Charlie seems to be mesmerized by something, but what? Is Marian holding up a can of cat food? Is she getting ready to toss a toy Charlie's way? Or is it just the big glass eye that has him enthralled? I'm afraid the answer is lost in the mists of history.

Month: April 2022

Russia says it blew up its own ship, but takes it out on Ukraine anyway

Russia really seems to take it personally when a country they've invaded decides to fight back:

Thunderous blasts echoed in the capital, Kyiv, and in Ukraine’s eastern battle zone on Friday, a day after Russia’s most important warship in the Black Sea sank while being towed to port, marking a humiliating wartime setback for Moscow.

Russia’s defense ministry threatened stepped-up missile attacks after its flagship missile cruiser Moskva went down Thursday following what Ukraine said was a missile strike and what Moscow claimed was an accidental fire aboard.

The Russian defense ministry said Friday that in Kyiv, a plant that made and repaired Ukrainian missiles was targeted. The capital had enjoyed a period of relative calm after Russian forces broke off an offensive in Ukraine’s north at the beginning of this month.

Let's get this straight. The Moskva went down in an "accidental fire" so Russia decided to lob a few missiles at Kyiv. And for good measure, they targeted a missile plant even though their ship sank due to an "accidental fire." And they've sent us a diplomatic note demanding that we stop arming Ukraine even though the Moskva sank because of—oh, yes, "accidental fire."

Those accidental fires really piss off the Russians, don't they? Perhaps we should offer the Russian Navy some pointers in how to keep their ammunition holds safe?

Lunchtime Photo

Kevin’s economic predictions for 2022

My earlier post reminds me that I've uncharacteristically made a few economic predictions lately:

- 30-year fixed mortgages will break 5%.

- Home prices will stop rising and might even drop 10% by the end of the year.

- Gasoline prices will drop 40-50 cents within the next couple of weeks.

- Inflation will start to recede by late spring and will be three or four points lower by the end of the year.

Have I missed any?

