Asking prices in the Southern California housing market are already starting to show some strain:

The share of homes listed for sale that took recent price cuts has more than doubled since last year. During the four weeks that ended June 5, 16.2% of listings in L.A. County had at least one price cut, up from 7.5% during the same period last year, Redfin data show.

In Orange, Riverside and San Bernardino counties the share of price drops rose to more than 20% of listings, up from about 7% a year earlier.

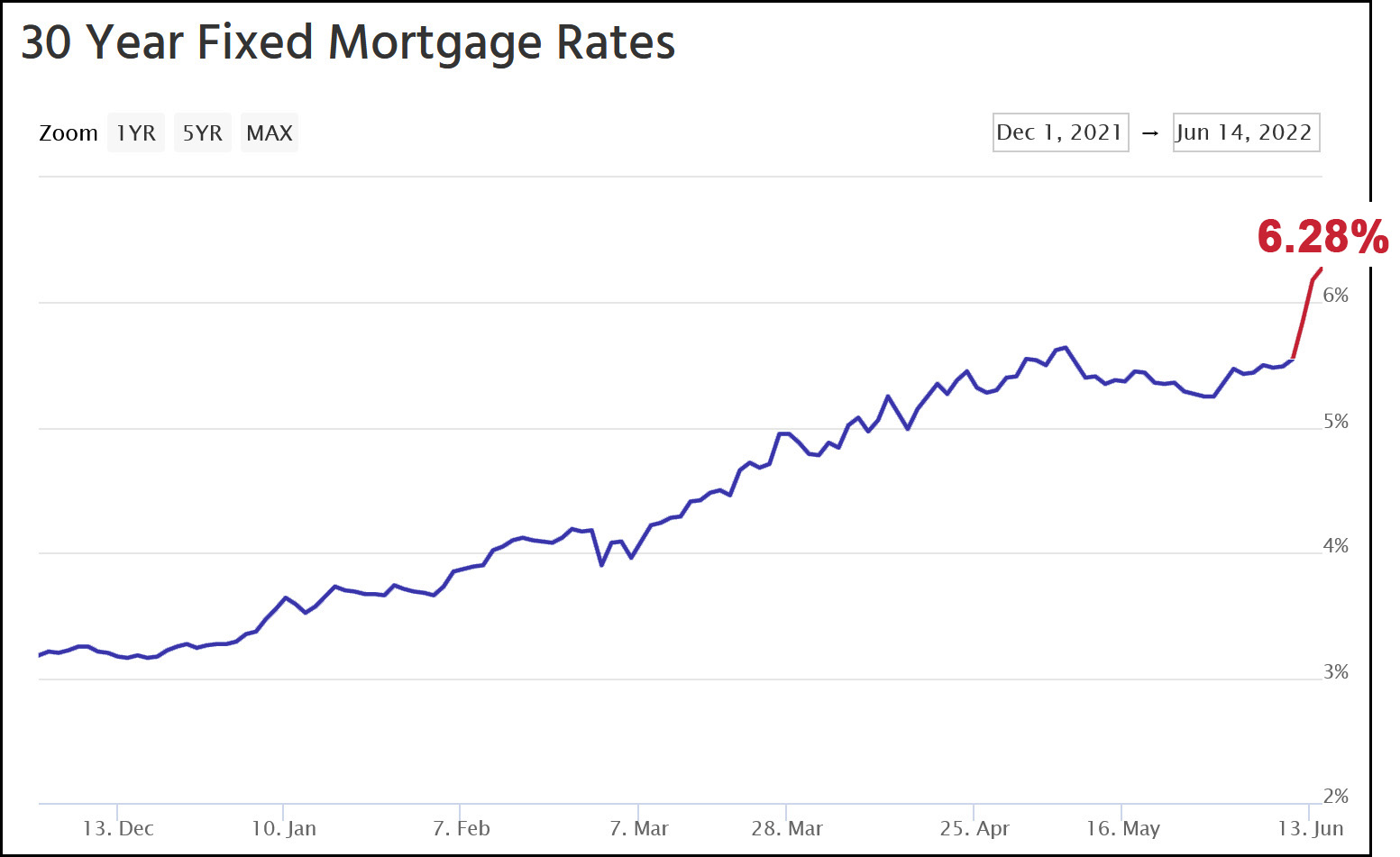

Nationwide, there haven’t been this many price cuts since 2019. Homes for sale in Los Angeles and Orange Counties haven’t seen this number of price reductions since late 2018 — the last time mortgage rates shot up. In the Inland Empire, price reductions are at an all-time high in a dataset that started in 2015.

