This tweet is making the rounds today:

Most of the tweets are from people wondering who buys 12 gallons of milk per week, but that's hardly interesting. The answer is that the Stotlers have adopted a bunch of kids and now have nine children living under their roof.

What's more interesting about this news segment is what it tells us about people's perceptions of inflation. Let's review. At one point, Mrs. Stotler says, "I think probably in June it was about a dollar was worth a dollar, so now that dollar is worth about 70 cents."

A little later, she gets specific: milk has gone up from $1.99 to $2.79.

Their total shopping bill for the week comes to $310. A few months ago, "we would have spent probably 150, 200 dollars, something like that."

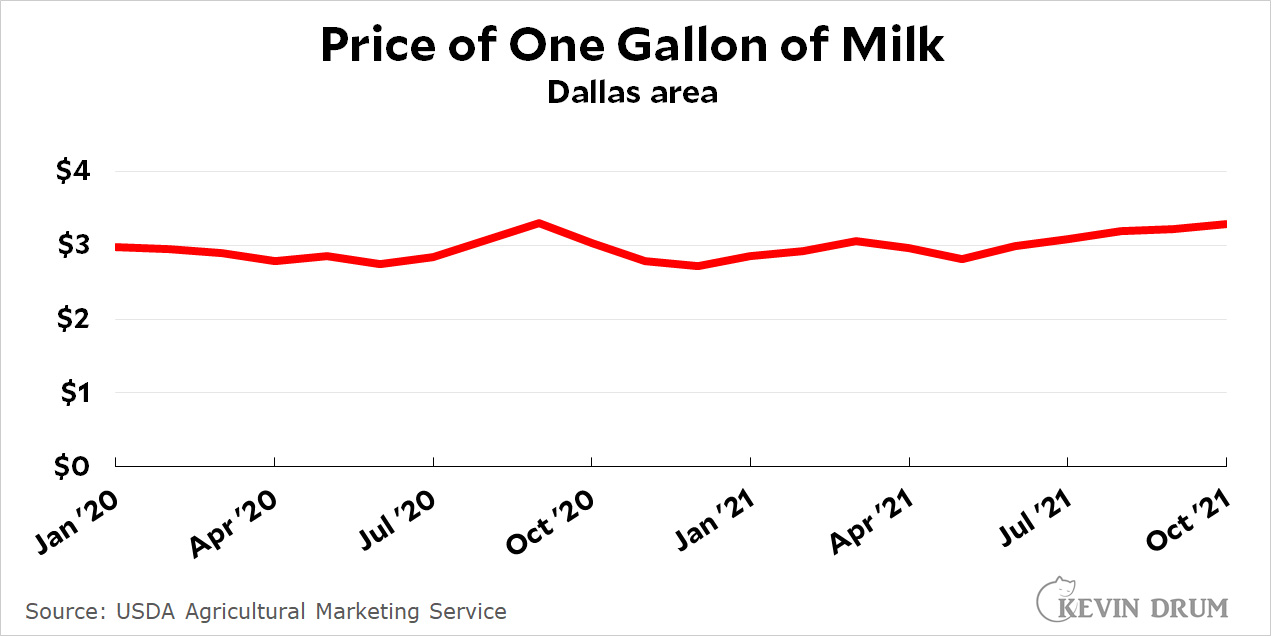

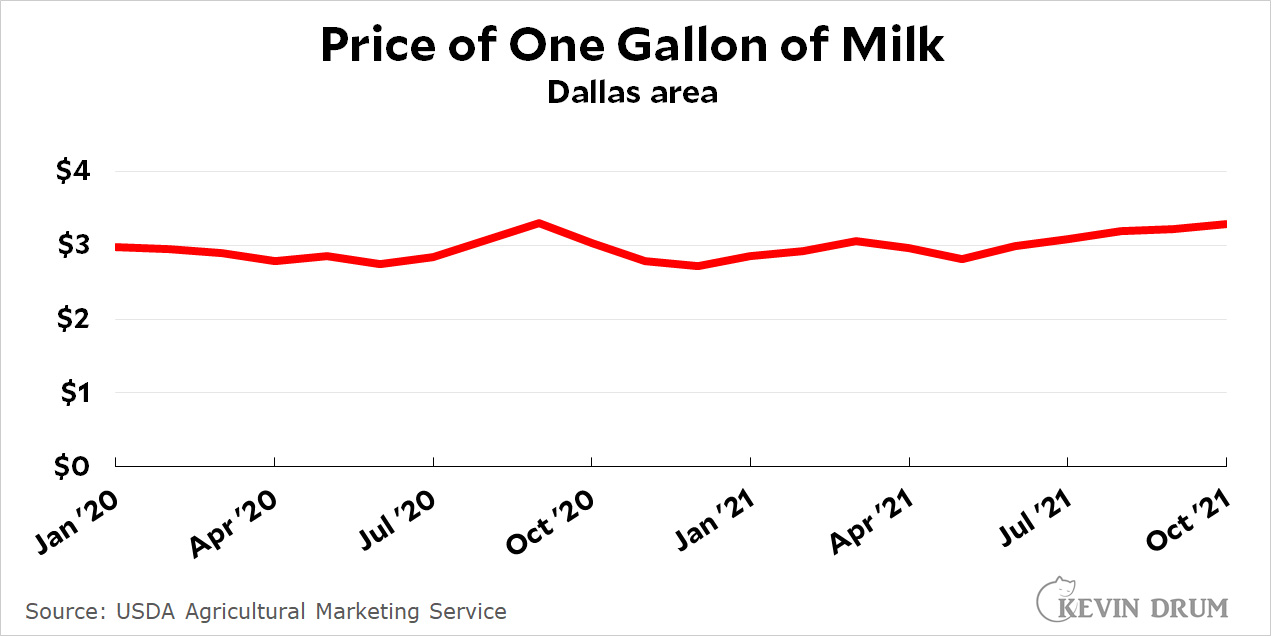

We also have USDA figures for the price of milk. In Dallas, it's gone up from $2.99 to $3.29 since last June. (That's an average. It might be cheaper at certain stores.)

As it happens, the price of milk bounces quite a bit around depending on the mood of the cows and the whims of the bureaucrats. In the past year, a gallon of milk in Dallas has gone up from $3.03 to $3.29.

Here's how this nets out:

Here's how this nets out:

- First Stotler guess: Inflation is running at about a 100% annual rate.

- Second Stotler guess: inflation is running at about a 90% annual rate.

- Third Stotler guess for all groceries: inflation is running at a 70-140% annual rate.

- USDA figures: Extrapolating from the June price, the cost of milk is going up at about a 25% annual rate.