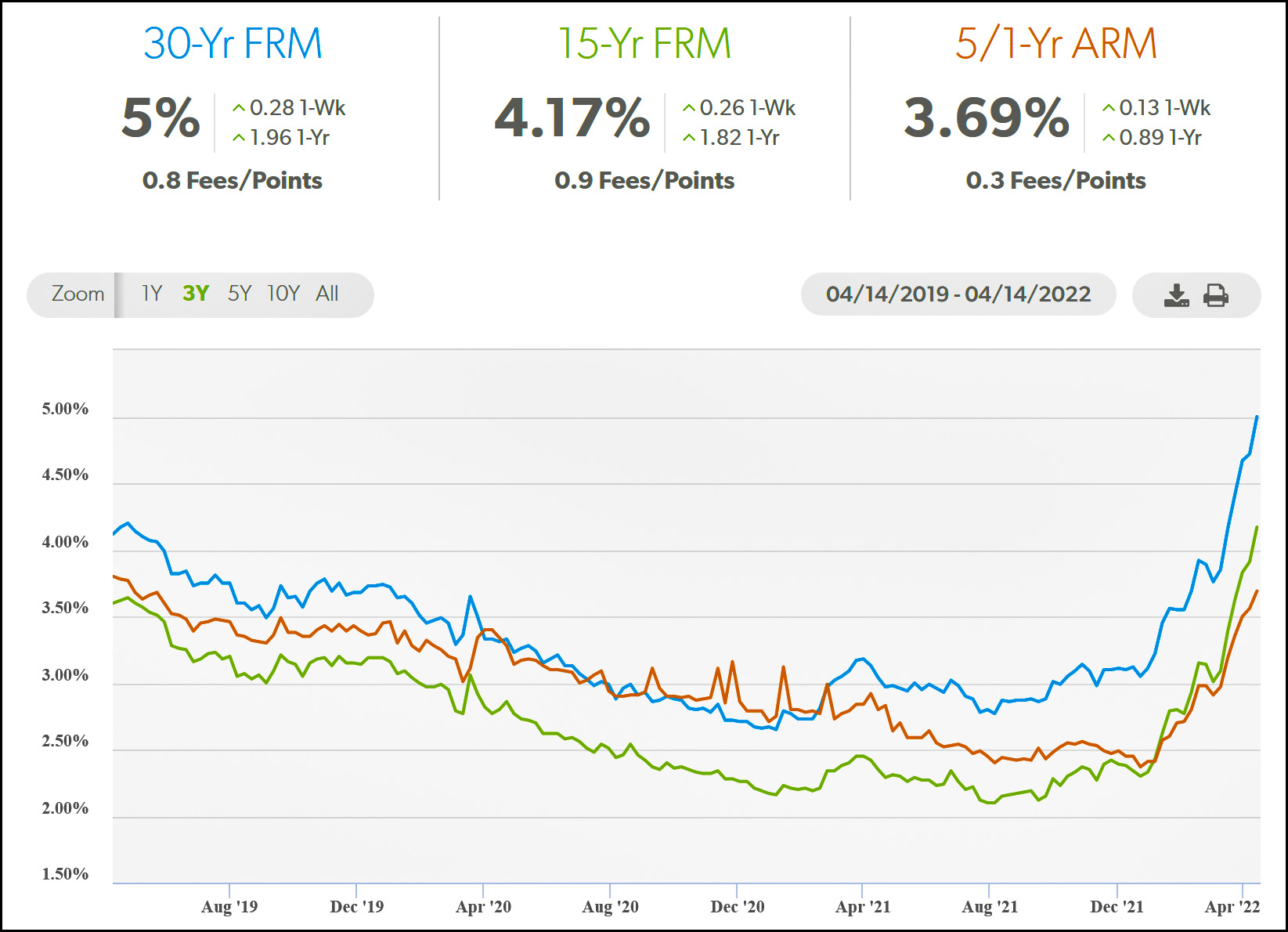

Mortgage rates break 5% for the first time in a decade

Me, three weeks ago:

We can cross our fingers and hope that mortgage rates don't go up to 5%, but that's a vain hope....The workhorse 30-year fixed mortgage is almost certain to average 5% or more over the rest of this year.

Freddie Mac, today:

This week, mortgage rates averaged five percent for the first time in over a decade. As Americans contend with historically high inflation, the combination of rising mortgage rates, elevated home prices and tight inventory are making the pursuit of homeownership the most expensive in a generation.

Lesson: Always trust Kevin Drum on interest rates.

But will home prices drop too, as I predicted? That's much less clear. People really, really like to buy homes no matter the obstacles. As with so many things, we'll just have to wait and see.

