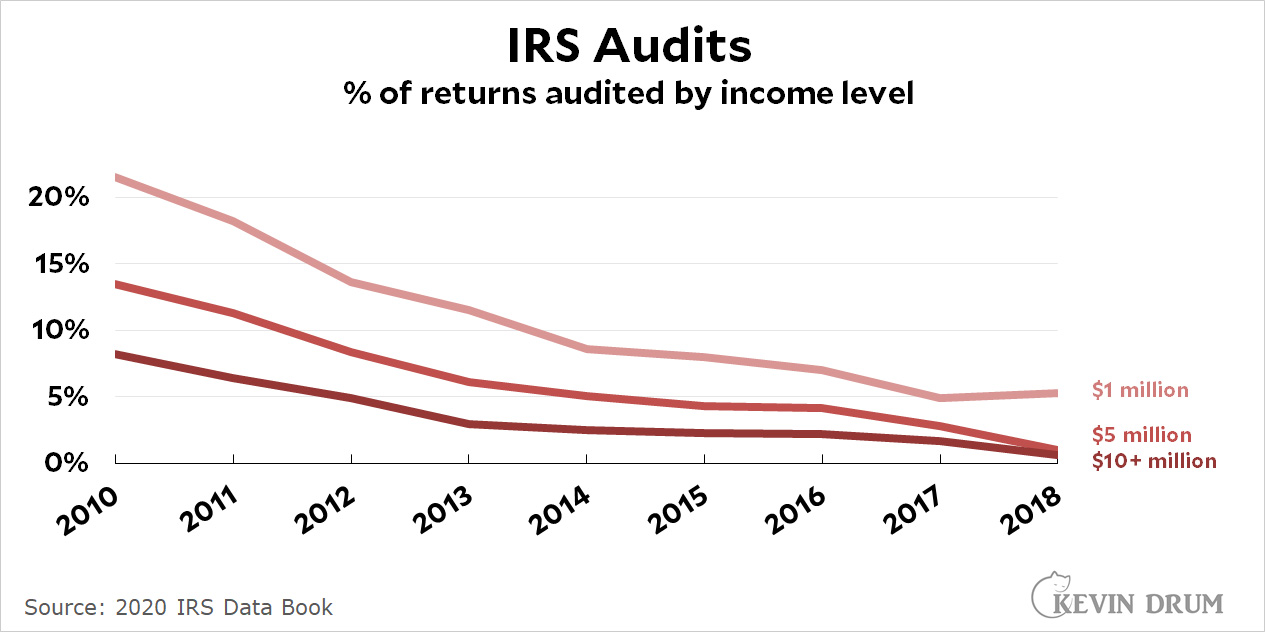

- They want to gut the IRS of the resources to audit rich people—and they have. I assume this needs no explanation.

Recently, of course, the IRS has been in even worse shape. But this is because of temporary staffing shortages due to COVID-19, not IRS incompetence. Even an NRO writer ought to know that.

Defund the IRS! What could go wrong?

The only tax that gets paid is from workers and others who get W2s. Mission accomplished.

You got it.

i generally hate the run-government-like-a-business bs conservatives seem to love, but at least a business executive would look at those numbers and attempt to find and solve the problems plaguing the agency. this is just ideological bovine excrement in its purest form.

Steve Mnuchin agrees with you,

or at least he did that day,

https://www.vox.com/policy-and-politics/2017/1/19/14324766/steven-mnuchin-irs-funding

"I acknowlege I murdered my parents, Your Honor, but I plead for mercy on the grounda that I'm an orphan."

The IRS is the police for rich people. The GOP has been defunding the police for decades.

+1

+2

+10

+100

+1000

Not limited to the IRS.

It’s the American way. Teachers. Police. UPS.

Need 10 people for the job? Here’s 7.

Good luck.

I blame Reagan.

A few days ago I happened to catch an appearance he did on Johnny Carson shortly after he left the governorship (on Youtube). A nice, genial, elegant man (at least in public). He would've been superbly suited for serving as a ceremonial president if the United States were a parliamentary republic like Germany or Ireland.

But he was massively misinformed about public policy. And yes, the US is still paying the price.

(Although if it hadn't been Reagan, I think it's likely someone of similar philosophy would eventually have taken control of the GOP, perhaps in a later cycle.)

“. . . poorly run organizations should not be rewarded with more money.”

Just another variation on the old Republican theme: the beatings will continue till morale improves.