- Also USDA figures: Milk has actually gone up 8% in the past year.

- BLS: The inflation rate for groceries in general is currently 4.4%

Altogether, as we move from personal feelings to actual numbers, our estimate of inflation in the grocery store declines from about 100% to about 4%.

There are some cognitive biases at play here. Obviously one of them is that most of us are bad at mental math and draw wildly incorrect conclusions about relative prices.

But the cognitive bias most at work here is that when we think of prices, our brains go back to eras long past. It seems as if milk only cost $1.99 a few months or a year ago, but it didn't (unless it was on sale or something). It's been years since milk cost so little, but our memories are largely stuck in our early adulthood, when we first started paying attention to things like the price of milk. Mrs. Stotler, by misremembering the price of milk a year ago and then doing some bad mental math, concludes that inflation is running at an insane rate. The truth is that groceries are up 4.4% and milk is up only a little more than that.

I don't blame Mrs. Stotler for any of this. It's just a common human foible. But I do blame CNN for not spiking this story—or, at the very least, providing the full context along with the actual level of inflation in the grocery store. Instead, Evan McMorris-Santoro made every effort to imply that the Stotler's figures were an accurate and alarming reflection of the actual inflation rate today.

Why? Why do television correspondents keep doing this? It's very little short of a bald-faced lie.