Realtors are bravely saying that there are still plenty of eager buyers and plenty of bidding wars. And it's true that housing prices continued to rise through March—the latest data available. But this is just the start. I don't expect a housing bust on the order of 2006-2008, but I do expect a sustained moderate drop in house prices. In aggregate, this decline is likely to shave half a point or more off GDP growth—and that's in addition to all the other headwinds facing the economy.

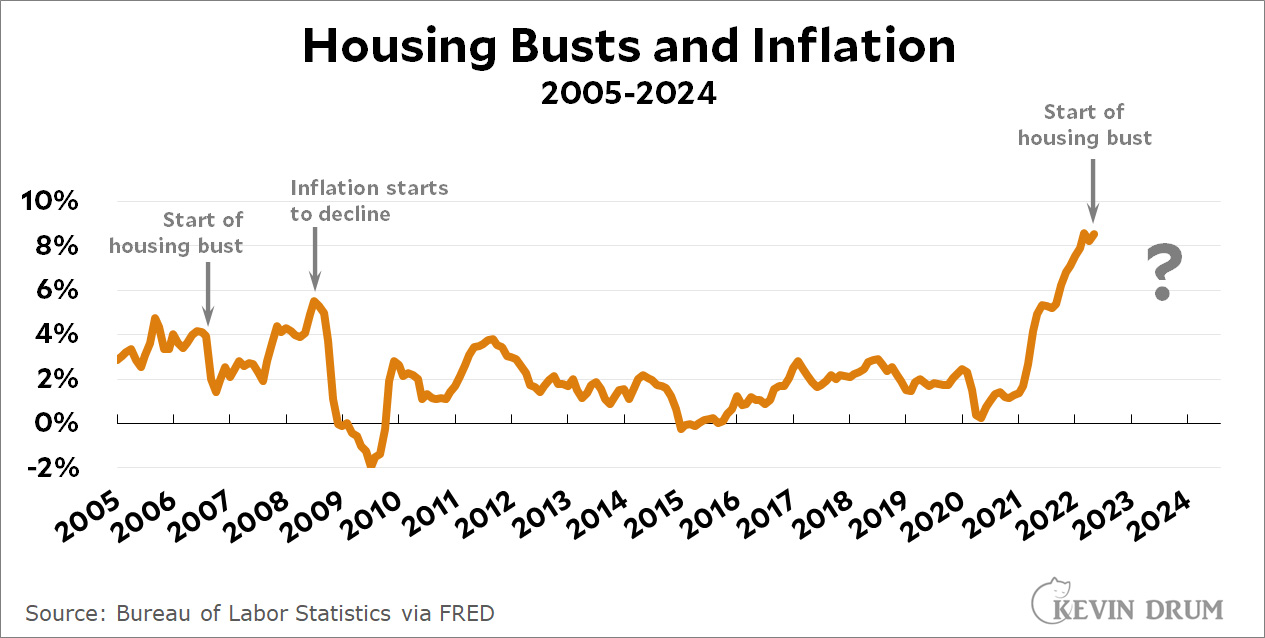

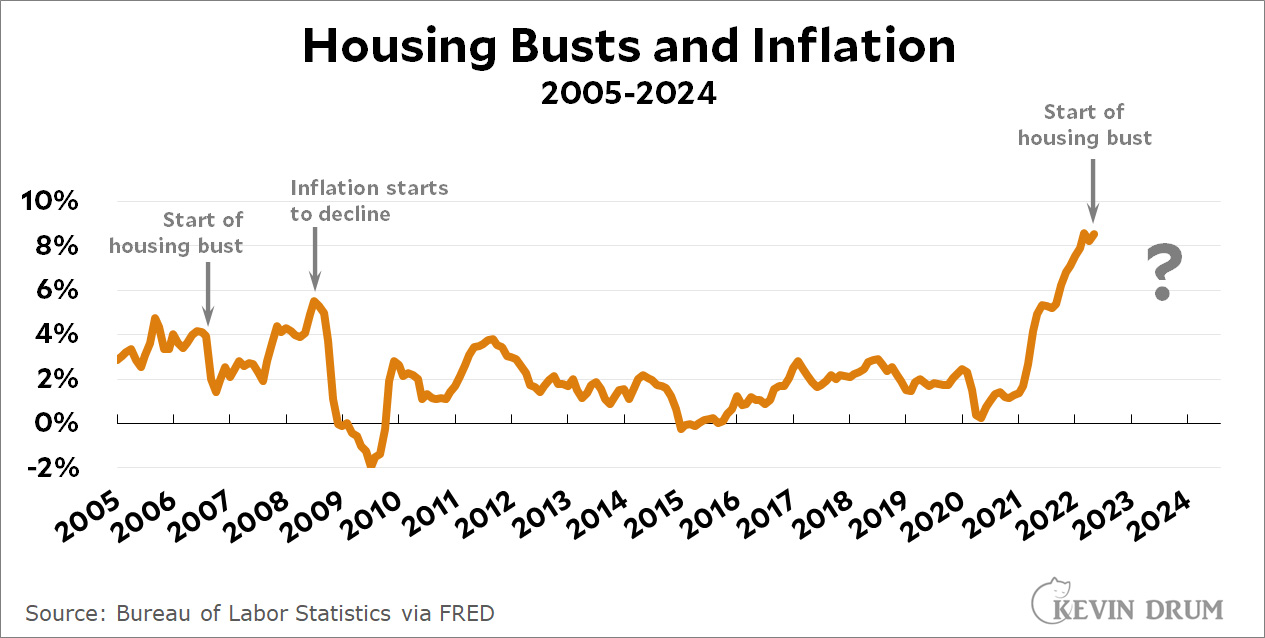

It will also bring down price levels—although judging from our experience during the Great Recession it's hard to say how long it will take for it to work its way through to lower inflation rates:

Our last housing bust was followed by a quick decline in inflation, but the decline was small and temporary. It was two years before inflation was seriously affected.

