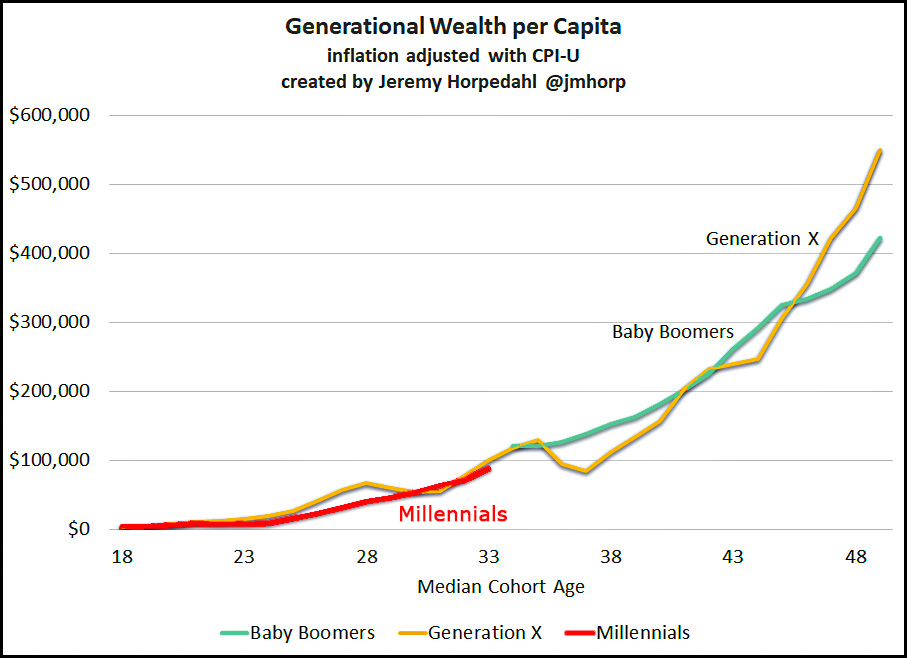

Believe it or not, I came home from Virginia with a homework assignment. The assignment was to answer this question: Is it really true that the share of wealth owned by Millennials is much lower than the share of wealth owned by Baby Boomers at the same age?

The simple answer is: Yes. The better answer is: Where did this meme come from in the first place? Who cares about population shares, anyway? Wouldn't it make more sense to look at per-capita wealth instead?

Yes it would. In fact, it's so obvious that I truly do wonder where this share-of-wealth meme started. But let's put that aside and move on.

Unsurprisingly, what follows is a bunch of charts. But don't get impatient with them! I'll eventually get to student loan debt, housing costs, and other Millennial issues.

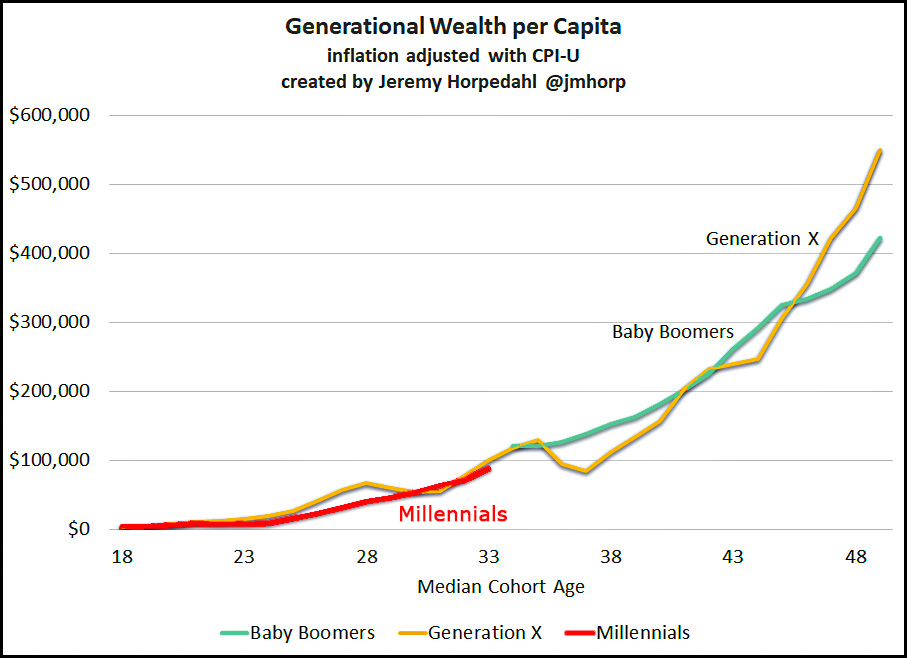

First off, here is wealth per capita for both Boomers and Millennials:

This comes courtesy of Jeremy Horpedahl, who pulled his data from the Federal Reserve’s Distributional Financial Accounts. This is more or less where everyone gets their data on wealth, and for now I'm going to assume that the Fed's data is reasonable and that Prof. Horpedahl has done his sums correctly.