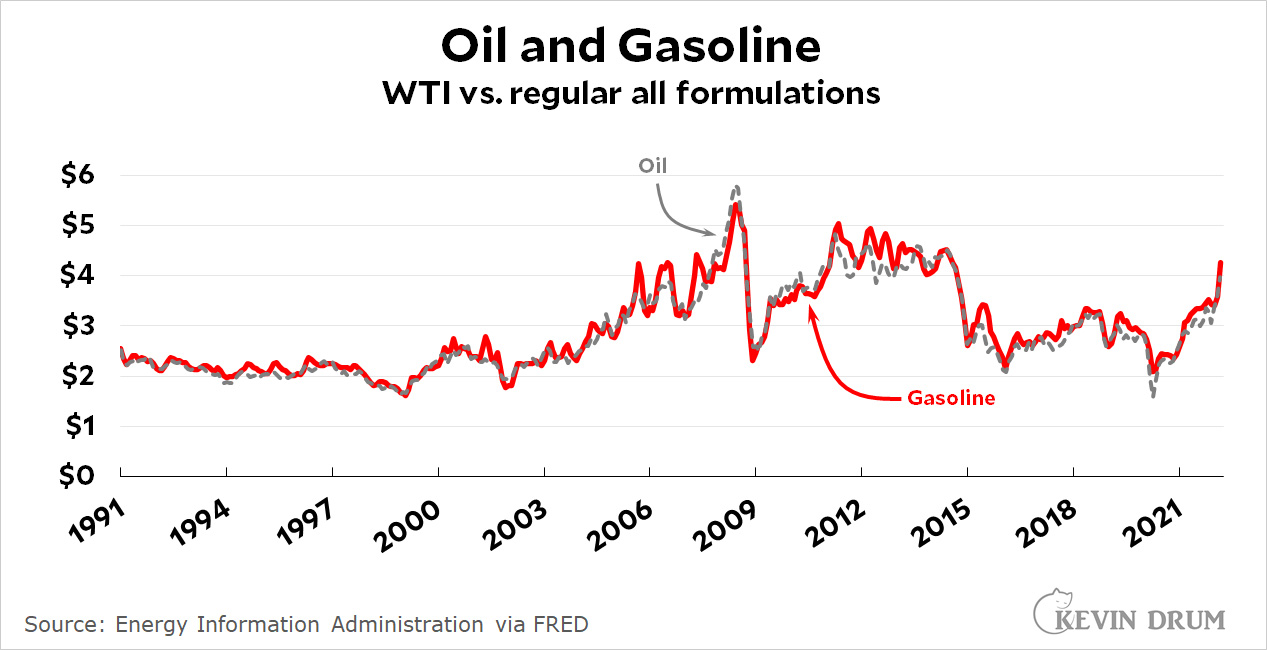

Gasoline should drop 50 cents per gallon over the next week or two

The price of oil is down but the price of gasoline isn't. What's going on? Here's an update of my chart from last week comparing oil and gasoline prices:

This uses the same formula as before to regress the price of oil on gasoline,¹ and last week it suggested the price of gasoline was about where it should be. This week, however, gripes about the price of gasoline look more justified. Last week gasoline was only about ten cents above its expected price; this week it's 50 cents higher.

This uses the same formula as before to regress the price of oil on gasoline,¹ and last week it suggested the price of gasoline was about where it should be. This week, however, gripes about the price of gasoline look more justified. Last week gasoline was only about ten cents above its expected price; this week it's 50 cents higher.

The price of gasoline has dropped 13 cents in the past week, but the regression formula says it should have dropped 50-60 cents. Most likely this is just a timing issue: the price of oil has dropped so fast that it hasn't worked its way through to retail gasoline stations yet. But it will, and if my formula is correct we should see the price of gasoline drop by 40-50 cents within the next couple of weeks.

¹The formula is Gasoline = $1.10 + (Oil ÷ 38). Real prices are used for both oil and gasoline.

