As you may recall, I got cataract surgery several months ago even though I don't have cataracts. I just wanted to replace my natural lenses with artificial lenses that promised sharp eyesight both near and far. Here's how it went.

My original intent was to get multifocal lenses that are designed with two separate focus points, but the ophthalmologist I saw talked me into something different: RxSight lenses that can be adjusted after they've been implanted and have an extended focus range.

Sadly, the former was true but the latter wasn't. What I ended up with was two monofocal lenses. My left eye had good distance vision but terrible near vision. My right eye had good near vision but terrible distance vision. In some people this is OK because your brain will merge them together and produce good eyesight at all distances. My brain was not clever enough to do this.

After a few months to give the lenses (and my brain) a fair shot at working, I finally asked to have them replaced with the multifocal lenses I wanted in the first place. A few weeks ago we implanted a Synergy lens in my left eye.

The Synergy lens has good distance vision and so-so near vision. However, this works fine: with good near vision in one eye and OK near vision in the other, my reading vision is pretty good. And my distance vision is fine even though my right eye still has terrible far vision.

However, all was not perfect: the Synergy lens produces a sort of vague double vision as well as strong halos at night when I look at bright lights. This is tolerable, and might get better with time, but I wasn't willing to risk putting another one in my right eye. If I ended up with both double vision and so-so near vision in both eyes, I was afraid I'd lose my reading vision entirely.

So I canceled the surgery for my right eye and I consider myself done for now. I'll reassess at the end of the year depending on whether the Synergy lens improves by then.

This may all sound like bad news, and it has been a pain in the ass. However, I did meet my goal: I no longer wear glasses at all and my vision is acceptable at all distances.¹ I wish it were sharper, but it's sharp enough for all ordinary activities, and I hold out hope that my brain will eventually edit out the the halos and double vision.

Would I recommend this for others? I would definitely avoid the RxSight lenses, which I later learned aren't even recommended unless you have an eye condition that precludes the use of multifocal lenses (I don't, and my doctor never should have proposed them). If you have to have them, then go ahead, but you'll just end up with a very expensive pair of monofocal lenses.

The Synergy lenses are better, but their near vision is only OK, not great. I have some fuzziness too, but not everyone does. It's a bit of a crapshoot.

And it's expensive. My surgery cost a little over $10,000. If I had it to do over again, I'm on the fence. It did work, but only barely.

¹Oddly, there's a caveat here: I now wear sunglasses outdoors. I never did before, but the artificial lenses are clearer than my old natural lenses. In theory that's good, but in practice it means I now have to haul around sunglasses on bright days, though I can do without them if I have to.