Our last housing bust was followed by a quick decline in inflation, but the decline was small and temporary. It was two years before inflation was seriously affected.

So what will it be this time around, with different circumstances and a smaller fall in housing prices? If I knew, would I still be doing this free blogging thing?

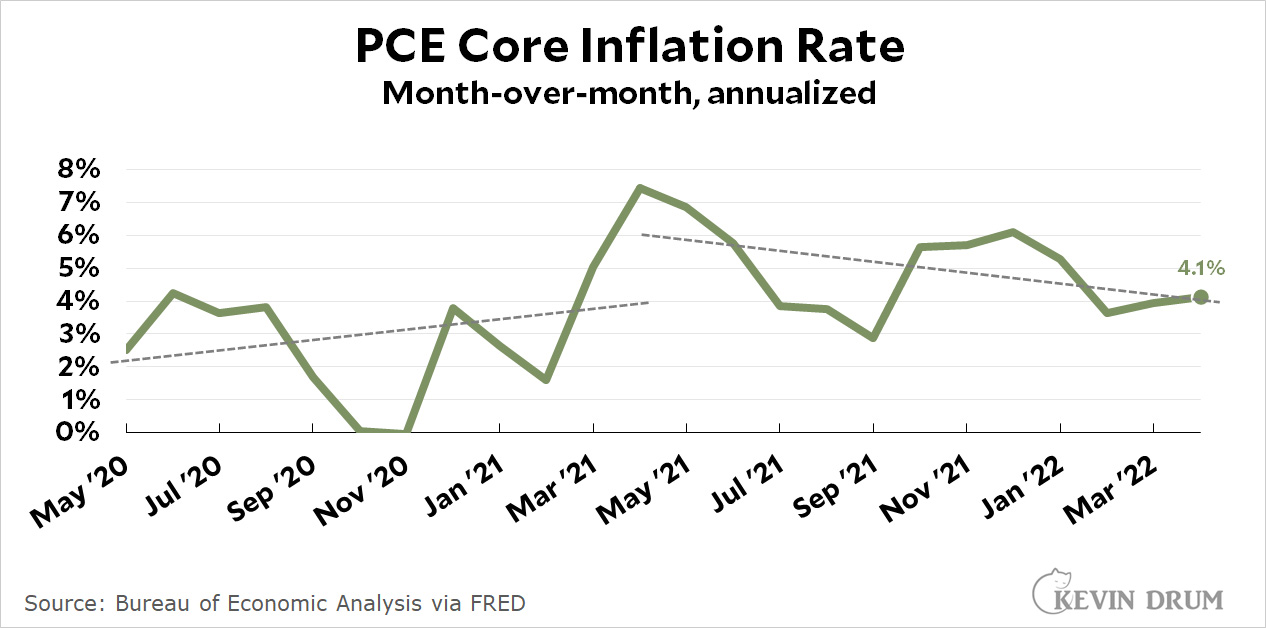

I'm not saying this is the inflation measure everyone should put on their front pages. Overall CPI inflation is a good measure of what people see in their daily lives, which is why it's the one that shows up in headlines.

I'm not saying this is the inflation measure everyone should put on their front pages. Overall CPI inflation is a good measure of what people see in their daily lives, which is why it's the one that shows up in headlines.