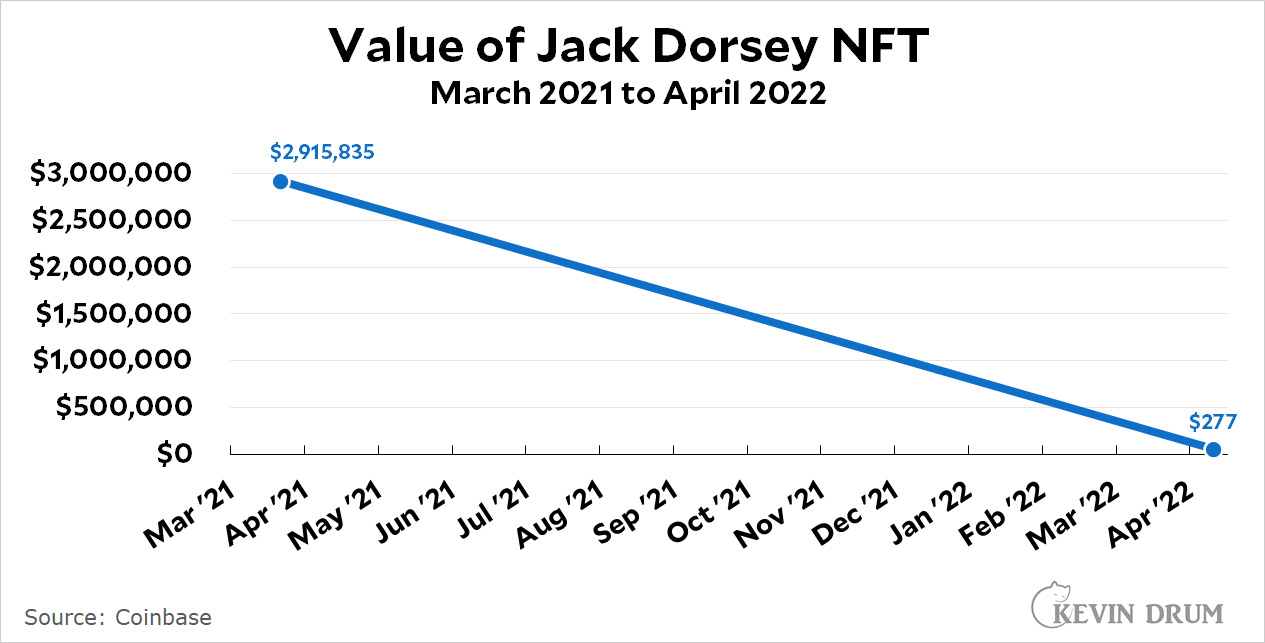

Dorsey NFT declines 99.991% in 13 months

A year ago Twitter founder Jack Dorsey auctioned off an NFT of his very first tweet. It sold on March 22, 2021:

After it spent just over two weeks on the market, Twitter CEO Jack Dorsey has sold his first tweet as an NFT for the weirdly specific figure of $2,915,835.47. The winning bidder was Sina Estavi, who had held the high bid since offering $2.5 million on March 6th. He upped his bid to this number at the last moment.

....Dorsey put the tweet up for digital auction as an NFT — non-fungible token — a digital good that lives on the Ethereum blockchain, on March 5th. Bids were handled on a platform called Valuables by Cent that lets people make offers on tweets that are “autographed by their original creators.”

Last week Estavi announced that he was ready to sell the Dorsey NFT and would accept offers until today. The high bid was $277. I have illustrated this in the chart format for which I'm famous:

That's a decline of 99.991%. Unsurprisingly, Estavi hasn't accepted any of the offers. Via WhatsApp he told a Coinbase reporter, “The deadline I set was over, but if I get a good offer, I might accept it, I might never sell it.”

That's a decline of 99.991%. Unsurprisingly, Estavi hasn't accepted any of the offers. Via WhatsApp he told a Coinbase reporter, “The deadline I set was over, but if I get a good offer, I might accept it, I might never sell it.”

Easy come, easy go. That's life in the NFT racket.

