Larry Summers makes the case on Twitter that inflation is stubbornly here to stay unless the Fed takes aggressive action. He has six arguments:

- Inflation expectations may still be anchored, but this is largely based on the belief that we're headed toward a recession.

- Core inflation is robust and the labor market is tight.

- The economy is overheated.

- Historically, it's been impossible to produce a "soft landing."

- Risk management suggests that inflation is our biggest problem. If anything, we should err on the side of aggressive action to bring it down.

- Nobody really understands inflation anyway.

Let's take these one by one.

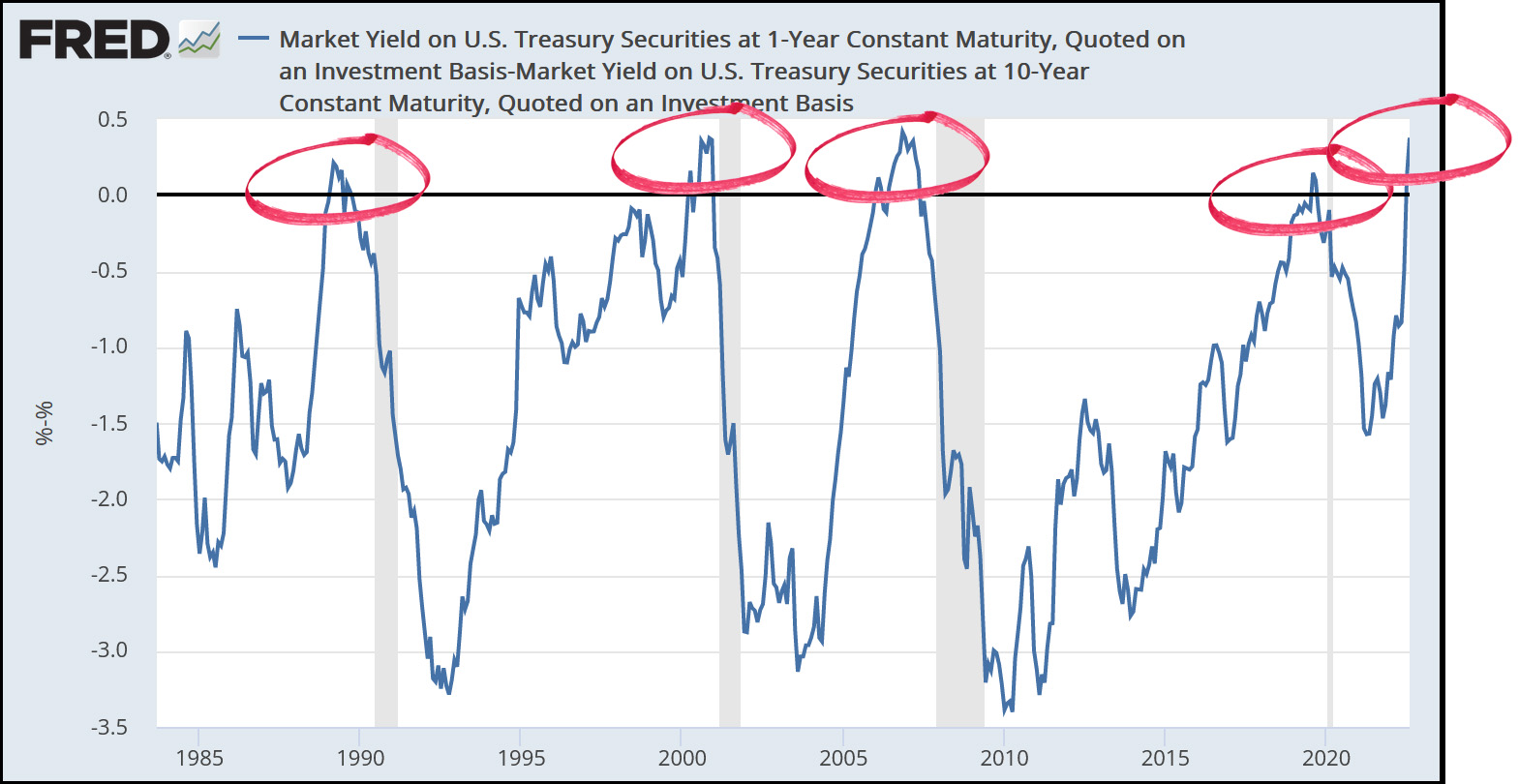

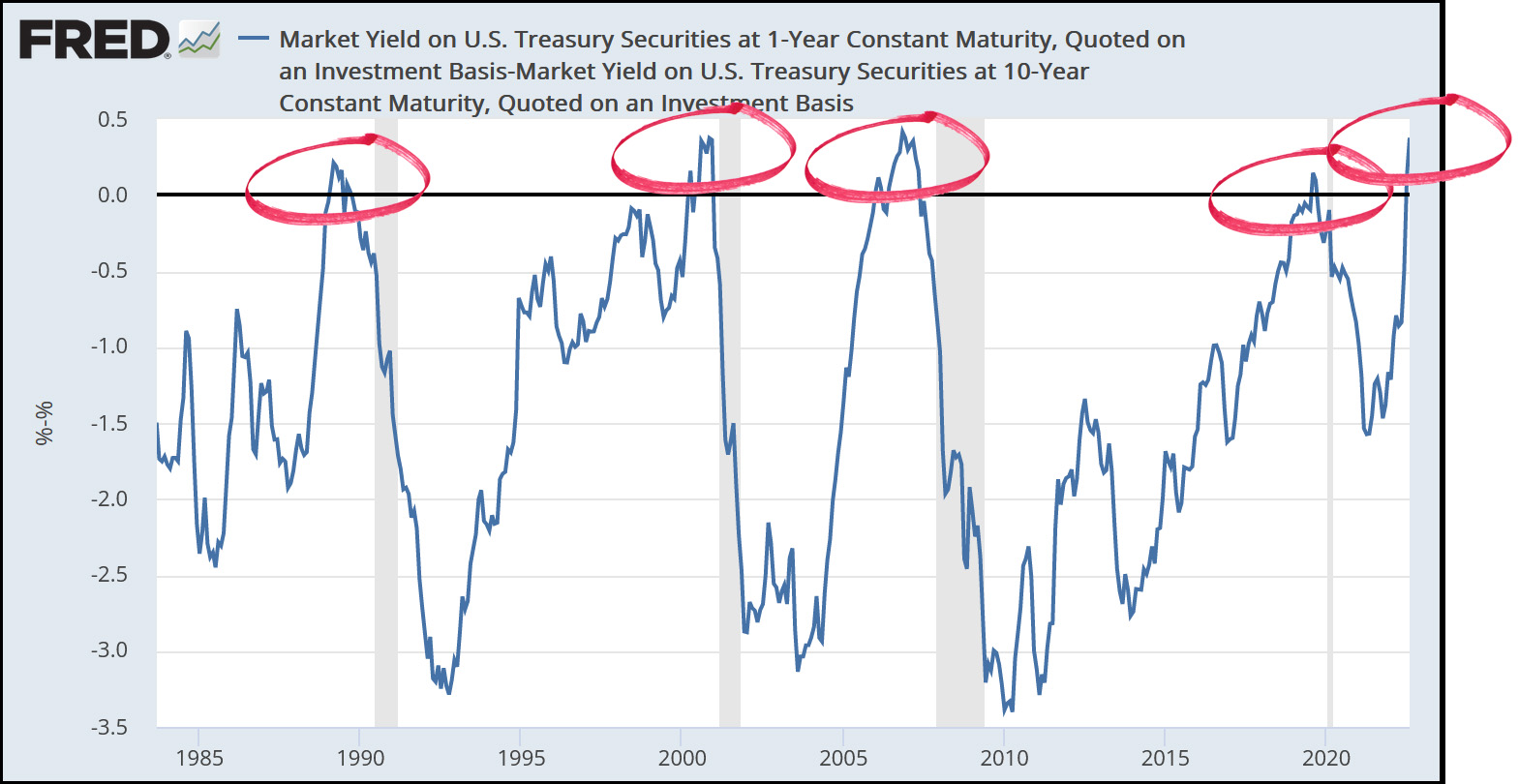

1. Maybe! There aren't very many good recession predictors, but the good ol' inverted yield curve seems to do the best job. Here it is:

The inverted yield curve has correctly predicted the past four recessions, and right now it's predicting another one in the early part of next year.

The inverted yield curve has correctly predicted the past four recessions, and right now it's predicting another one in the early part of next year.

