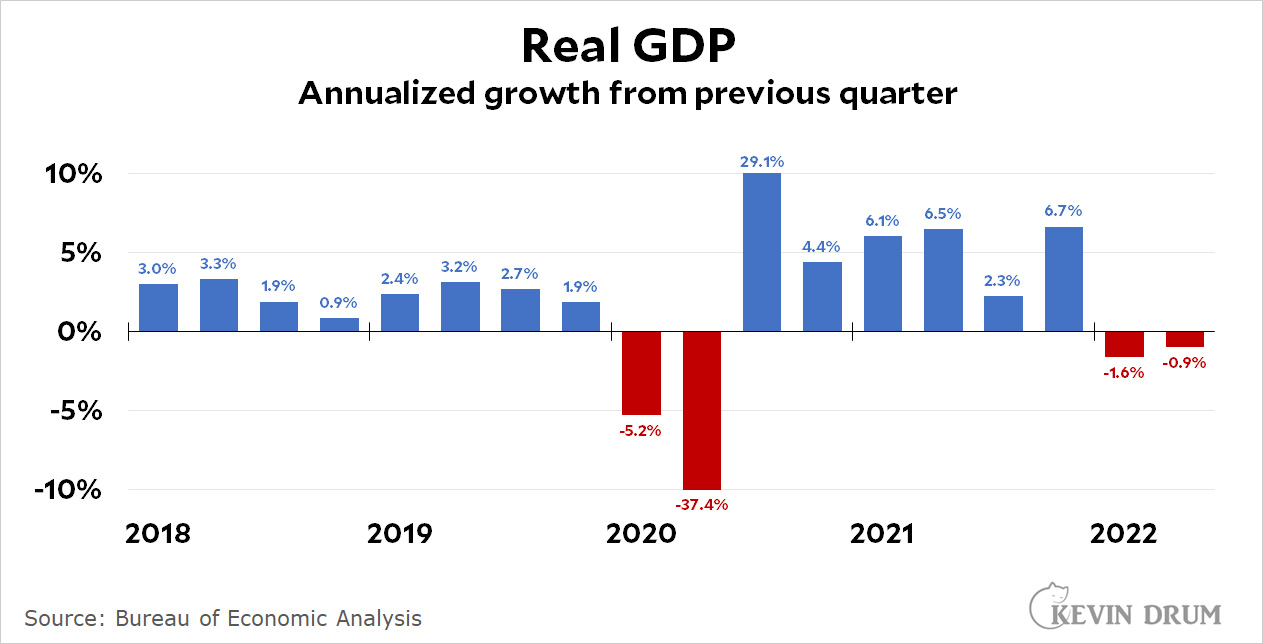

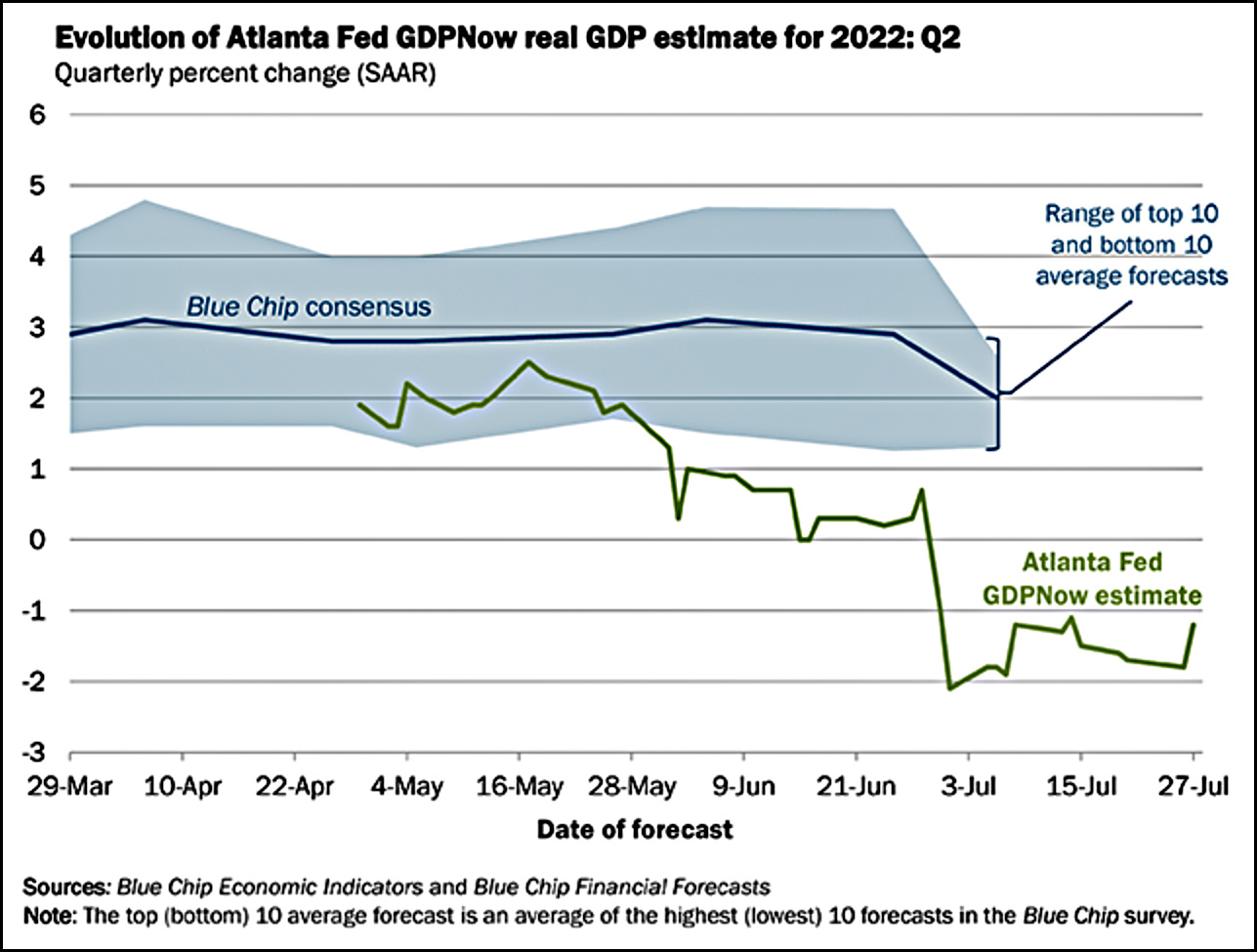

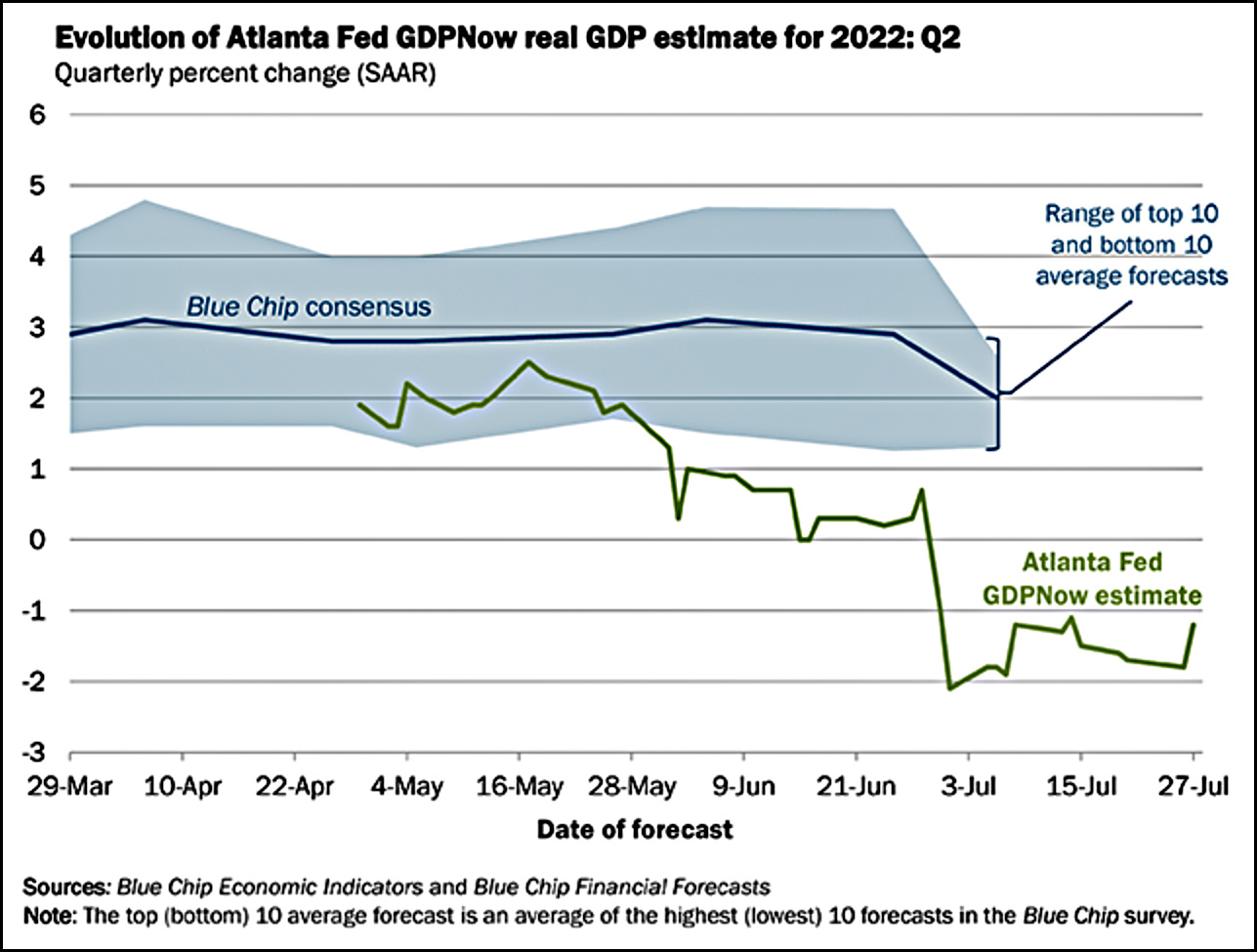

Tomorrow is a big day: the BEA will announce GDP for the second quarter and then we can all spend the rest of the day arguing about whether we're in a recession. Here's the forecast from the Atlanta Fed:

This will be a good test of the Atlanta Fed's GDPNow algorithms. They predict that GDP will come in at -1.2%, while the consensus of blue-chip forecasters puts it at +2%. That's quite a spread. Of course, the blue-chip forecast only goes through July 3, and it's gotten more pessimistic since then. The Conference Board is currently at +0.8%. The rest of the blue-chip gang is apparently at about +0.4%.

This will be a good test of the Atlanta Fed's GDPNow algorithms. They predict that GDP will come in at -1.2%, while the consensus of blue-chip forecasters puts it at +2%. That's quite a spread. Of course, the blue-chip forecast only goes through July 3, and it's gotten more pessimistic since then. The Conference Board is currently at +0.8%. The rest of the blue-chip gang is apparently at about +0.4%.

