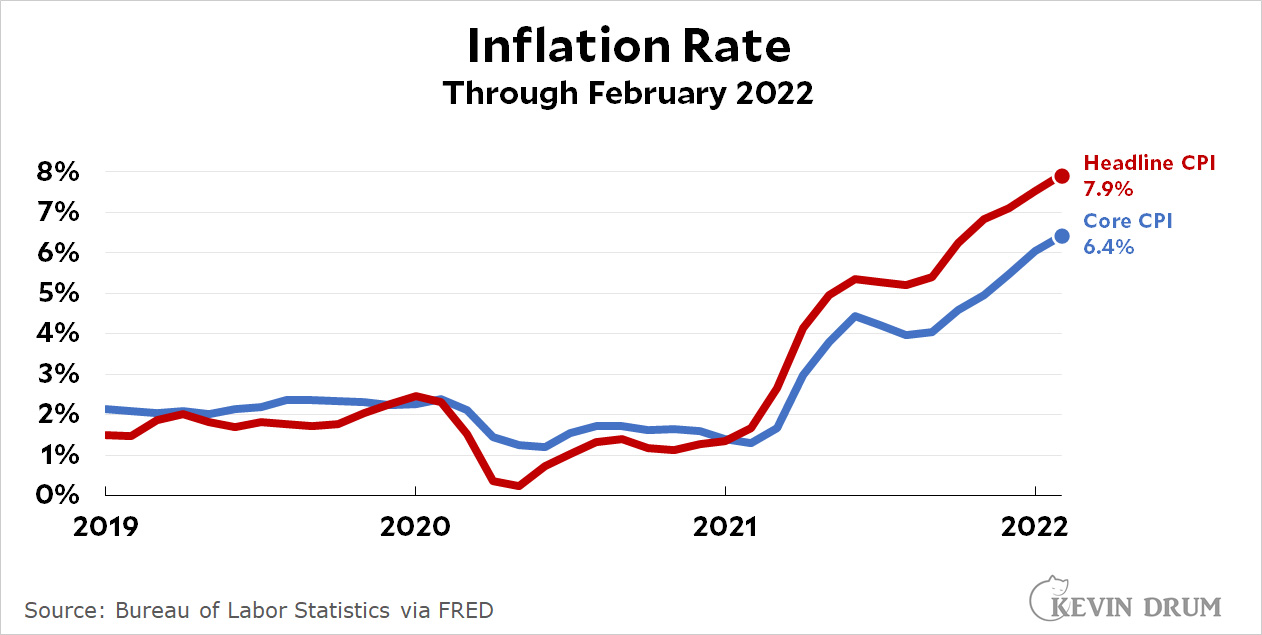

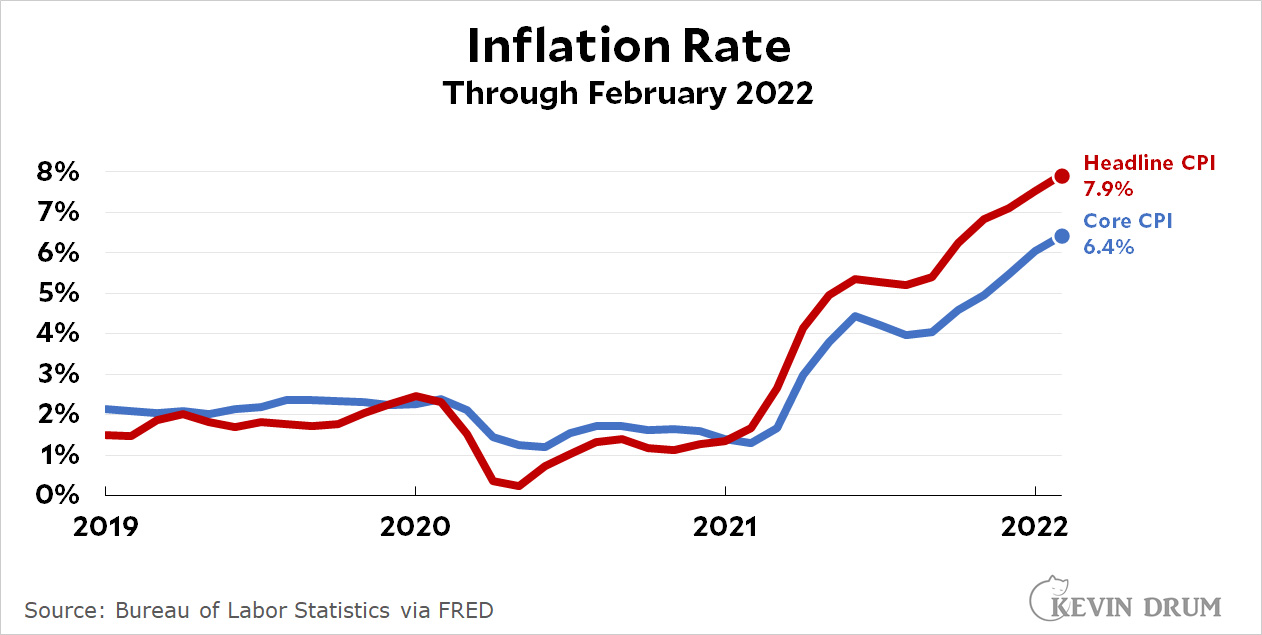

Today is inflation day, and the BLS reports that the US inflation rate rose in lockstep with the European rate announced a few days ago. The headline inflation rate went up from 7.1% in January to 7.9% in February:

Average weekly earnings, adjusted for inflation, declined 0.8% from January to February. That's an annualized rate of about -10%.

