As you know, I've spent a long time arguing that the Fed's interest rate hikes aren't responsible for lower inflation. This is because inflation started to ebb within a few months of the hikes, and that's way too fast. It takes a year or two for interest rate changes to affect inflation.

Well, it's been a couple of years now, so where does that leave me? Still puzzled. You see, interest rates don't affect inflation magically. They slow down the economy by making loans more expensive, and a slower economy then brings down inflation. But that never happened. The economy never slowed down:

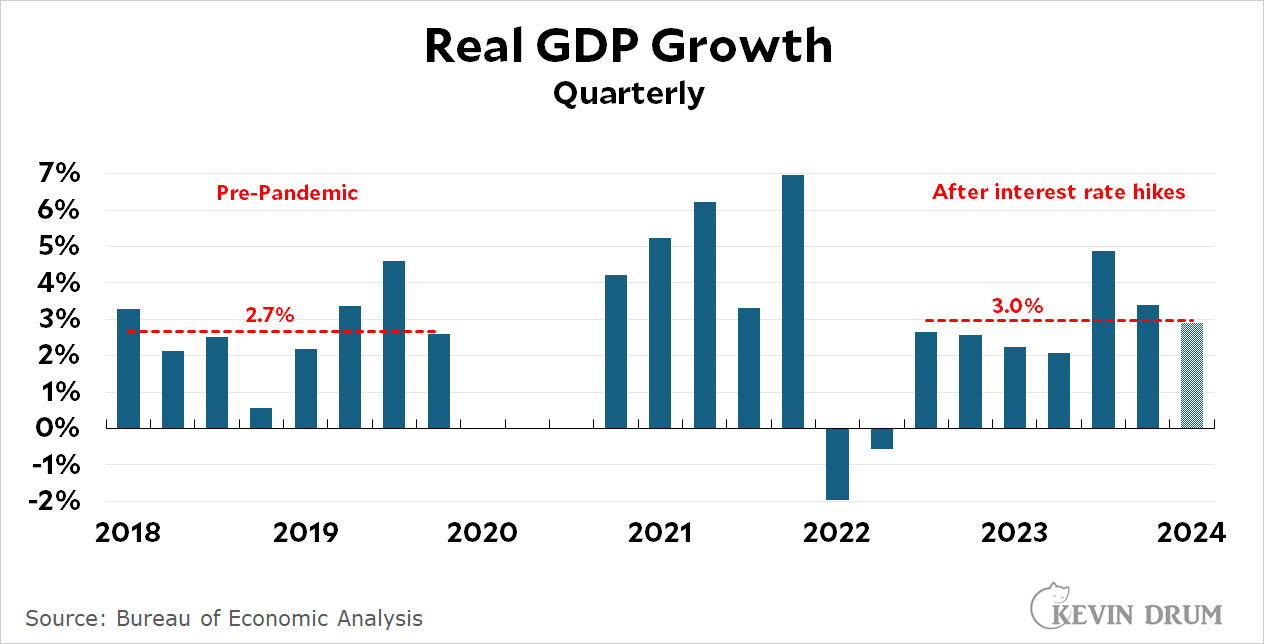

Average GDP growth since the interest rate hikes began has been about 3.0%. That's more than it was before the pandemic, which was a pretty strong growth era itself.

Average GDP growth since the interest rate hikes began has been about 3.0%. That's more than it was before the pandemic, which was a pretty strong growth era itself.

So what happened? This was well after stimulus spending had mostly dried up and wasn't affecting anything. So how is it that a large and sharp increase in interest rates didn't slow down the economy? Does anyone know?

I have a potentially stupid question to ask about this. I mentioned a few months ago that the Fed no longer controls interest rates via open market operations—that is, by buying and selling treasury bonds on the open market. Instead, it's mostly switched to the much easier method of changing the rate it pays banks for the reserves they keep at the Fed. If the Fed is paying 5.25%, no bank will loan out money for less, so interest rates automatically go up.

But is it possible that high interest rates have a different effect depending on how they're created? In other words, maybe higher interest rates without any open market operations behind them have an attenuated effect on the economy.

That sounds kind of stupid, but there's got to be something going on. More prosaically, maybe the fed hikes were just too small to have much of an effect. It was only a year ago that real interest rates went above zero, and even now real rates are only about 2%. In the past it's taken real rates of around 4% to touch off a recession.

Either way, it's hard to believe that no one really knows what's going on. How is it that the Fed hiked rates and produced not a soft landing, but no landing at all?

My theory- if Powell really wanted to stop inflation he’d have raised rates to at least 8%. My guess is he knew a good amount of it was supply chain and would regress. How much no one knows. However had he raised them to 8% ( or 10%) and caused a recession he would have stopped the economy dead and gotten the Orange Gobblin elected. Powell is no dope.