This comes courtesy of Jeremy Horpedahl, who pulled his data from the Federal Reserve’s Distributional Financial Accounts. This is more or less where everyone gets their data on wealth, and for now I'm going to assume that the Fed's data is reasonable and that Prof. Horpedahl has done his sums correctly.

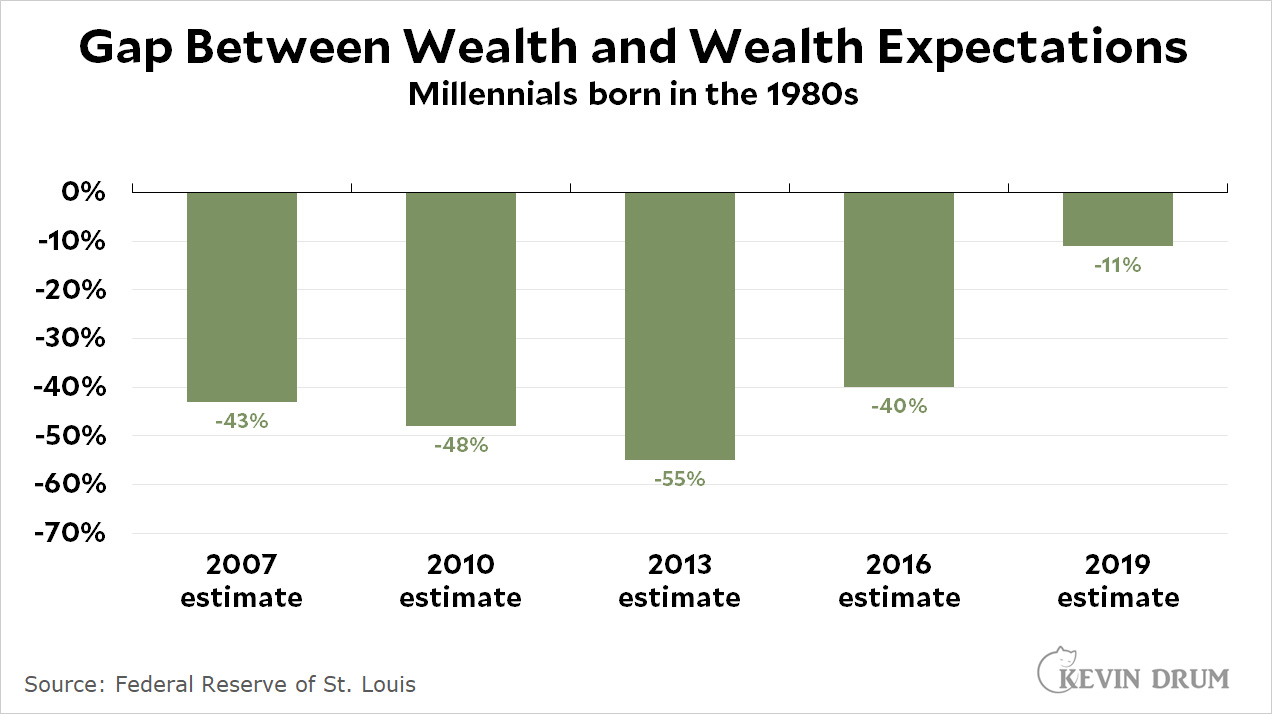

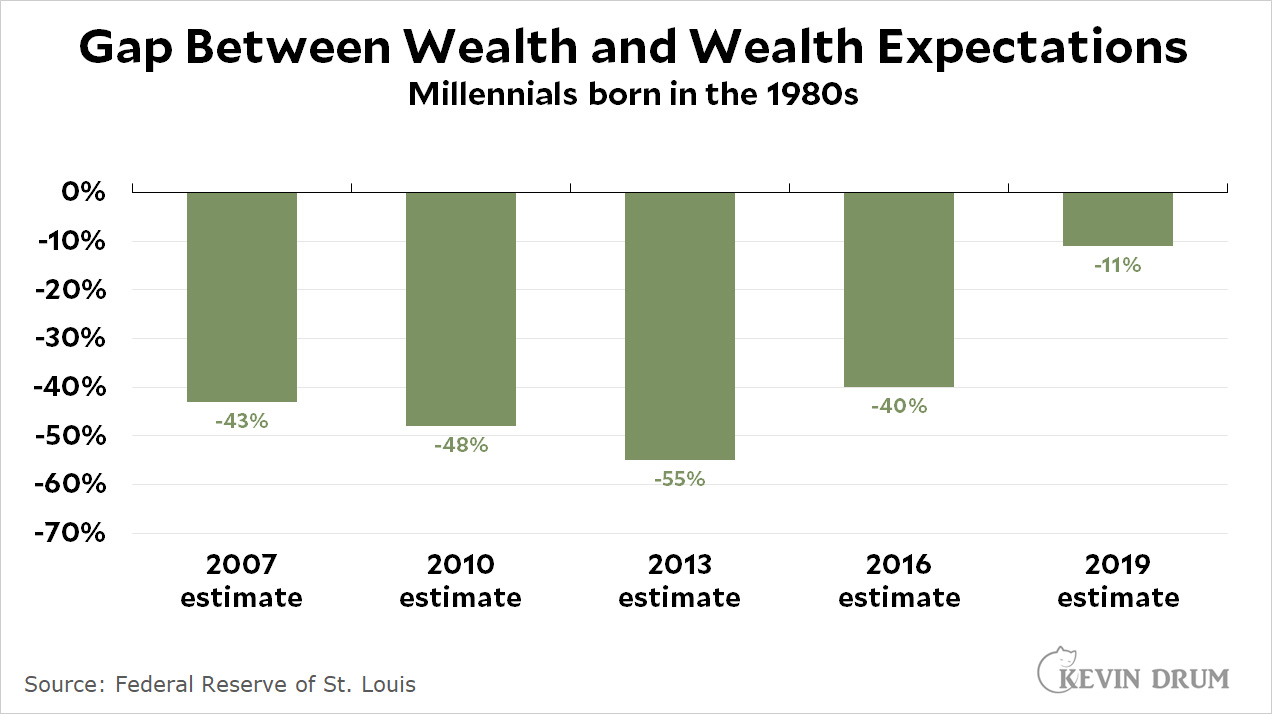

Here's another chart courtesy of the Fed:

The raw data for this chart comes from the Fed's Survey of Consumer Finances. The authors modeled expected wealth from the five most recent editions of the SCF and then compared it to actual wealth by generation.

The raw data for this chart comes from the Fed's Survey of Consumer Finances. The authors modeled expected wealth from the five most recent editions of the SCF and then compared it to actual wealth by generation.

As you can see, in 2007 Millennials were 43% below where they should have been. This continued through 2016, but in 2019 suddenly Millennials caught up. They are now only 11% below expectations and seem likely to make that up fairly soon.

There are two lessons to learn here. First, you have to keep up with the data. Things that we believe because we've seen them over and over don't necessarily stay true forever. Second, when you're dealing with small numbers, small changes can be a big deal.

For example, one of the reasons for the big jump in 2019 is probably student loans. When Millennials were in their 20s, they had lots of students loans and small incomes. Those loans had a huge impact on their ability to accumulate wealth. Today, many of those loans are paid off and Millennial incomes are higher. Put together, a big jump in wealth accumulation is what you'd expect.