Average weekly earnings, adjusted for inflation, declined 0.8% from January to February. That's an annualized rate of about -10%.

Obviously Team Transitory took another big hit last month. It looks as though high inflation is lasting longer than any of them expected.

And here's one more takeaway: Corporations are using the current high inflation rate as an excuse to raise prices on just about everything. However, despite their claims of a workforce shortage, they are somehow finding the fortitude to avoid raising wages for their workers. Funny how that works.

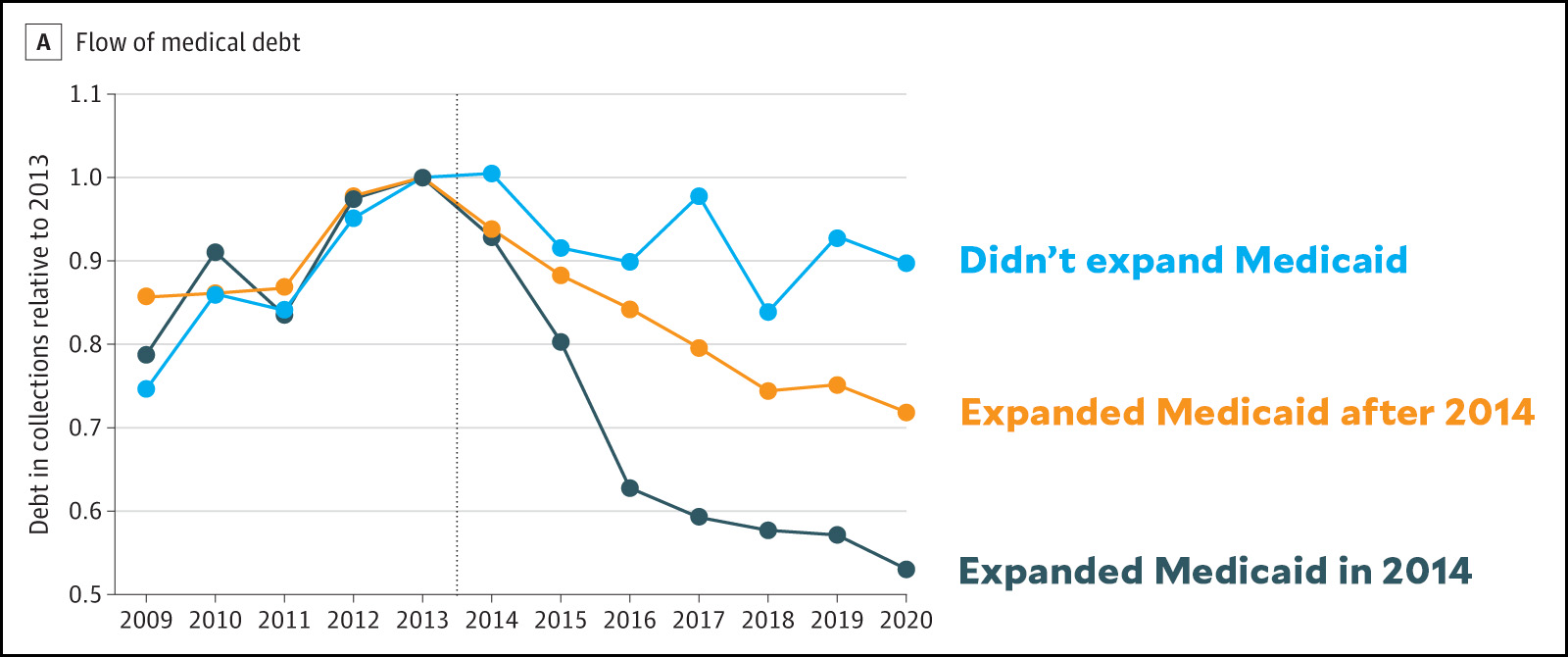

This is from a study published in JAMA a few months ago. In states that expanded Medicaid, serious medical debt (i.e. debt in collections) has been cut in half. In states that didn't, medical debt has stayed about the same. And needless to say, this debt is mainly a problem for those with low incomes.

This is from a study published in JAMA a few months ago. In states that expanded Medicaid, serious medical debt (i.e. debt in collections) has been cut in half. In states that didn't, medical debt has stayed about the same. And needless to say, this debt is mainly a problem for those with low incomes.