Lunchtime Photo

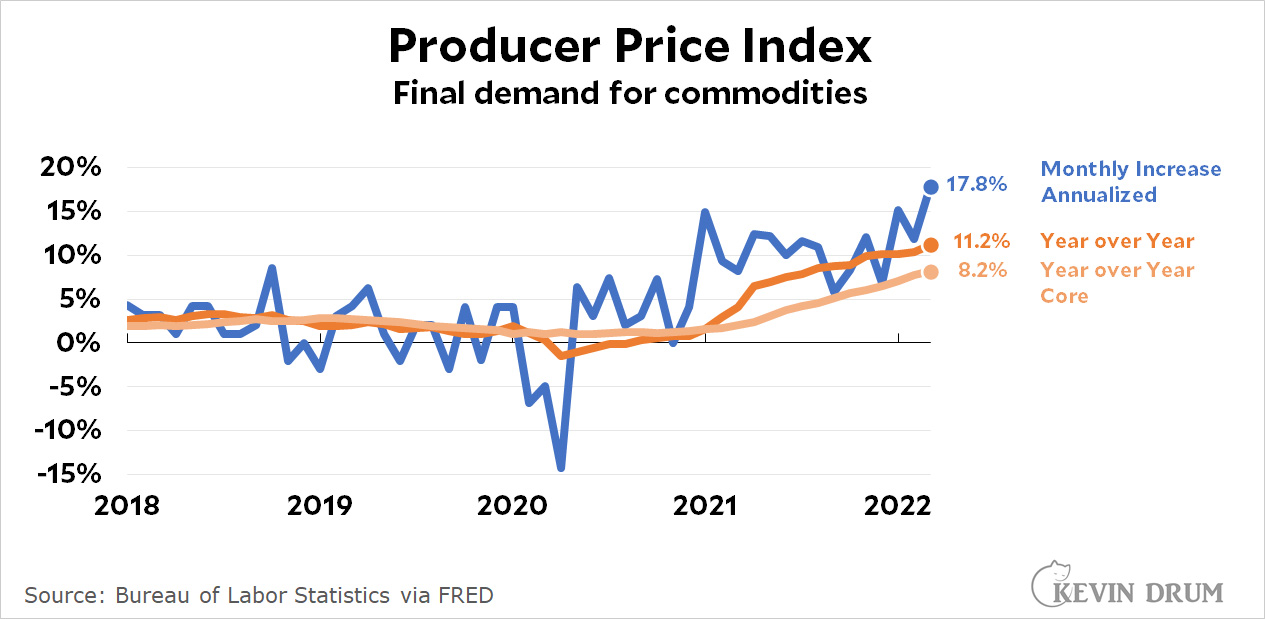

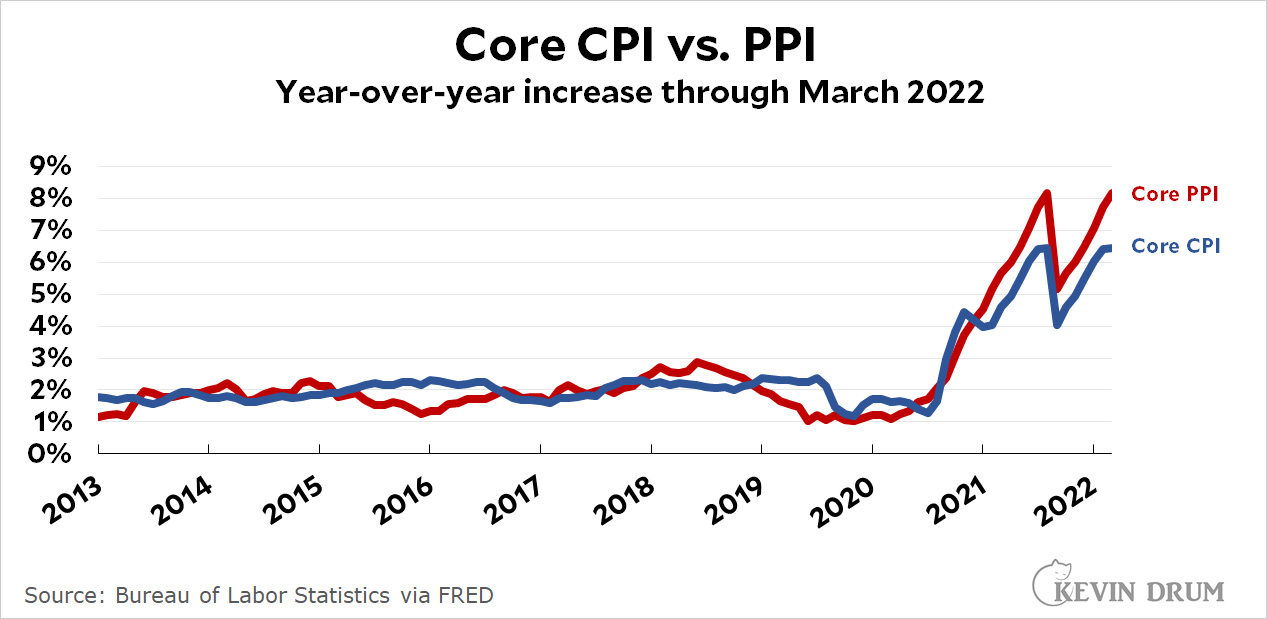

Chart of the day: The Producer Price Index vs. the Consumer Price Index in March

I don't normally bother posting the producer price index, but since inflation is on everyone's mind these days let's take a look at the latest numbers:

Not good! The PPI for goods was up 11.2% from last year and the monthly increase from February came to 17.8% on an annualized basis. In both cases they seem to have accelerated a bit.