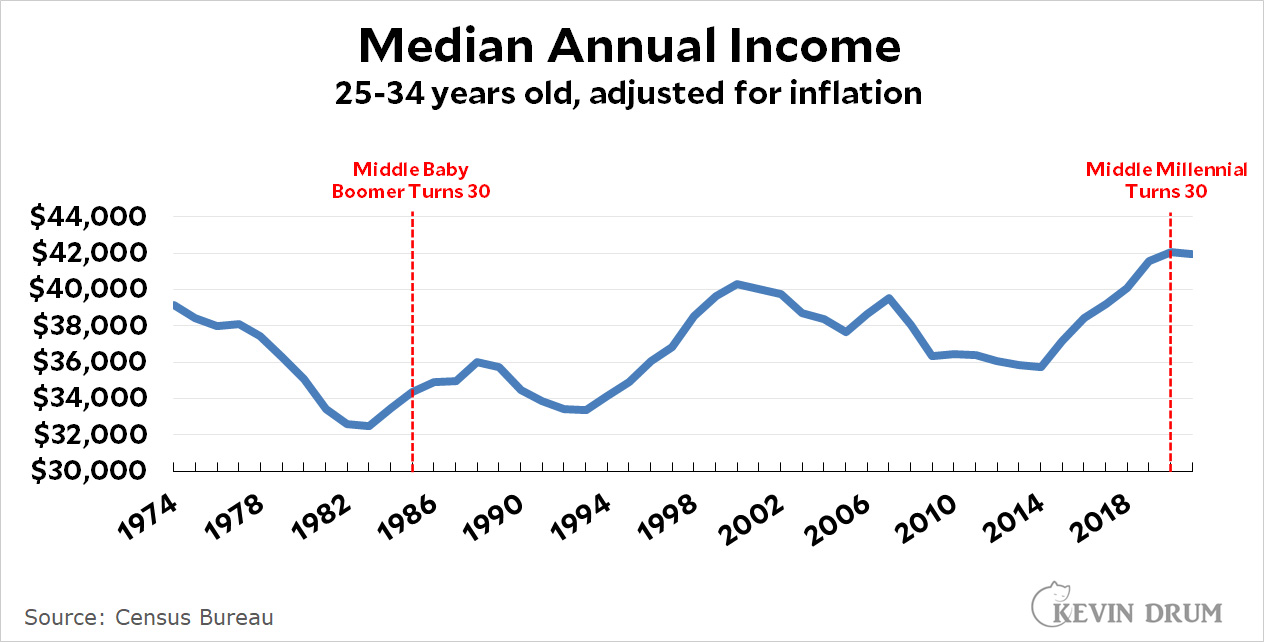

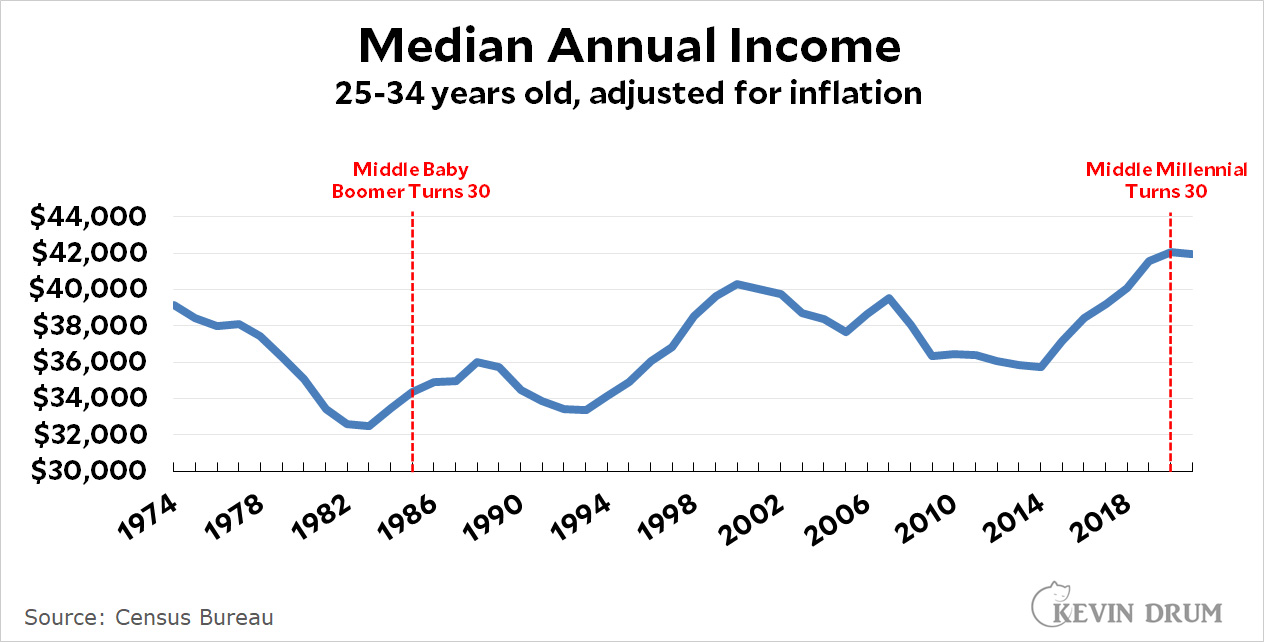

Now let's take a look at some other stuff. First up is plain old income:

Incomes haven't gone up much over the past few decades, but it's nonetheless the case that Millennials make more money than Boomers did at the same age.

Incomes haven't gone up much over the past few decades, but it's nonetheless the case that Millennials make more money than Boomers did at the same age.

Here's a GAO look at retirement assets:

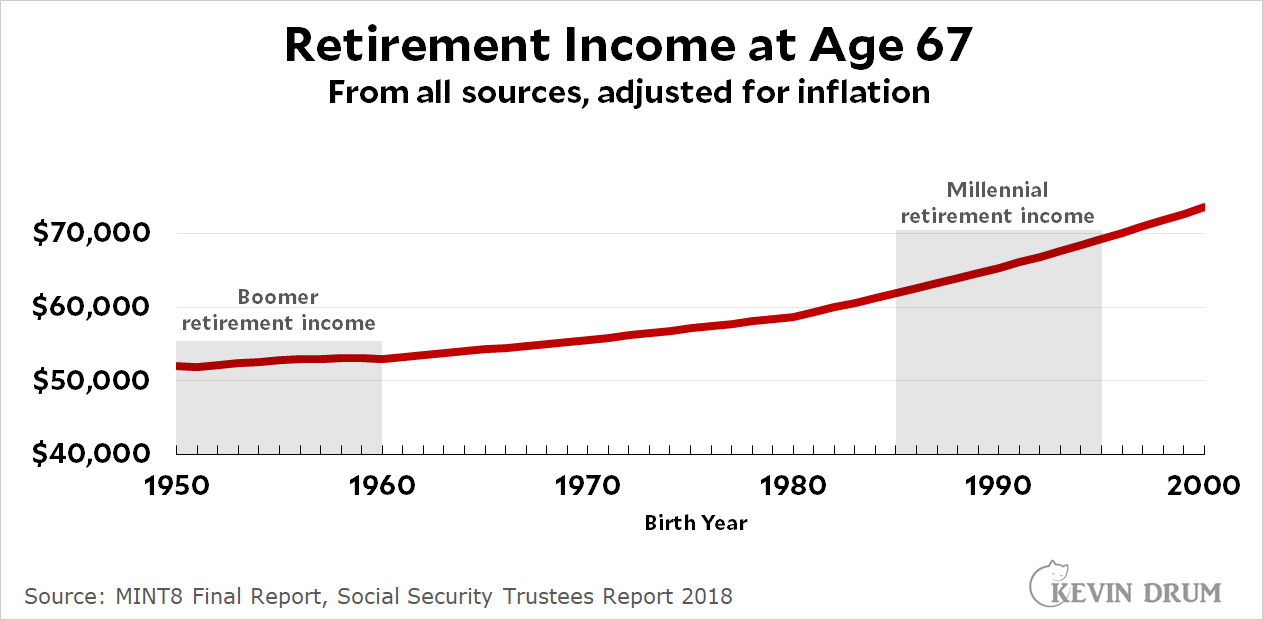

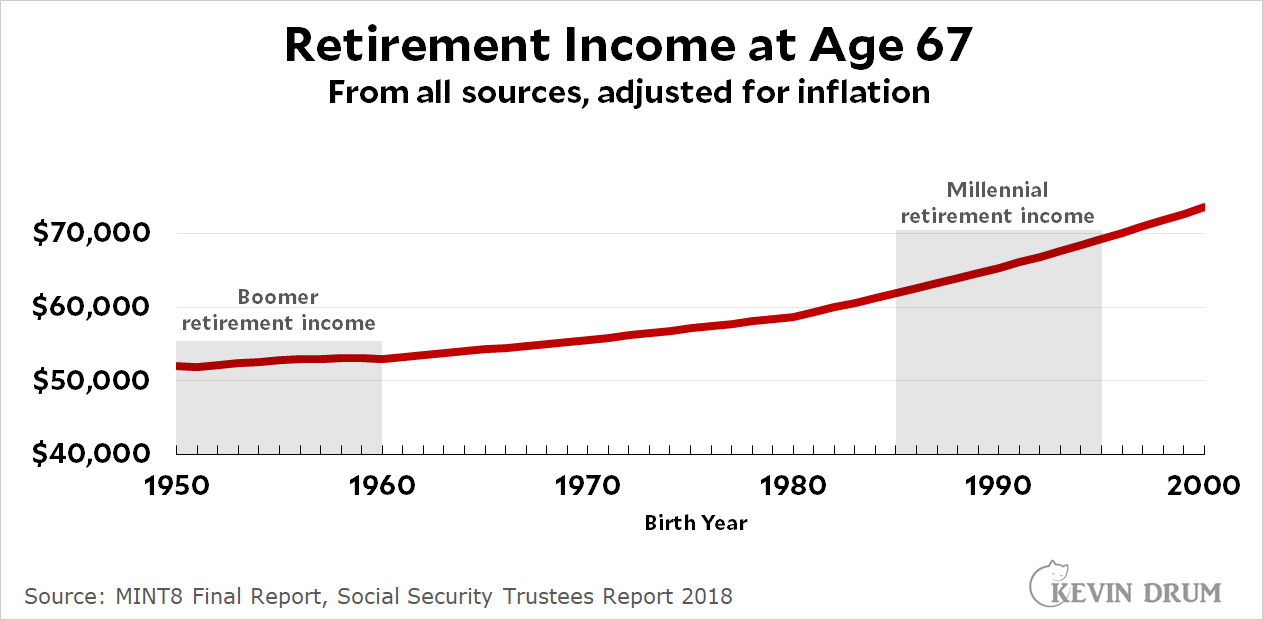

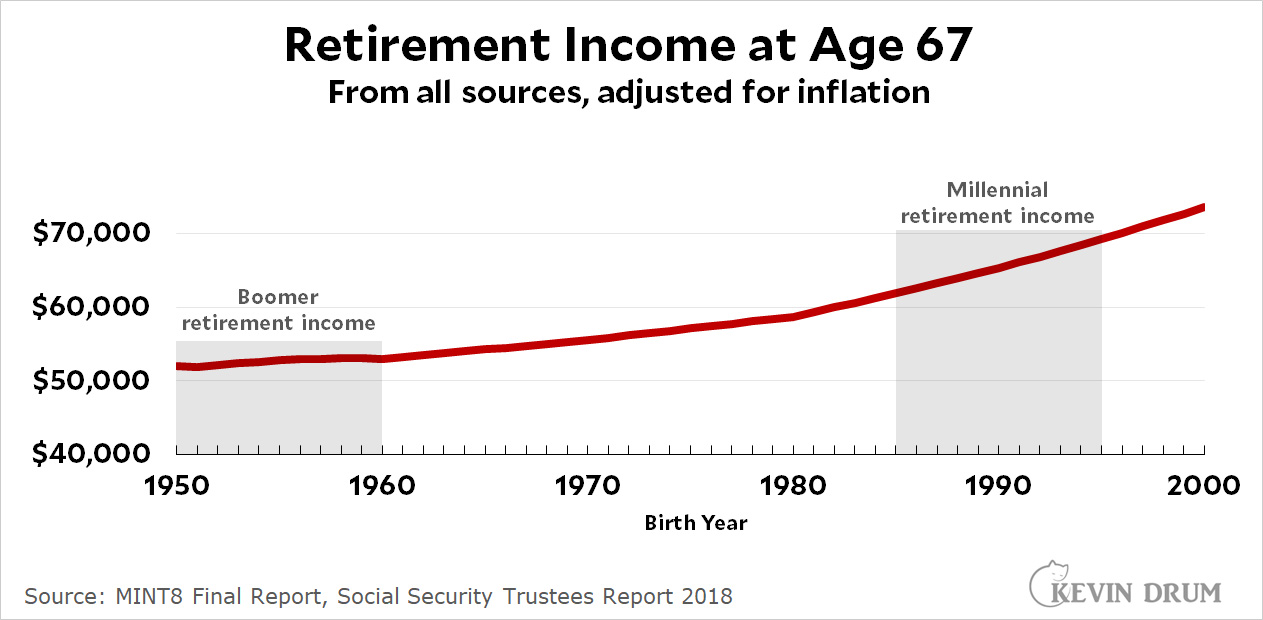

Millennials are doing well, and this data gibes with projections from the Social Security Administration:

Millennials are doing well, and this data gibes with projections from the Social Security Administration:

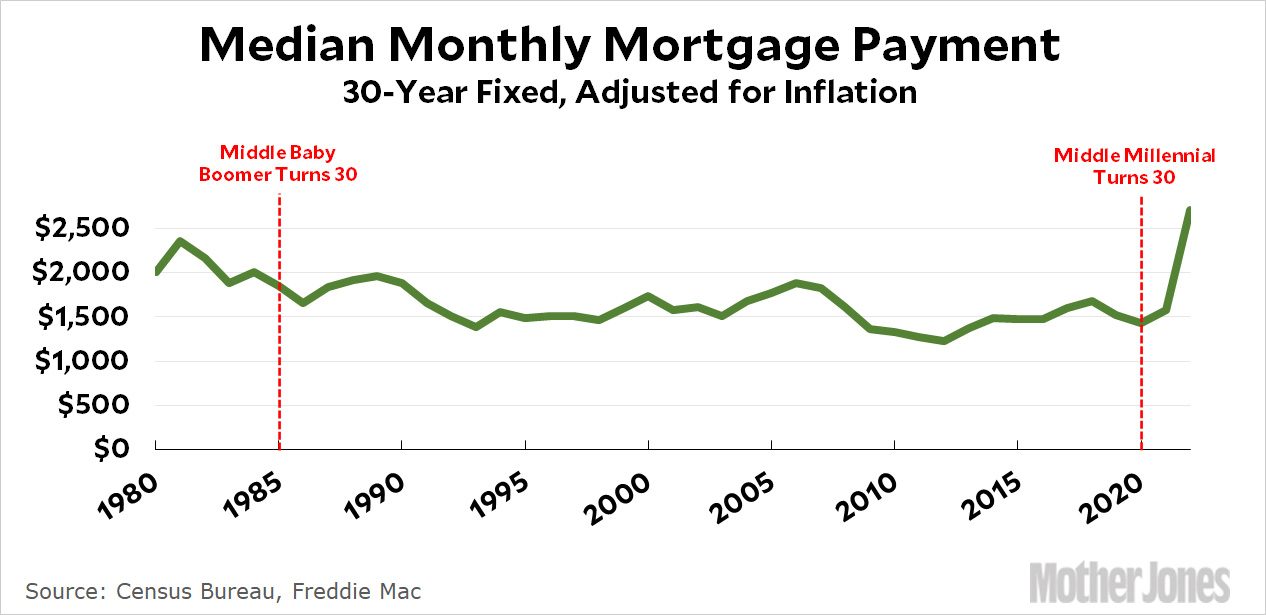

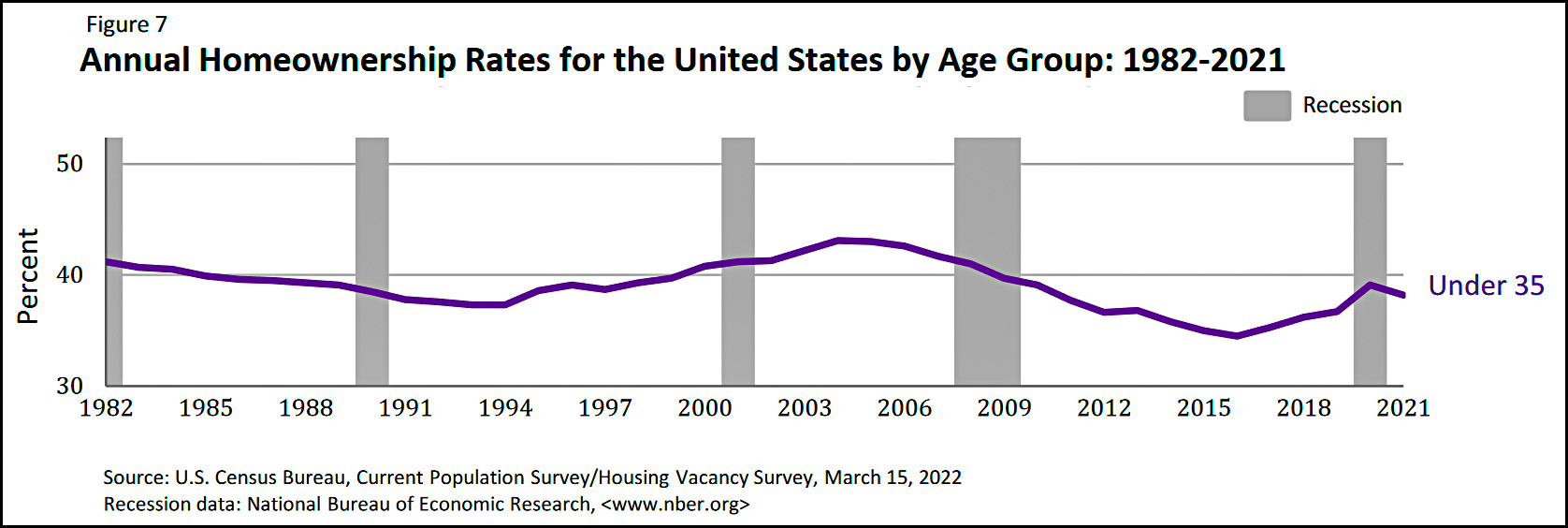