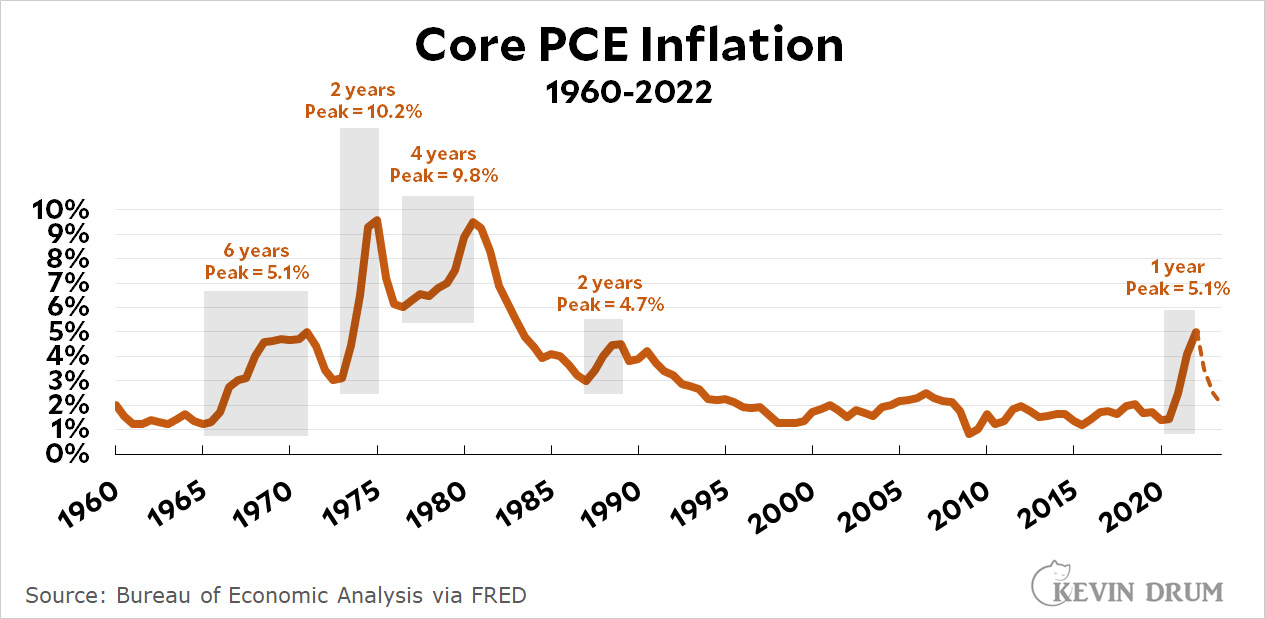

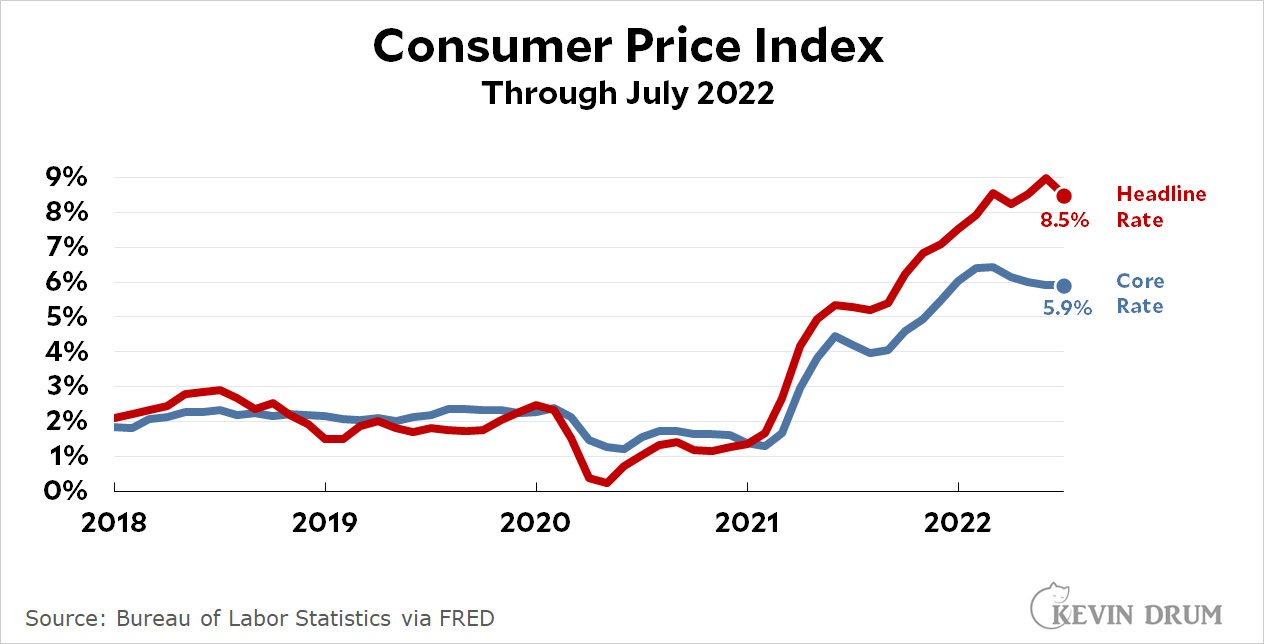

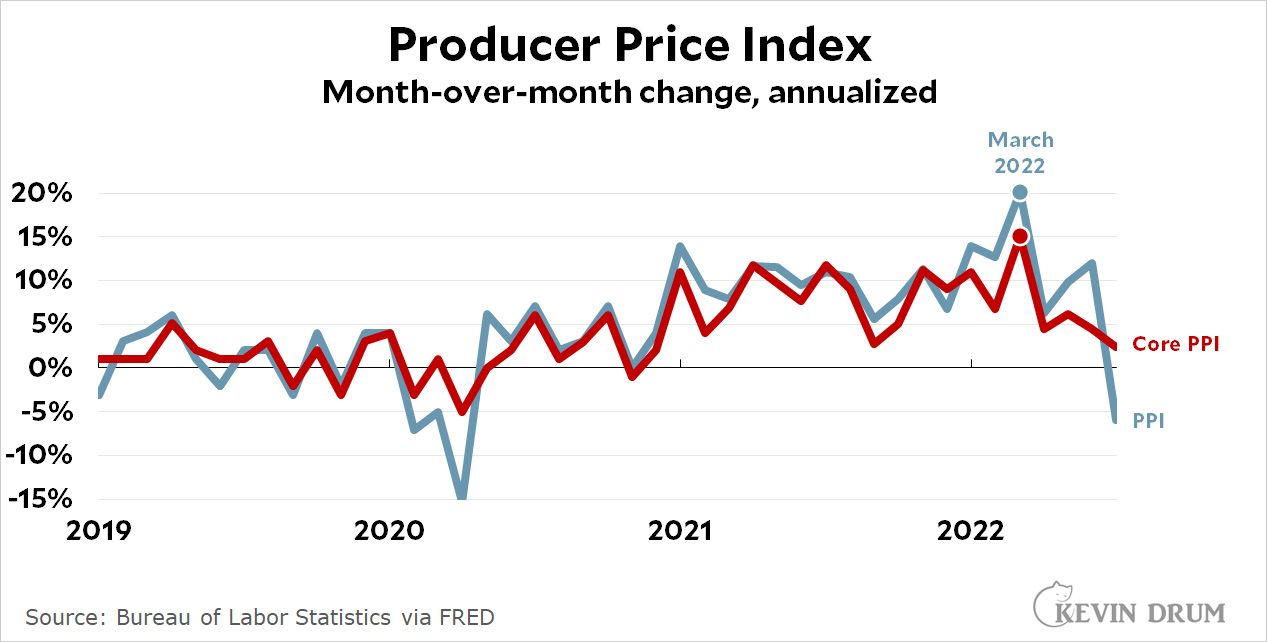

The Producer Price Index clocked in at -6% from June to July on an annualized basis. Core PPI remained positive, but declined to 2.3%. As with other inflation indexes, they both peaked in March and have been easing off ever since.

The Producer Price Index clocked in at -6% from June to July on an annualized basis. Core PPI remained positive, but declined to 2.3%. As with other inflation indexes, they both peaked in March and have been easing off ever since.