President Biden has proposed an increase in the capital gains tax to 43.4%. This produced a brief response on Wall Street and then everyone returned to their real business: namely that of piling every last cent they could lay their hands on into a SPAC.

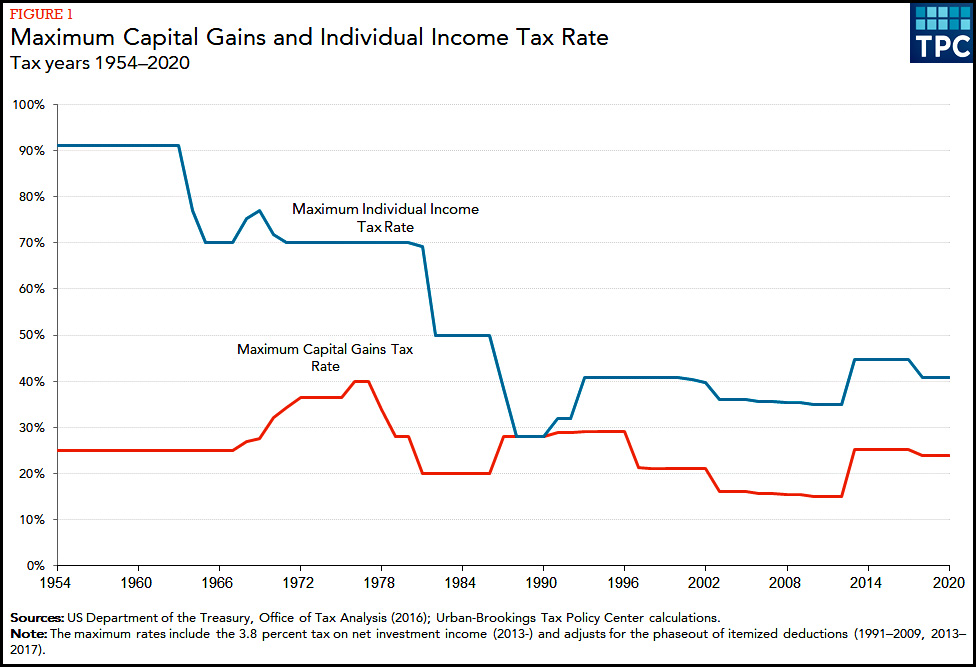

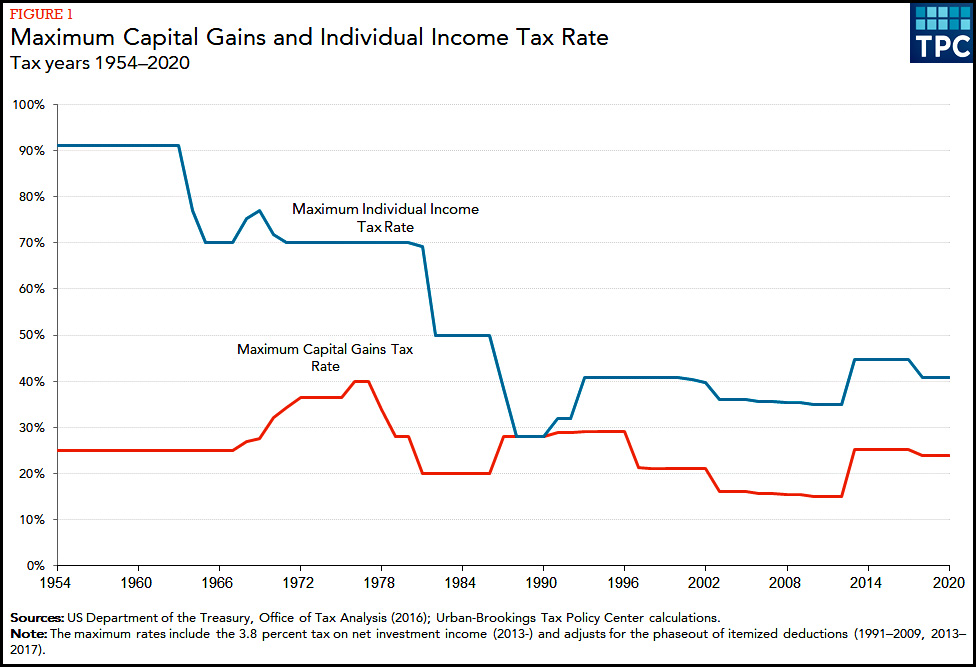

So what would a cap gains rate of 43.4% look like? The Tax Policy Center has you covered:

It would be high! On the other hand, during the early '90s the combined individual and cap gains rates were about 70%, while under Biden's proposal they'd be about 83%. So rich people wouldn't be all that badly off.

Of course, the real question is whether it's a good idea to tax capital at such a high rate. In theory it's a bad idea since it discourages investment. But does it?

It's hard to see much of an effect in either direction. This is, needless to say, not a sophisticated analysis, but at the very least we'd like to see a downward spike in investment when the cap gains rate increases, but we see no such thing. We'd also like to see an upward spike when the cap gains rate decreases, but again, there's no sign of that. The only things we see are brief pauses in the investment rate during economic recessions.

I'm enough of a neoliberal shill to be nervous about a high cap gains rate, but I'm also enough of a technocrat to want some serious evidence that a high cap gains rate has historically been bad for investment in the United States. So let's see it. Let the games begin.