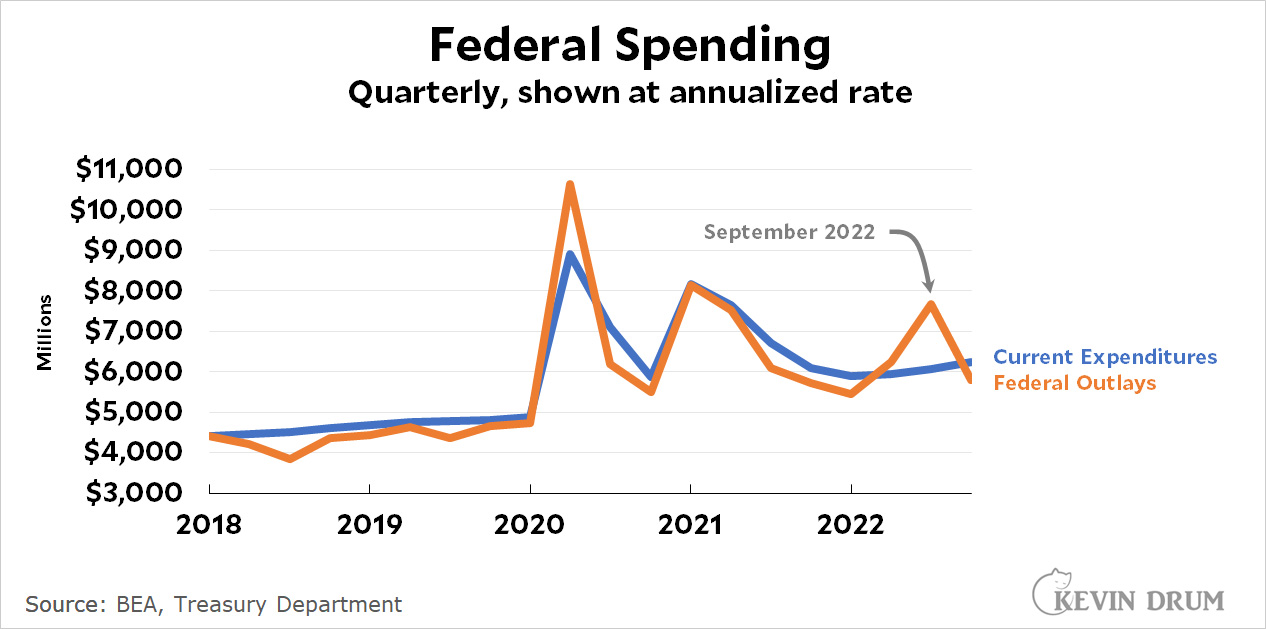

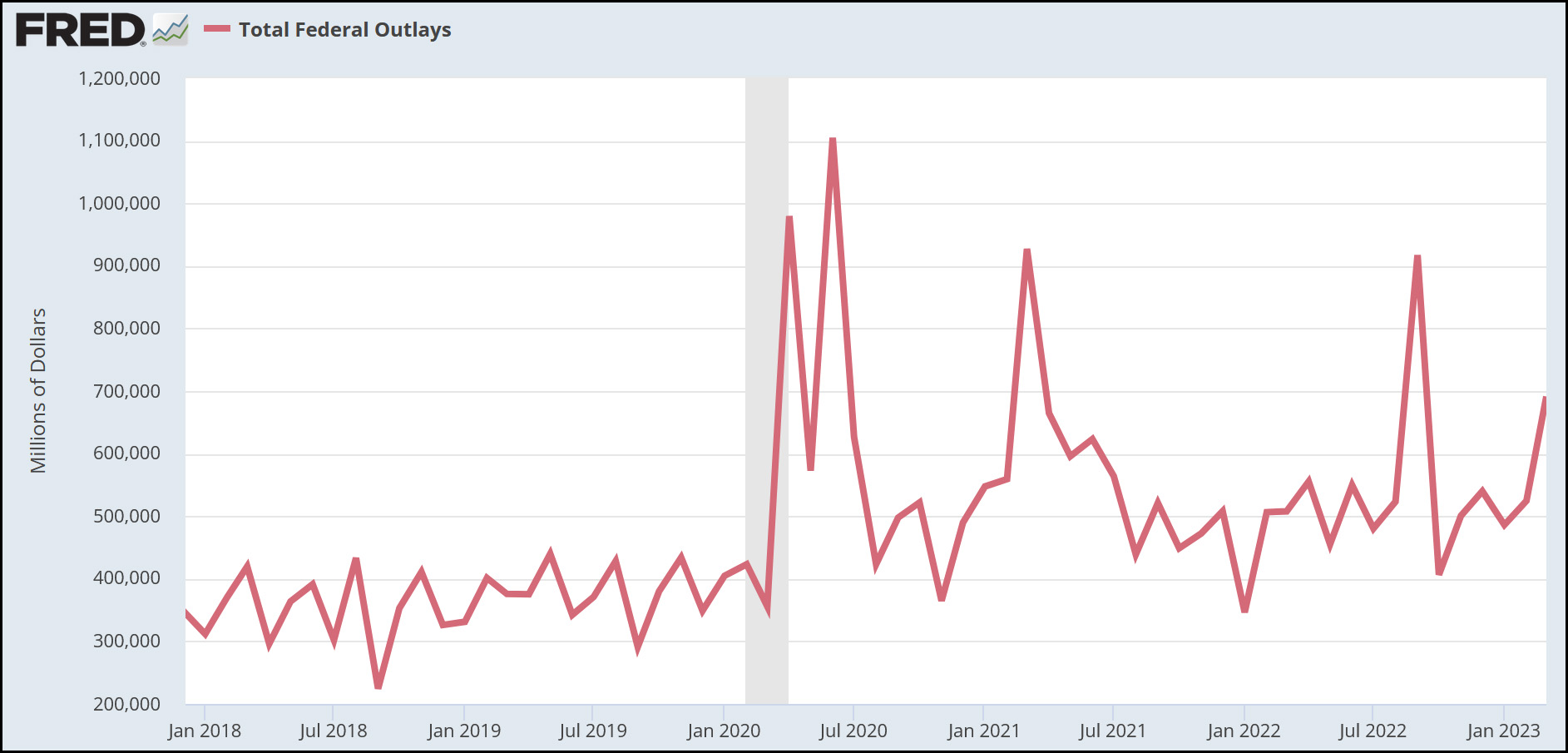

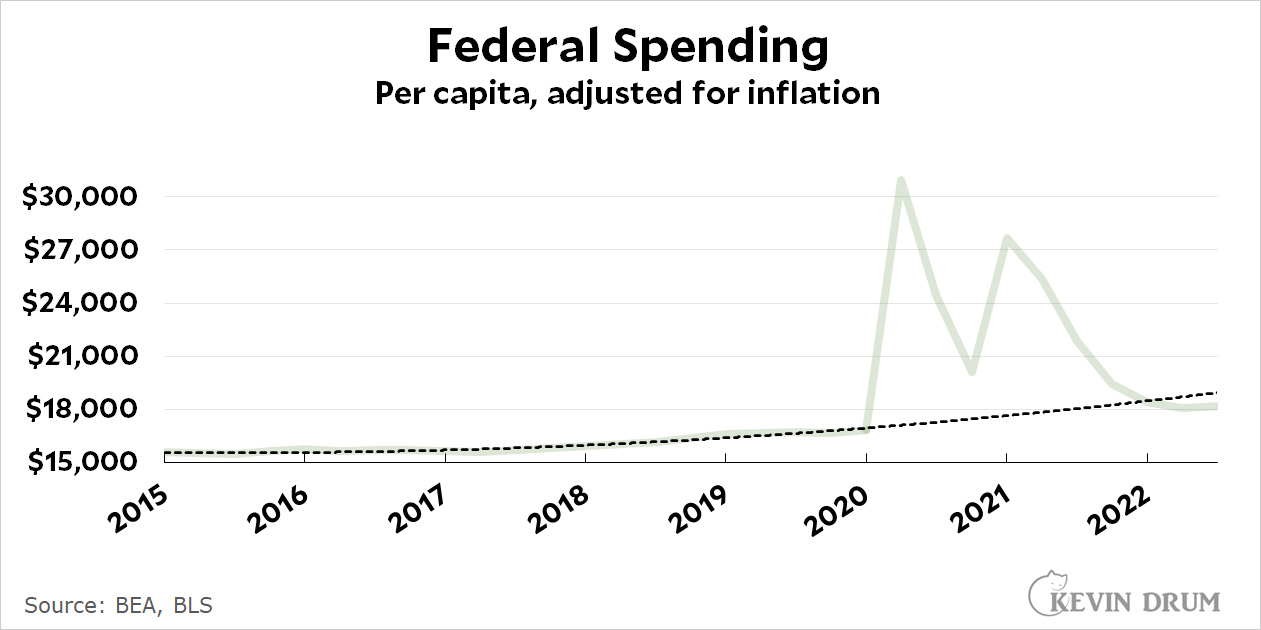

After the pandemic started we immediately passed a $3.5 trillion rescue bill. Later we passed two more rescue bills, bringing the total to over $6 trillion. Was that responsible for the spike in inflation that began in 2021?

