With Economy Poised for Best Growth Since 1983, Inflation Lurks

That damn inflation! It's always lurking.

But as long as we're on the subject of inflation, something is about to happen that you'll probably hear about many, many times over the next few months. So you might as well hear about it now.

It's this: thanks to unusually low inflation at the start of the pandemic last year, the headline inflation rate for the next few months is going to be unusually high. This is not because inflation is actually high. It's just a mechanical result of the arithmetic. It's as if you were comparing your electricity usage to a year ago when you were on vacation for a week. It would look like your usage was up 25%, but it's not. It's just a mechanical result of the previous year being artificially low.

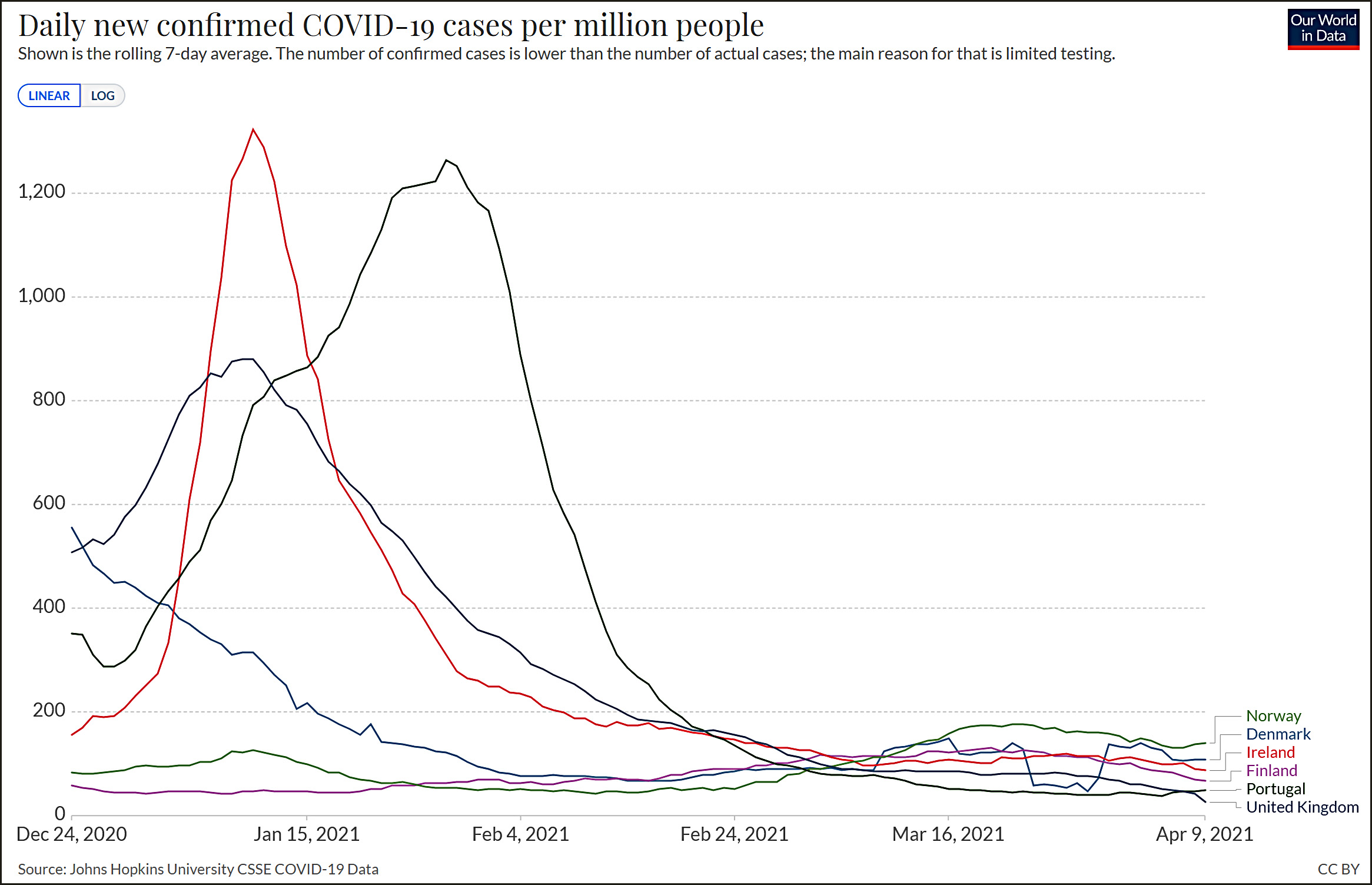

Here's a chart that will either confuse you or make things clearer. Inflation is actually calculated as an index in which the average price between 1982-84 is set to 100. Here's what the CPI index looks like over the past few years:

The point here is simple: Even if the inflation index in April 2021 is precisely on the trendline of 1.6% growth, it will artificially look higher because the year-over-year comparison is with April 2020, which is in the red dip.

There's not much to do about this except to ignore the inflation numbers for the next few months. One alternative, I suppose, is to compare the current index to the one two years ago, and then divide by two to get an annual rate. That's unofficial, but probably gives a better idea of what the real inflation rate is. I'll try to remember to report that whenever I post about inflation.

One other thing: all the various forecast metrics suggest that inflationary expectations are still restrained. There's bound to be some upward pressure as the economy opens up this year, but nothing substantial.