The debacles of Iraq and Afghanistan are why Republicans support slashing the budget for the military...

National Review has been losing money for many years https://www.politico.com/blogs/media/2015/03/national-review-goes-nonprofit-204795

Obviously a poorly-run organization.

William F. Buckley's grow operation is a drain. But then, weather in Connecticut isn't conducive to outdoor agriculture year round, so it's all greenhouses & hydro.

I was an employee of a Republican controlled state in 2009 when the Long Recession took hold and the agency that received the most layoffs was the Dept. of Revenue.

great post and great summary of the problem

Like Canuck says above, this is the offspring of the Reagan idiocy, which has been the GOP's MO since then.

Step One:

"The government is the problem and can't do anything right, so it should be made smaller"

Step Two:

When they are in power they intentionally run the government as bad, as incompetently, and as corruptly as possible

Step Three:

"See? We told you that the government is the problem, so send us back to office to slash it and make it smaller"

Step Four:

Rinse and repeat

This post could also use a chart showing how many tax returns claiming the Earned Income Tax Credit get audited based on presidential administration. Can't have the poors claiming an extra penny!

Well, the District of Columbia is presumably not subject to such whims, and their tax collection isn’t much better. Very long on hold times, with hold music. A ten second of, repeating loop….

The California Franchise Tax Board is also terrible and it's hard to blame that on conservatives.

Are you saying conservatives don't live in California?

No, but they haven't held sway in the Legislature for decades.

Are you sure the District’s revenue department isn’t subject to the whims of Congress? I realize the District has had home rule since the 70s, but congress still technically has to acquiesce to its actions… and sometimes overrides or subverts whatever the District wants to do. It’s why the District can’t impose any kind of commuter tax, it’s why the District’s budget historically has been frozen whenever the federal government is shutdown (until quite recently) and it’s why the District has to tiptoe around imposing popular liberal reforms like legalizing marijuana (introducing them when Congress is distracted, on recess or run by Dems, and hoping that Congress doesn’t use its review powers to repeal them).

Point is, I wouldn’t be surprised if the District’s revenue dept was hamstrung by Republican shenanigans buried in unrelated federal legislation. Perhaps on one of the anti-tax jihads Kevin described, a rider was added to also cut or limit the growth of tax collection in the District too?

While I am a 30+ year DC expat, I suspect that were the District's revenue department hamgstrung by Congress there would have been any manner of hue and cry about it.

Was 1992 the peak of headcount?

Was 2010 the peak of audits?

I didn't lookup audits but I did manage to find, without tooooo much trouble, IRS reports giving (average) personnel counts going back to 1951. In at least some of their annual reports, they give the counts going back a few decades.

https://docs.google.com/spreadsheets/d/1QCDTT2M0-xb2KeLdmdVyj4nsAfnrRiPWV1B2-ZLH9qw/edit?usp=sharing is the result.

I don't doubt there have been forces looking to defund/shrink/neuter the IRS. So, specifically how many employees should the IRS have? It has been getting more computerized since 1959.

A more complete look might include not only some factor to account for increasing automation, but the ratio of IRS employees to national population - their data books do seem to include numbers for the latter. I'll leave that as an exercise for a pundit with time on his hands.

Side note: It can be somewhat interesting to read those annual reports - and the multitude of things they include about taxes collected, what type, from where, etc etc etc.

And, since Kevin didn't deign to provide even the highest level link for where I assume he got his data, here you go: https://www.irs.gov/statistics/soi-tax-stats-all-years-irs-data-books

ratio of IRS employees to national population

Neither you nor Kevin provide this data, but I’m gonna go out in a limb and guess that if the overall number of IRS employees have gone down, the ratio of IRS employees per capita has also gone down. Basic math tells us if the numerator decreases while the denominator increases, the result will be a steadily decreasing fraction over time. And for sure, the US population has grown since 1990… ever decennial census since the first one has found population growth in the US. https://en.m.wikipedia.org/wiki/Demographic_history_of_the_United_States

So I’m not sure what your point is with this particular criticism? No matter how you slice it, IRS is being asked to collect revenue from more people every year with fewer employees. Whether you think automation can make up the difference is debatable… but you still need some people to run the computers, answer the complicated phone questions and haul the tax cheats into audit interviews.

There’s no simple way to assess the performance of the IRS. For one thing, with a static process, staff would be expected to scale with the number of taxpayers (individual and corporate). But there have been process improvements; computers doing screenings and flagging unusual/suspicious returns for humans to review, for example. IRS could probably do a reasonable benchmark study against private accounting firms - but I suppose they would have to get that funded by Congress ….