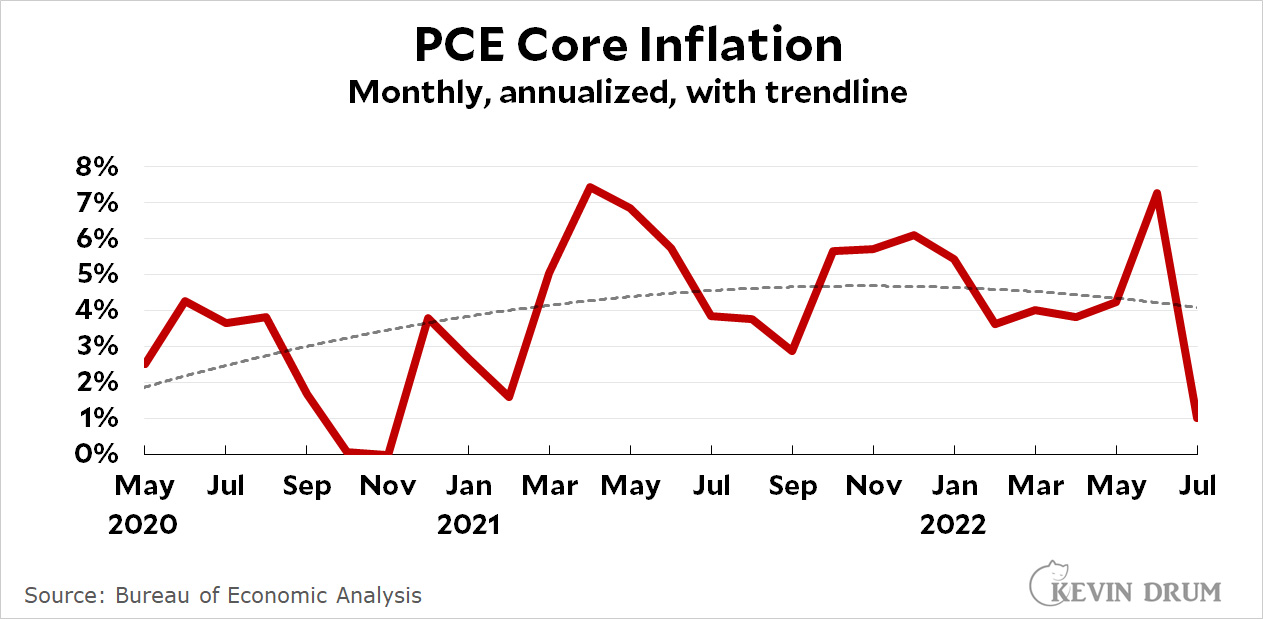

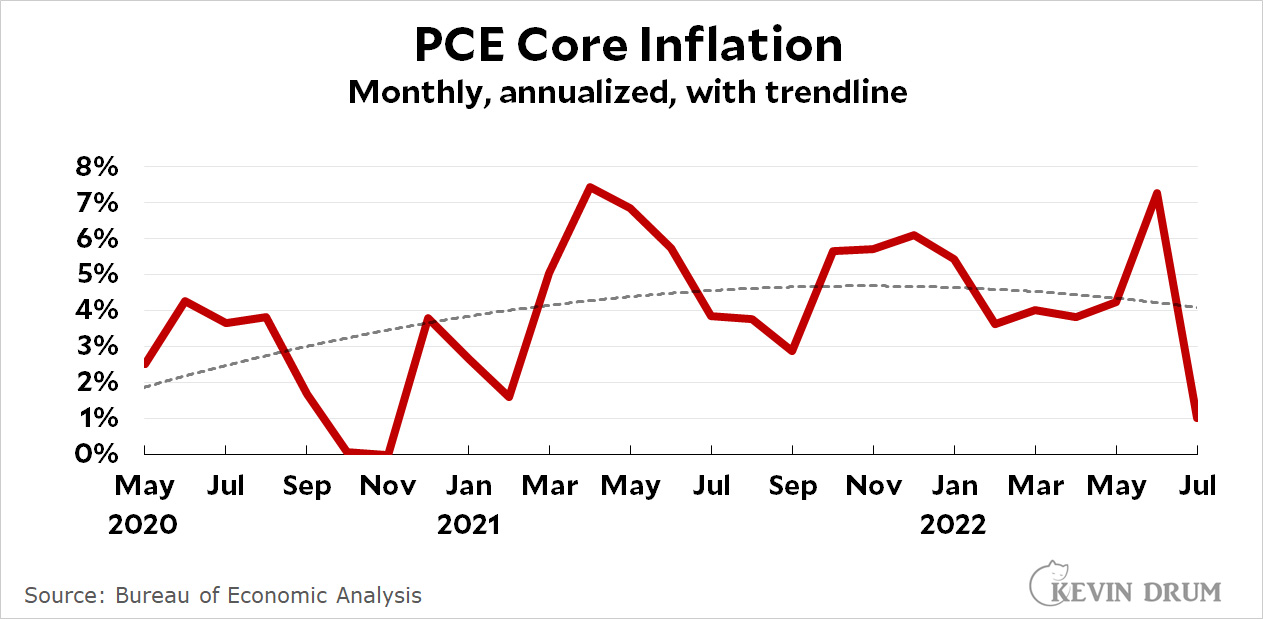

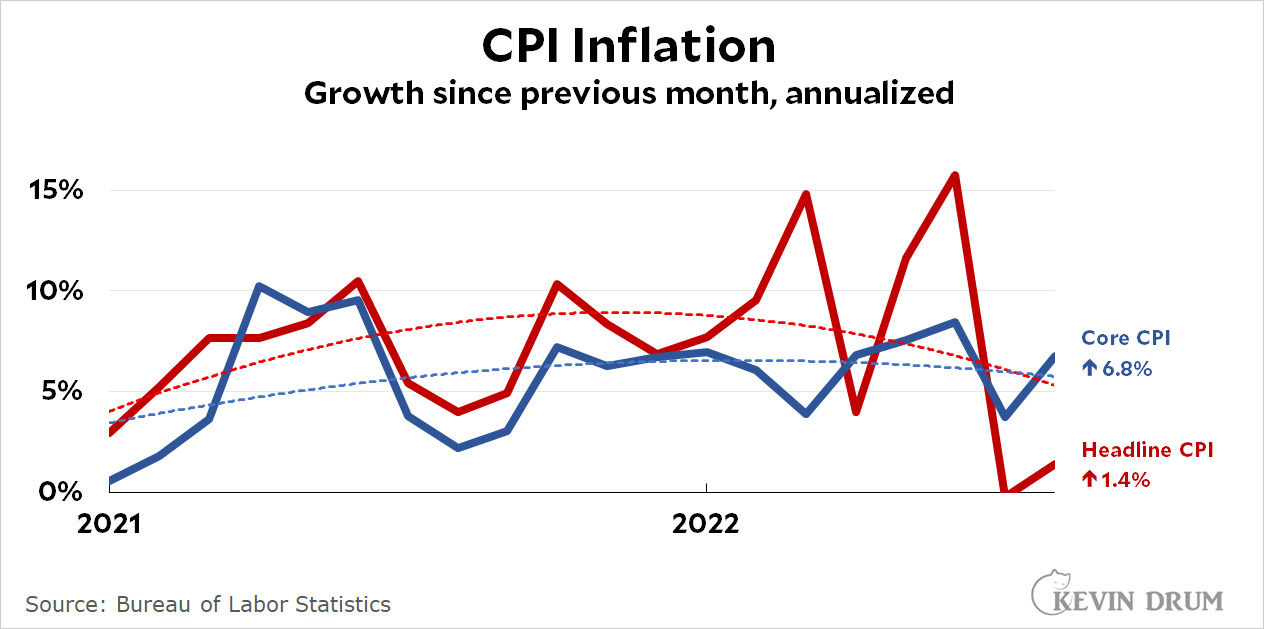

2. Here is core inflation:

It seems to have peaked at the beginning of 2022 and is now slowly receding.

It seems to have peaked at the beginning of 2022 and is now slowly receding.

As for the labor market, the data is inconclusive. Unemployment is at 3.7%, which suggests tightness. On the other hand, the labor force participation rate is still below its pre-pandemic level; weekly hours have been declining; and real wages have been falling for two years. This all suggests a little bit of looseness. Overall, the labor market appears to be close to full employment, but perhaps not quite there.