Not good! The PPI for goods was up 11.2% from last year and the monthly increase from February came to 17.8% on an annualized basis. In both cases they seem to have accelerated a bit.

The large monthly increase in the PPI for goods is way, way different from yesterday's CPI number, which clocked in with a drop of -4.7%. That's a difference of more than 22 points. However, on a year-over-year basis, which is generally less volatile, the PPI increase is only a few points higher than the CPI increase (11.2% vs. 8.5%).

As with the CPI, a good deal of these big increases is due to large rises in energy prices. The core PPI was up 8.2%, which is better than the overall number but still a couple of points higher than core CPI (8.2% vs. 6.5%).

The difference in core CPI and core PPI is not new. Before the pandemic, core CPI and core PPI for goods followed each other closely with only brief divergences. On average they were identical. But starting in 2021 they diverged and stayed diverged:

Since 2021, core PPI has averaged 1.2% higher than core CPI, and in March it was 1.7% higher.

Since 2021, core PPI has averaged 1.2% higher than core CPI, and in March it was 1.7% higher.

The divergence in the price level of services has been even more dramatic. Before the pandemic the growth of the overall PPI averaged a little lower than the growth in CPI. But since 2021 the divergence has exploded: PPI has averaged 2.7% higher than CPI and rose to 3.6% in March.

Sorry for this number-ific post. There's just a lot to see here. So far, this divergence in pretty much all forms of CPI and PPI (overall, core, goods, services) hasn't shrunk, which means it's not passing through to consumer prices. Or something. It's a little hard to parse, actually, which means it's hard to say if the March increase in PPI is bad news for future CPI growth. We'll just have to wait and see.

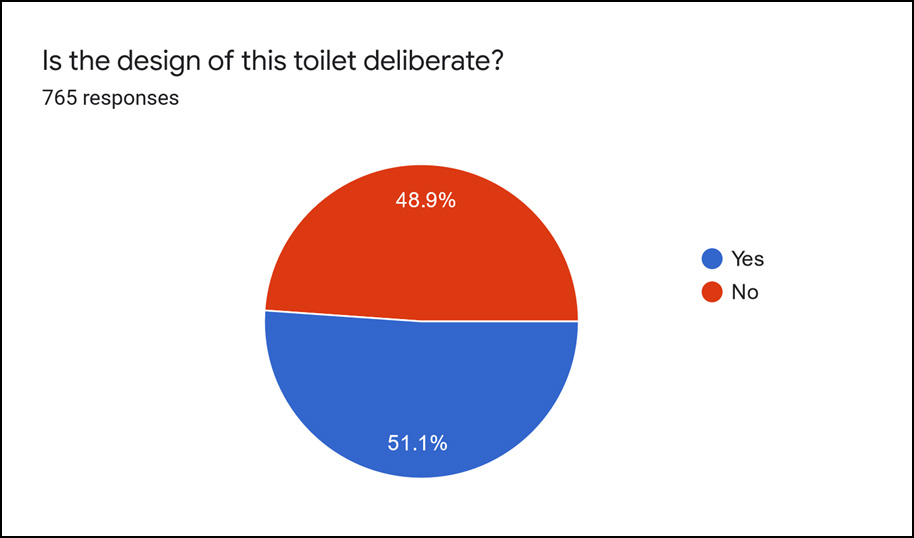

A toilet poll — Final response!

You've been waiting all night on the edge of your beds for this, so here are the results of yesterday's toilet poll:

This is my closest poll ever! Given the margin of error, it's a dead heat. Perhaps this now demands a bit of actual research to come up with an answer.

This is my closest poll ever! Given the margin of error, it's a dead heat. Perhaps this now demands a bit of actual research to come up with an answer.