Ah, I see rick has addressed these in the comment he wrote while I was writing mine!

I've gone ahead and computed the number of US residents per IRS employee for 1951 and on. And added that to the spreadsheet. In 1960 it was 3569 residents per IRS employee. From that point until about 1988 the IRS was hiring faster than the population was growing and it reached 2128 residents per IRS employee. "Today" (2020) it is 4375 residents per employee. So, the number is up (4375-3569)/3569*100 or 22.6% compared to 1960. Unless someone can say the IRS was crap in 1960, I would think one would have to be able to say that there has been very little increase in (potential) productivity with 60 years of computerization for the current ratio to be "bad."

Perhaps there is data on the number of pages in the USC (and CFR?) concerned with taxes, as a proxy for complexity of the law - which works against productivity.

In general, productivity improves about 2% per year. Seems like the number of IRS employees needed would go down steadily as computer aids and automation help more. However, this would not explain the reduction in audits.

As rick_jones and I noted, the volume of returns to be processed goes up with population and net of business starts minus discontinued. Also, productivity is likely to improve in larger steps, but at longer intervals, then be relatively constant between upgrade cycles for automation systems.

Audits generally can’t be automated by definition - computers can’t decide whether the data fed into them is false or true - so the subset of IRS staff that was conducting audits in the 1990s should’ve grown at the same rate as population growth if we wanted the chances of any taxpayer being audited to remain the same over time.

I’m guessing that the audit department of the IRS wasn’t protected from the ~40,000 job cuts though over the last 3 decades. But prove me wrong if you’ve got more detailed data than Kevin provided!

I forgot to add: Computers also are terrible at physically going out in the real world and hauling the tax cheats into an audit. Until robocops become readily available, the IRS will need real breathing IRS agents to do that… and those will need to scale with the growth in tax cheating (which I’ll let you decide if you think it may or may not have increased with the gutting of IRS staff in general along with the growing reliance of the IRS on computers to process everything, including the data the tax cheats know can’t be easily verified solely by computer).

I forgot another factor: the complexity of tax law, which I doubt has ever decreased. That can only mean more time to review flagged returns, and also more time spent training personnel, both increasing required annual person-hours.

The computer screening should be continually improved by randomly sampling returns, running the algorithm, and then having auditors check all the returns, flagged or not. That would allow the calculation of hit, miss and false alarm rates for the algorithm. I would guess that the IRS does this, assuming they have enough staff left.

It’s funny how the media works. Some obscure person writes a dishonest post and some other obscure person calls it dishonest then normal people are disgusted by the whole obscure episode.

The media, the government, and society are all broken beyond repair.

Why bother?

... And yet, here you are.

Yes, it took 6 months and calling my senator to get my $600 from coronavirus money. I still need to fight forcmy $1400 this year.

I'm not happy with the IRS but the blame is on republicans.

Well, that's the whole Republican MO, isn't it? Make government dysfunctional, break things, underfund programs. Then when it doesn't work, tell the voters that it's because government is inherently useless. And (oddly) vote to keep them in control of it.

Works every time, and better yet, prevents Dems from trying to move things ahead. Too much broken stuff to try to repair first, not that Republicans will let them. It's the gift that keeps on giving, like some kind of perpetual motion machine!!

"Even an NRO writer ought to know that."

It is amazing how easy it is to avoid knowing something if you are motivated enough. Examples abound: Vaccines, climate change, January 6, you name them.

Pingback: Kevin Drum Misses the Point | Watchman.Today

Pingback: Kevin Drum Misses the Point – REAL News 45

Pingback: Kevin Drum Misses the Point - Patriot Daily Press

Pingback: Kevin Drum Misses the Point – Conservative Action News

Pingback: Kevin Drum Misses the Point - Fierce Patriots

Pingback: Kevin Drum Misses the Point - HEALTHY LIVING NEWS

Pingback: Column: Don't blame the IRS for its lousy service. Blame Congress - Technocharger

Pingback: Column: Do not blame the IRS for its awful service. Blame Congress - World Newz Info

Pingback: Latest News From Round The WorldColumn: Don’t blame the IRS for its lousy service. Blame Congress

Pingback: Hiltzik: Why is the IRS so bad at customer service? - Current Time News

Pingback: Column: Don't blame the IRS for its lousy service. Blame Congress - tune.media