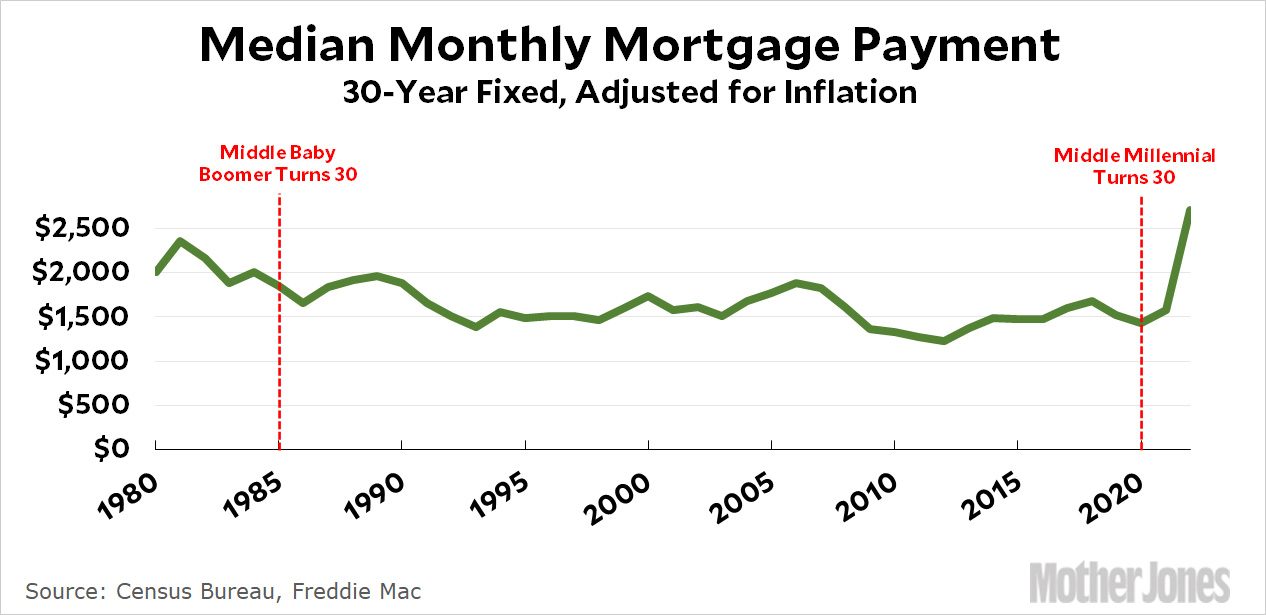

Here is housing:

Here is housing:

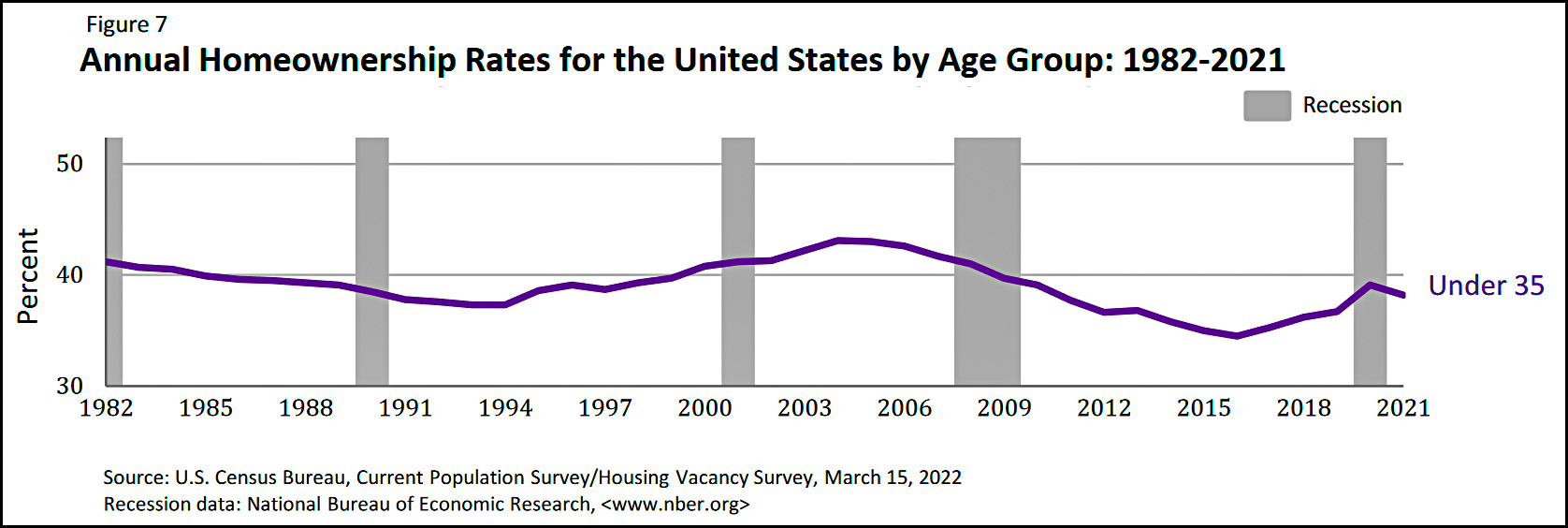

Up until this year, actual mortgage payments had been dropping. The middle Boomer had a monthly payment of about $1,900 at age 30 compared to the middle Millennial with a payment of $1,500. However, homeownership is still down among Millennials:

Up until this year, actual mortgage payments had been dropping. The middle Boomer had a monthly payment of about $1,900 at age 30 compared to the middle Millennial with a payment of $1,500. However, homeownership is still down among Millennials:

Homeownership dropped for a decade and then recovered, but today's Millennials still have a homeownership rate that's less than the rate of Boomers in the mid-80s. The difference is slight, but it shows that the Great Recession really did take a toll.

Homeownership dropped for a decade and then recovered, but today's Millennials still have a homeownership rate that's less than the rate of Boomers in the mid-80s. The difference is slight, but it shows that the Great Recession really did take a toll.

The big lesson I take away from all this is that student loans have probably been skewing these numbers for the past decade. Millennials really have borne the brunt of the student loan explosion, which means that college-educated Millennials have been forced to lead a more austere life in their twenties than Boomers did. However, the amount of wealth accumulation for any generation during their twenties has always been trivial, so once their loans are paid off Millennials catch up pretty quickly in the wealth department.

In any case, older Millennials (age 30+) are finally entering a phase of life where their loans are paid off and their jobs are paying well. As more and more Millennials exit student loan hell, the true state of their financial status becomes a lot easier to see. Roughly speaking, they're better off than Boomers in almost every respect.

POSTSCRIPT: All the usual caveats apply here. These are all averages, and lots of people are above or below them. Housing costs more in big cities. And most of the results I've presented here are for older Millennials. Younger Millennials are still affected by student loan debt and will not begin accumulating significant wealth for another 5-10 years.

This projection comes from MINT8, the current version of Social Security's MINT simulation tool. It was published in 2018 and relies partly on economic projections from the 2018 Social Security Trustees report.

This projection comes from MINT8, the current version of Social Security's MINT simulation tool. It was published in 2018 and relies partly on economic projections from the 2018 Social Security Trustees report.