The Wall Street Journal reports that rent and housing inflation are staying stubbornly high:

Economists expect housing inflation to strengthen further before cooling off in the coming months, but are unsure of when relief will appear....Not only are shelter costs rising, they are climbing at an accelerating pace....Shelter costs—comprising mostly rents and a gauge of home prices known as owners’ equivalent rent—rose 0.7% in August from the previous month, up from 0.5% in July. They rose 6.2% in August from a year before, up from 5.7% in July.

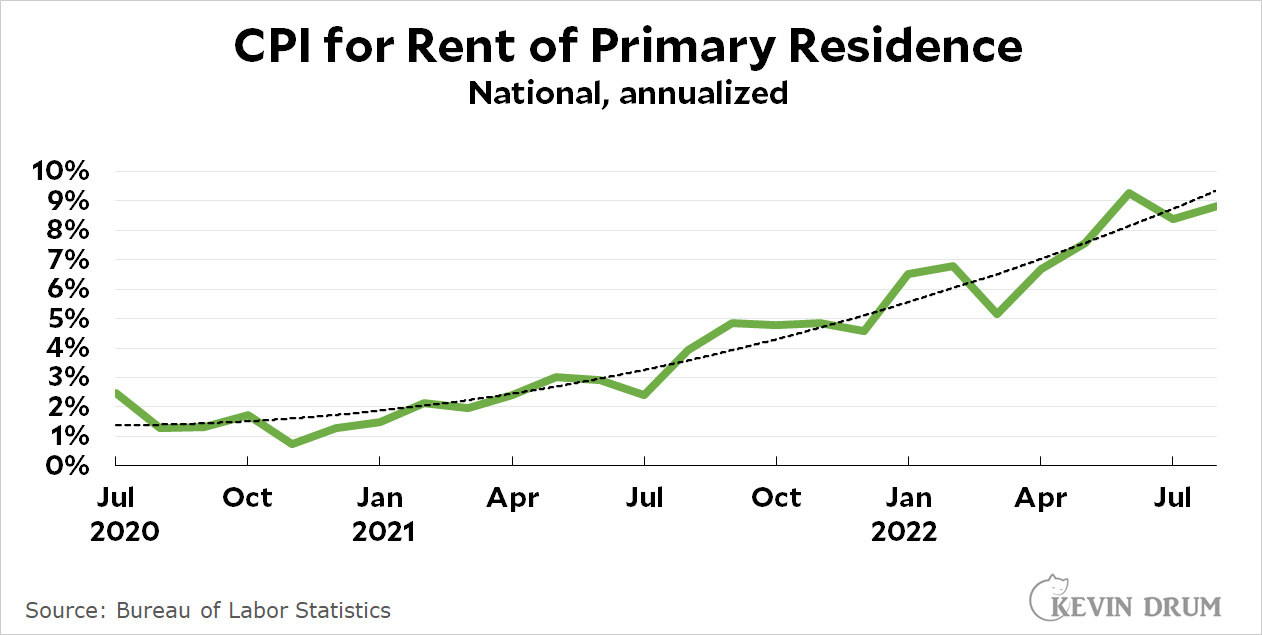

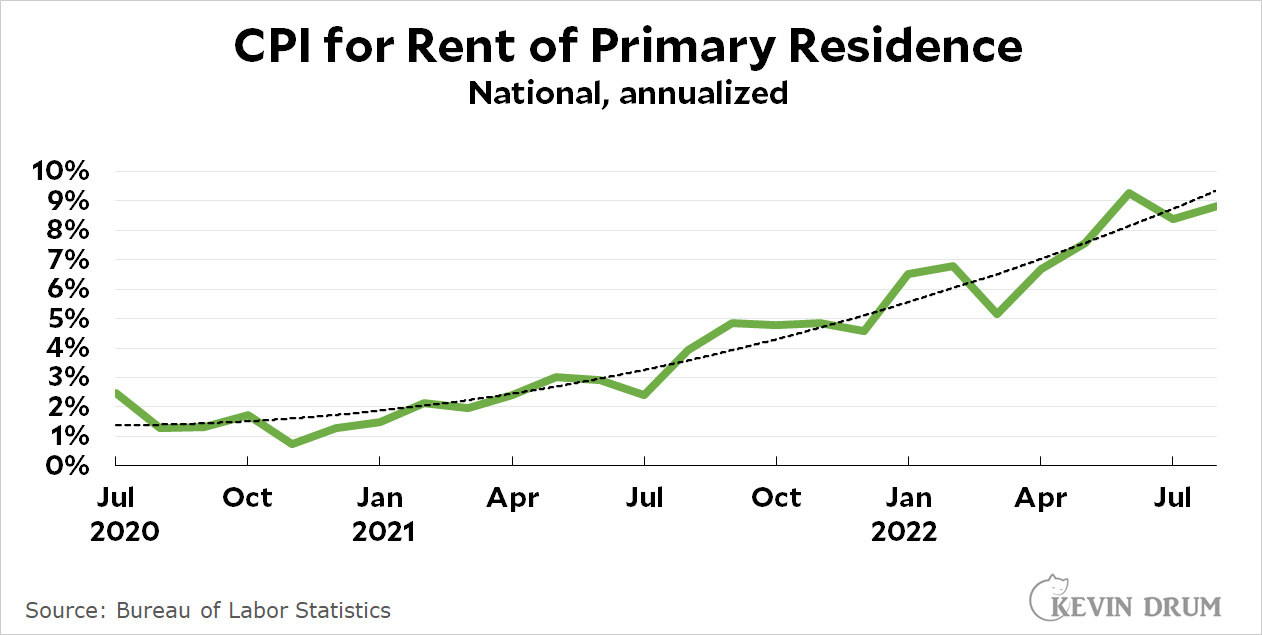

Rent is a tricky thing to measure. Here is the official CPI measure specifically of rent:

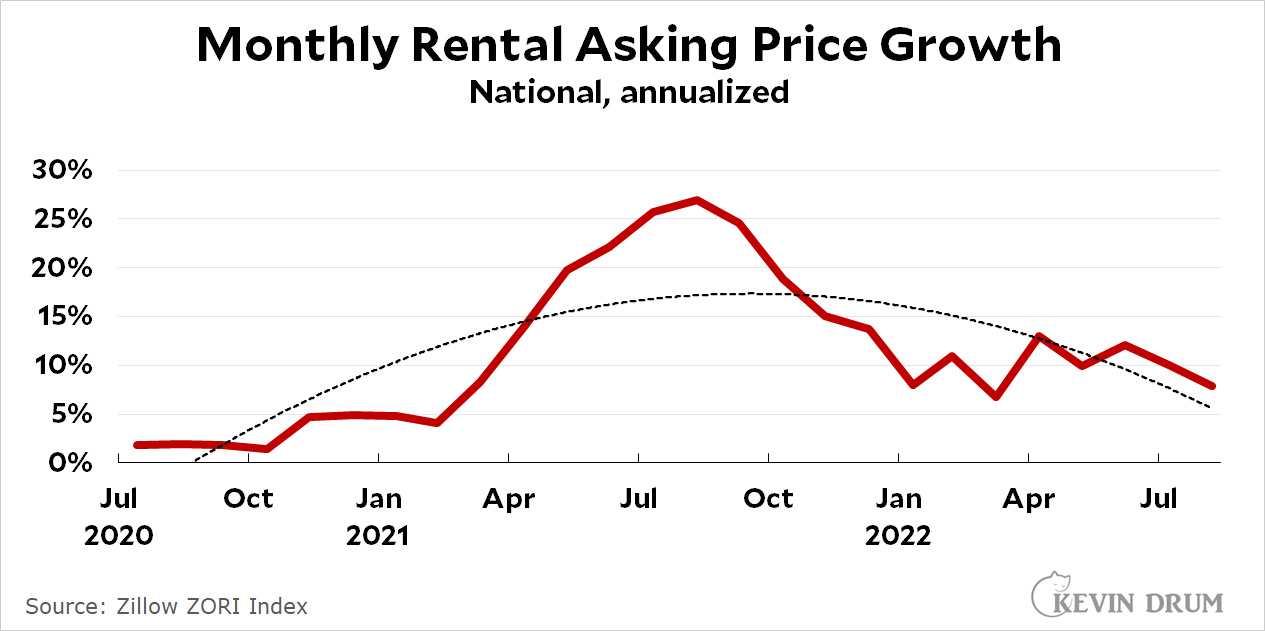

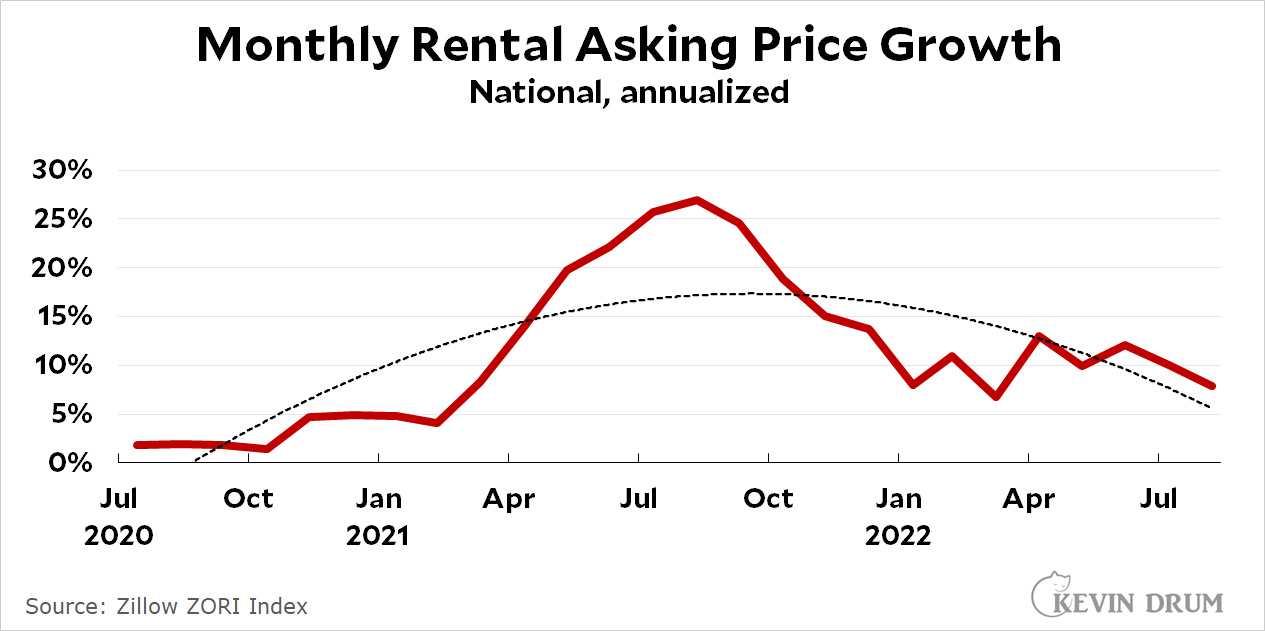

It is indeed high and accelerating. But now take a look at this:

It is indeed high and accelerating. But now take a look at this:

Same time frame, same subject matter. So why are they wildly different?

Same time frame, same subject matter. So why are they wildly different?

There are two reasons. The first is a matter of what's getting measured. When we think of rising rents, we usually think of what landlords are asking for new rentals. But CPI measures rent broadly, including both new rentals and apartments that are already occupied. This means that if there's a big surge (or drop) in asking prices for new rentals, CPI will barely notice it because it's such a small part of their overall index. By contrast, if you look solely at asking prices for new rentals—as in the Zillow chart—you'll see big ups and downs as they happen.

Second, CPI is measured using a complicated methodology (see here) that effectively makes it six or more months out of date at all times. So if rental prices go up or down, it will take a while for those changes to show up. The Zillow methodology is simpler and basically measures monthly changes in real time.

So what's happening is probably this: rents increased sharply in 2021 but then settled down in 2022. However, the CPI is too far behind to see this and thinks that rent inflation is still accelerating. Since rent is a big part of CPI, this means that it's artificially keeping the overall inflation index high too.

Even by Zillow's measure, rent inflation for new rentals is still fairly high—around 7-8% or so—but it's not accelerating and it's not higher than the overall inflation rate. Just the opposite. In another six months or so CPI will probably catch up with all this and then slowly start to decline.

Bottom line: don't let rent or housing inflation fool you. Both have already settled down and are getting pretty close to normal. CPI, because of the way it measures things, will show this slowly and late. But eventually it will show it.

In the meantime, we should base economic policy right now on what's actually happening right now. For that, the CPI measure is one of the worst. We should switch to something better in the overall inflation measure, but for now we're stuck with it. So just ignore it.