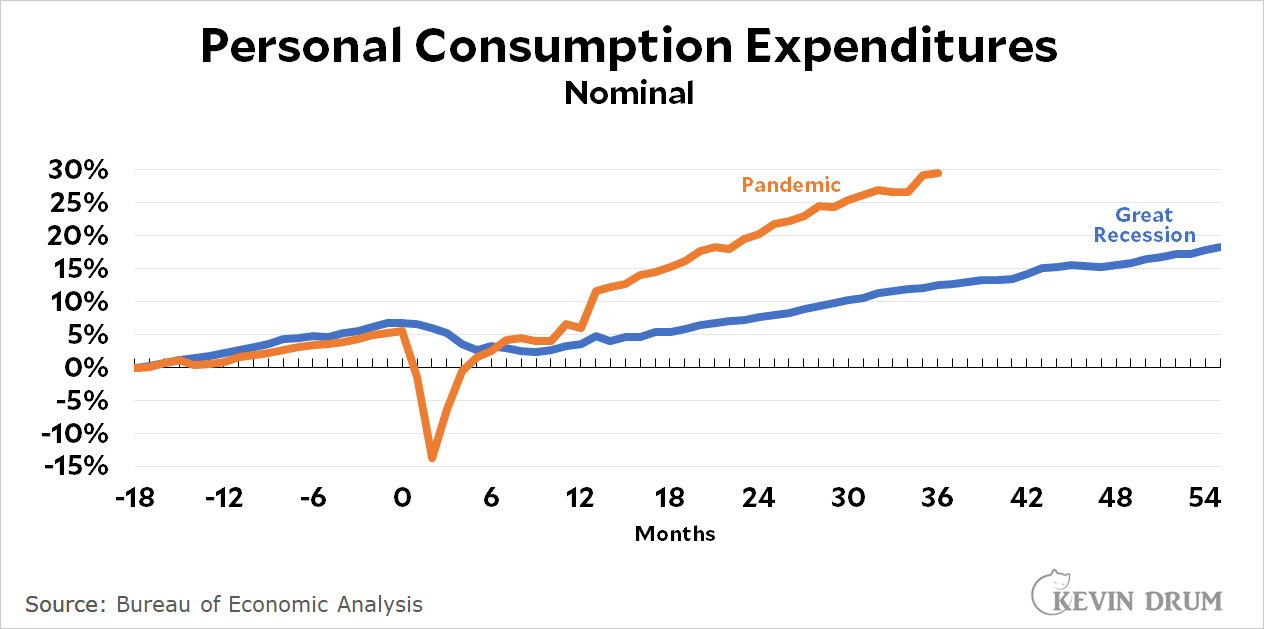

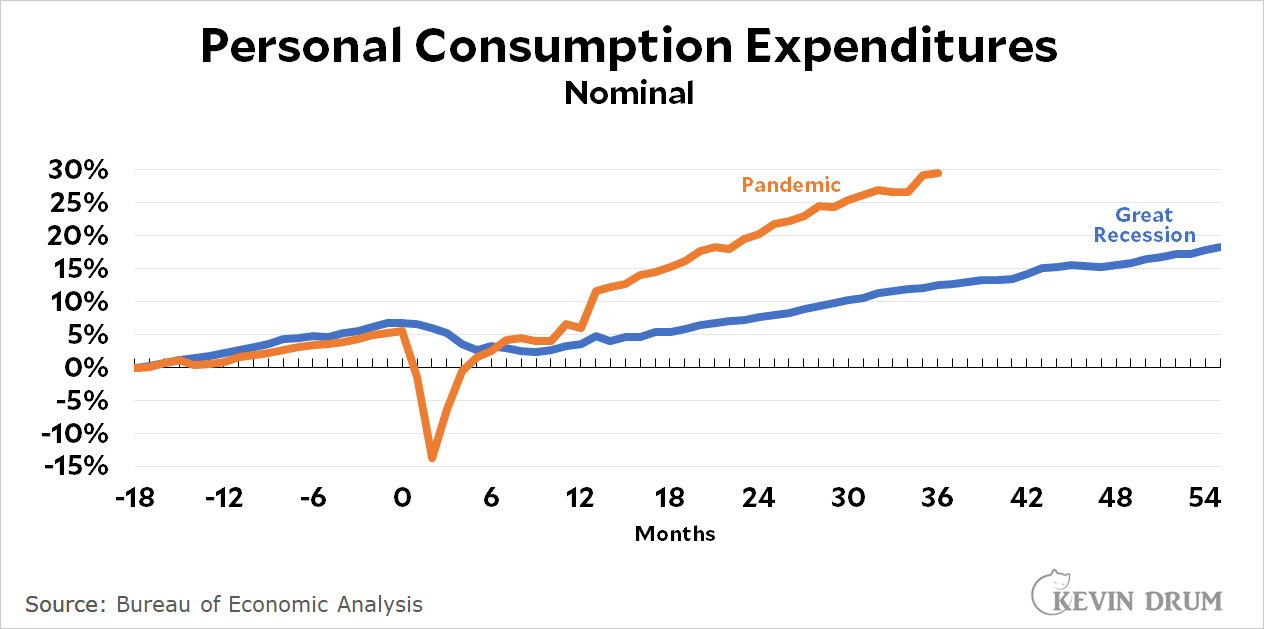

Yes and no. It was responsible for some of the inflation, but for a very specific reason: it kept consumer spending strong at a time when supply was constricted. Take a look at consumer spending during the pandemic vs. the Great Recession:

Following the Great Recession, nominal consumer spending grew slowly for many years thanks to inadequate stimulus. Conversely, consumer spending during and after the pandemic grew nicely, keeping the economy in good shape and helping millions of people avoid poverty and homelessness. So hooray for the COVID rescue packages!

Following the Great Recession, nominal consumer spending grew slowly for many years thanks to inadequate stimulus. Conversely, consumer spending during and after the pandemic grew nicely, keeping the economy in good shape and helping millions of people avoid poverty and homelessness. So hooray for the COVID rescue packages!

There was only one problem:

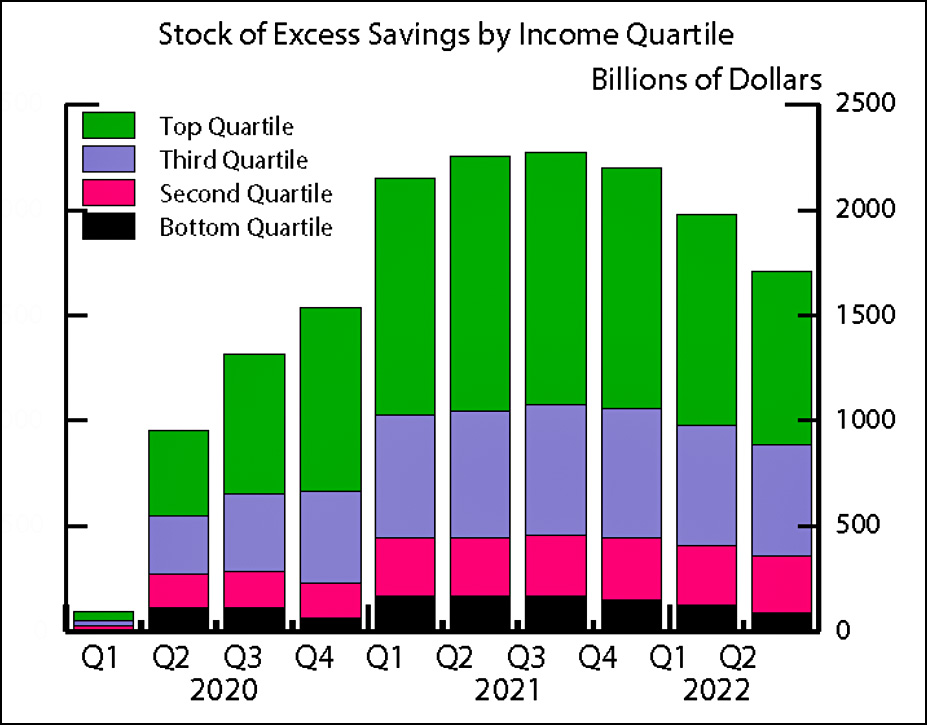

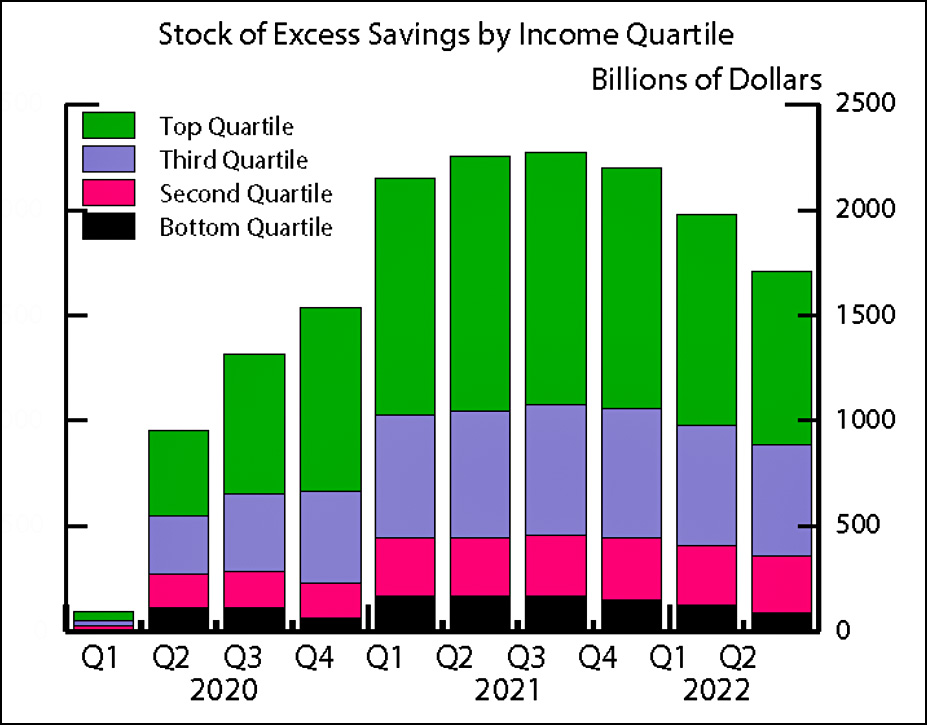

We gave too much money to people who didn't need it: middle and upper-middle class folks who hadn't lost their jobs. The lower half of the income spectrum never had a lot of excess savings in the first place, and in any case they mostly spent it on things like food and rent, which had little effect on inflation. The upper half, by contrast, peaked at close to $2 trillion in excess savings. And since they already had money for food and rent, they mostly bought consumer goods and services that were constrained by supply. So inflation shot up.

We gave too much money to people who didn't need it: middle and upper-middle class folks who hadn't lost their jobs. The lower half of the income spectrum never had a lot of excess savings in the first place, and in any case they mostly spent it on things like food and rent, which had little effect on inflation. The upper half, by contrast, peaked at close to $2 trillion in excess savings. And since they already had money for food and rent, they mostly bought consumer goods and services that were constrained by supply. So inflation shot up.

This was a situation that screamed out for means testing. We could have easily cut payments to the upper half by a trillion dollars with no adverse effects on either the economy or the individuals themselves. And on the upside, we would have created less inflationary pressure.

Inflation is declining now as supply constraints disappear and even high-income consumers eat through their excess savings. But we probably could have avoided our inflation spike altogether if we had been more careful about who we gave rescue funding to. Giving it to the well-off did nothing but cause problems.

Compared to the previous quarter, men's earnings were down $7. Women were up $8. The combined total was up 81 cents.

Compared to the previous quarter, men's earnings were down $7. Women were up $8. The combined total was up 81 cents.