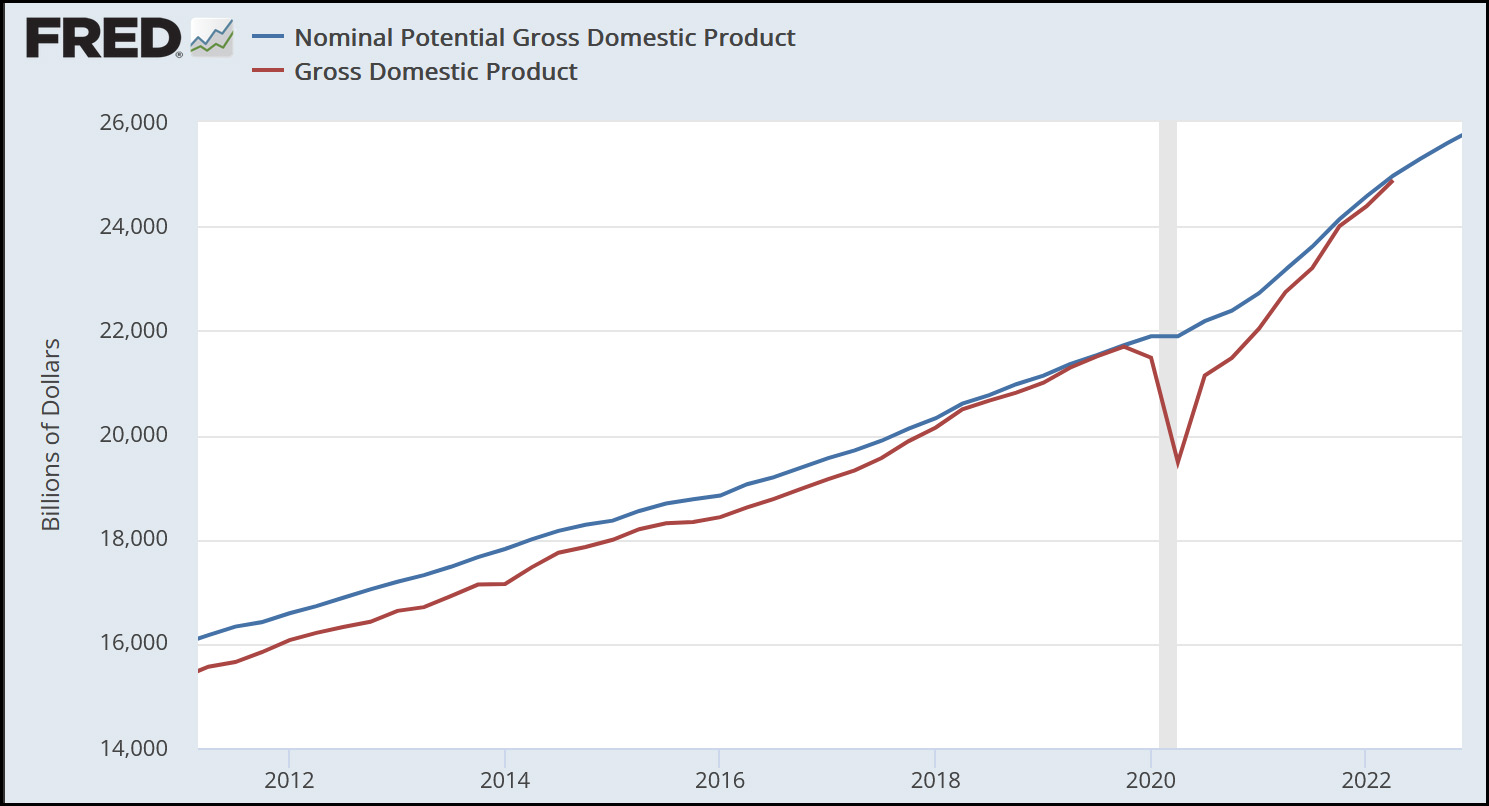

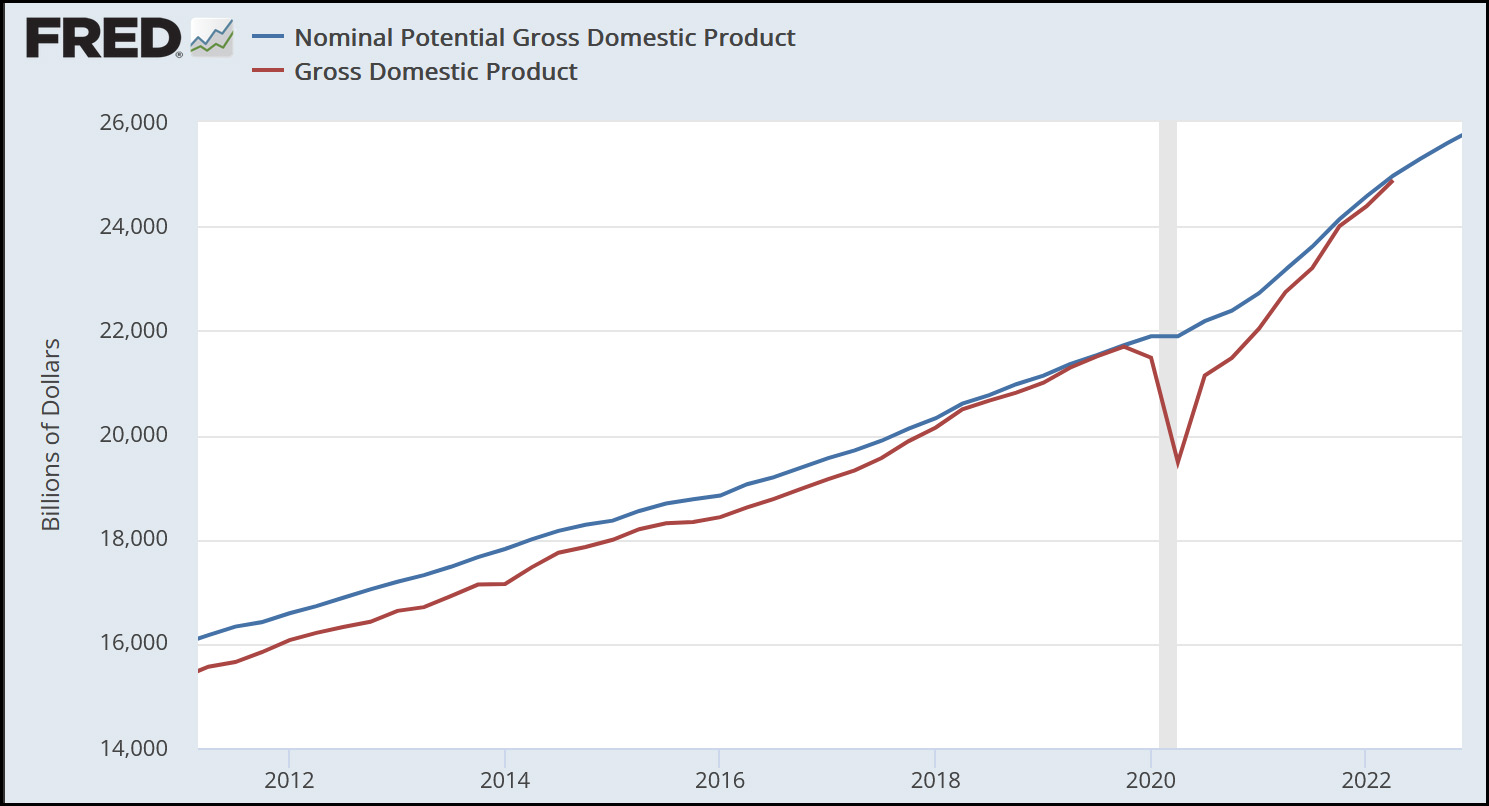

3. Here is GDP vs. potential GDP:

We have not yet hit potential GDP, let alone crossed it. This suggests the economy isn't overheated. On the other hand, we're pretty close. And inflation is high, which is the other classic sign of an overheated economy.

We have not yet hit potential GDP, let alone crossed it. This suggests the economy isn't overheated. On the other hand, we're pretty close. And inflation is high, which is the other classic sign of an overheated economy.

4. Soft landings are indeed difficult to pull off. On the other hand, it's not clear how hard we've ever tried to engineer one. The Fed tends to respond to inflation and only inflation. That's always likely to produce a hard landing.

5 & 6. Which side we should err on depends a lot on which side of the economic divide you're on. If you're old and rich, then yes, we should kill inflation wherever it appears. But if you're young and in danger of losing your job, maybe you think inflation is not the worst thing in the world.

FINAL SCORE: Really, Summers only made testable statements in 1, 2, and 3. And they're close calls. #1 supports his guess about anchored inflation expectations. #2 doesn't support his statement about core PCE being robust, and is half right about the tight labor market. #3 doesn't yet support his belief that the economy is overheated, but it's close. #4 is hard to argue with, but why not try anyway?

So it looks to me like we're on a knife edge. We probably are headed for a recession, but it's not clear to me that the rest of the data supports the notion that the Fed needs to engineer a deeper recession than we're already going to have anyway. They should pull back a bit and let the economy lose steam on its own.

On a year-over-year basis, headline inflation came in at 8.2%, down from 8.5% in July.

On a year-over-year basis, headline inflation came in at 8.2%, down from 8.5% in July.