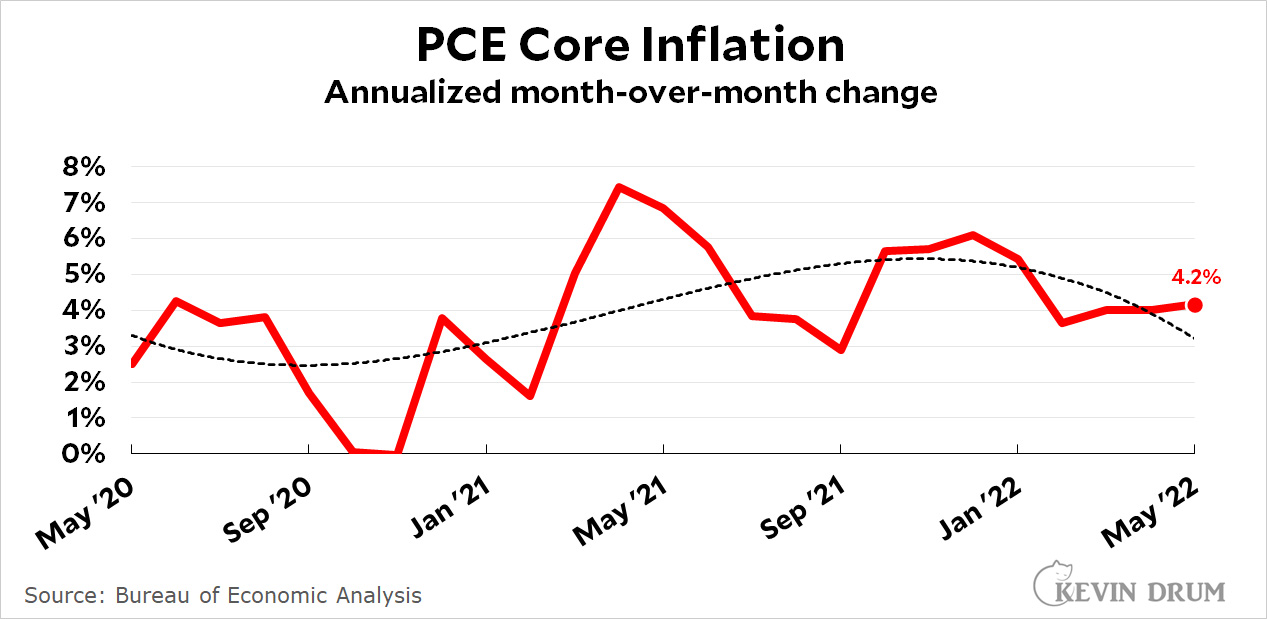

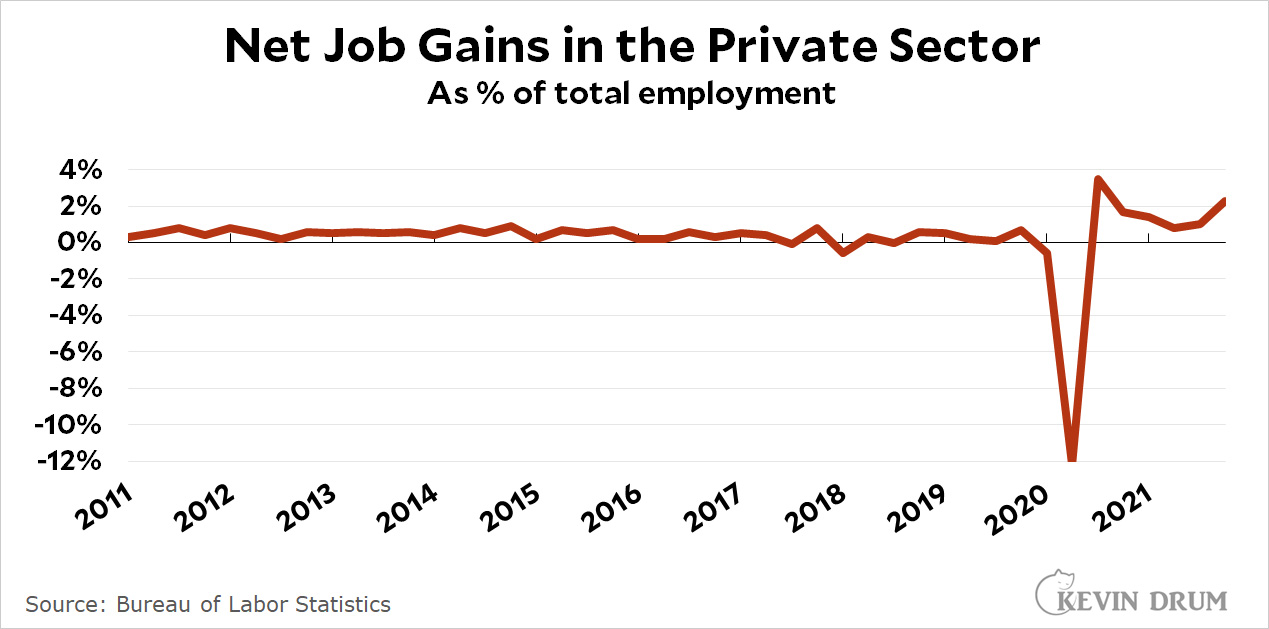

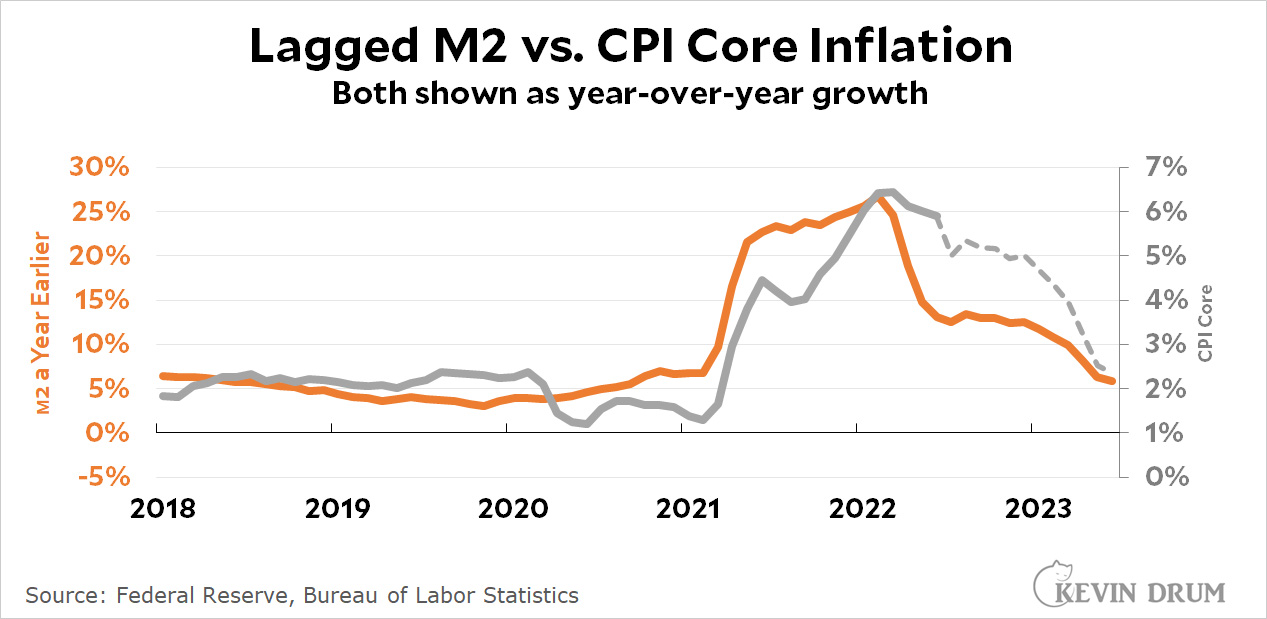

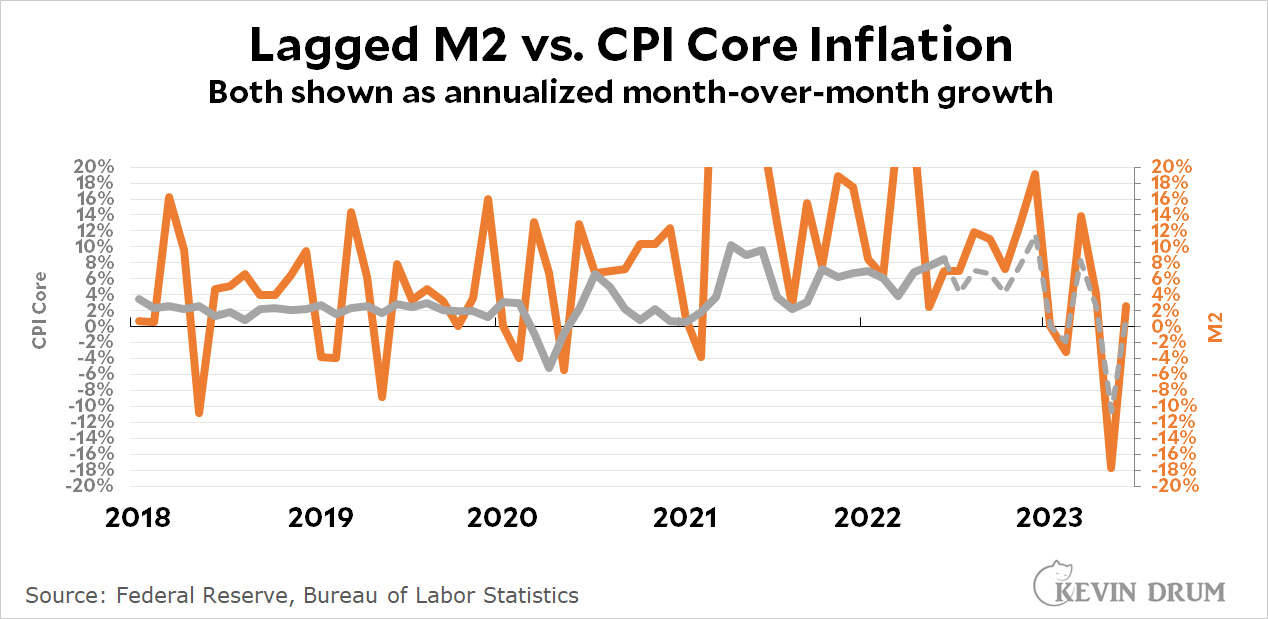

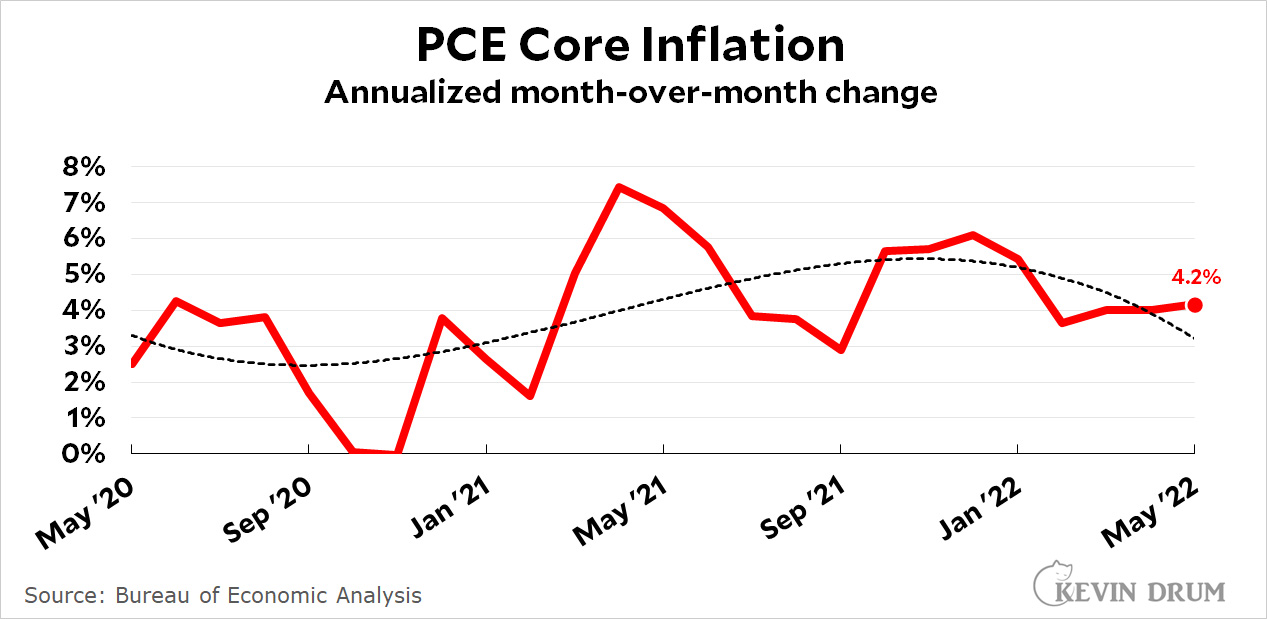

That's still a big difference, though. As for all the recession talk, it's hard to see it. Even if GDP is weak or negative, we're still talking about an economy that added more than a million jobs last quarter and maintained an unemployment rate of 3.6%. Consumer spending is flat, not down. And even core inflation is starting to ease:

On the other hand, real wages continue to decline and the stock market remained pessimistic during the entire quarter. So it's hard to say, isn't it?

On the other hand, real wages continue to decline and the stock market remained pessimistic during the entire quarter. So it's hard to say, isn't it?

In any case, what I'm more interested in isn't Thursday's GDP report but Friday's inflation report. Core PCE is allegedly the best measure of underlying inflation even though everyone ignores it, but not me. I'm genuinely curious to see where it's headed after a couple of months of refusing to make up its mind.