Politico has a big piece today about the growth of tax-free retirement accounts—things like 401(k)s and Roth IRAs. The gist of it is that (a) these accounts cost the government just as much as if they were funded directly, and (b) the benefits go largely to the affluent:

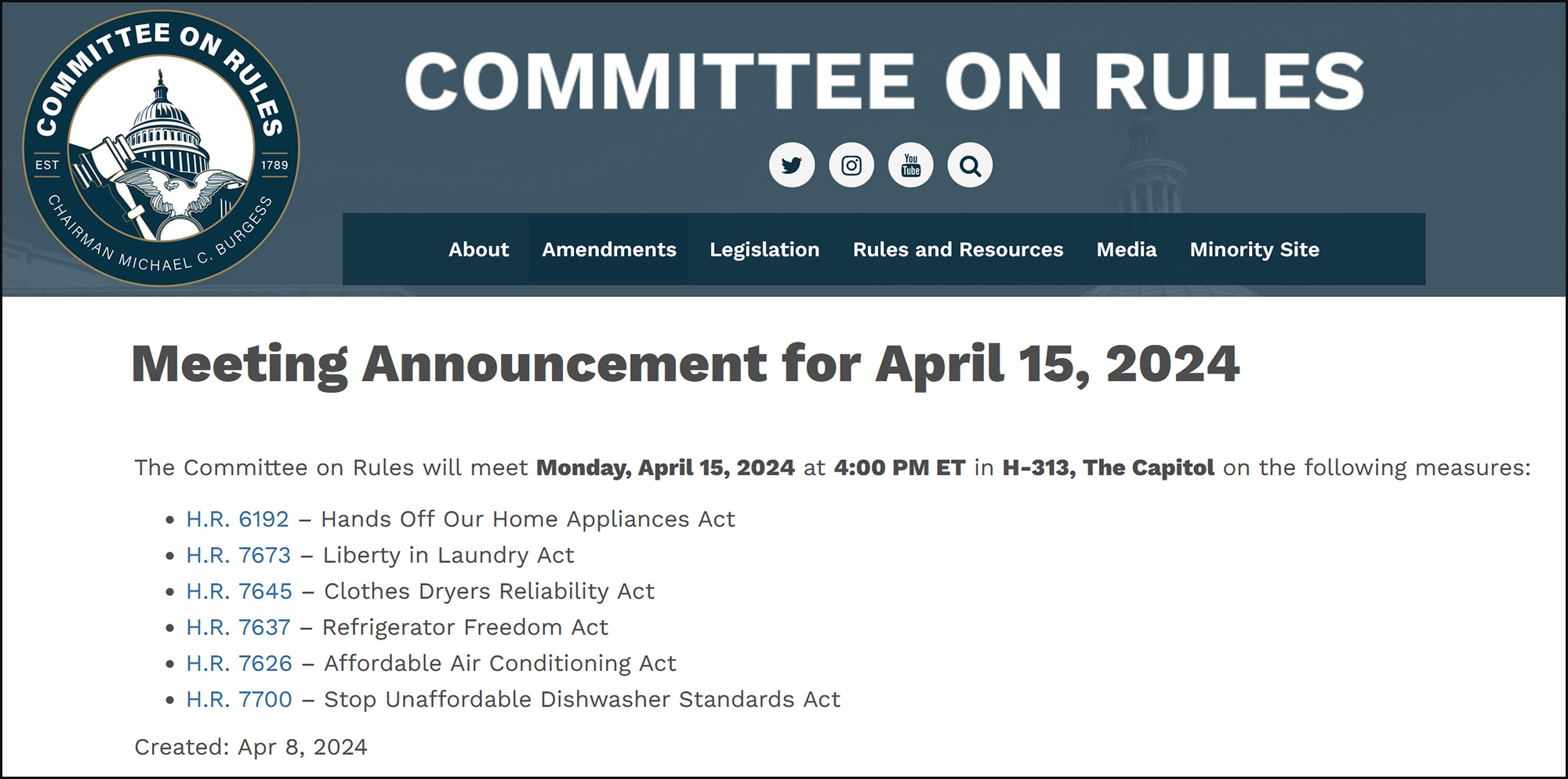

There's been a surge of expansion since 1996, largely pushed by the retirement industry:

There's been a surge of expansion since 1996, largely pushed by the retirement industry:

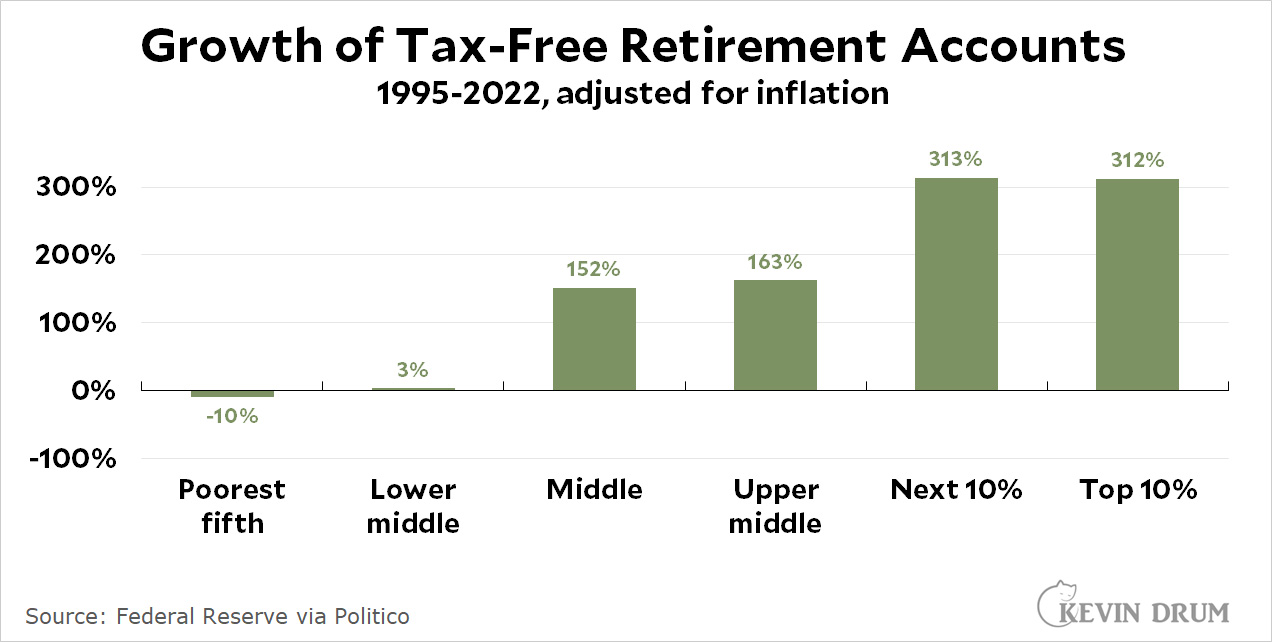

That success now vexes many retirement experts, alarmed by how easily Congress acquiesces to tax breaks for retirement savings that disproportionately help the wealthy while treating the benefits relied upon by most retirees — Social Security and Medicare — as budget-busters ripe for reform.

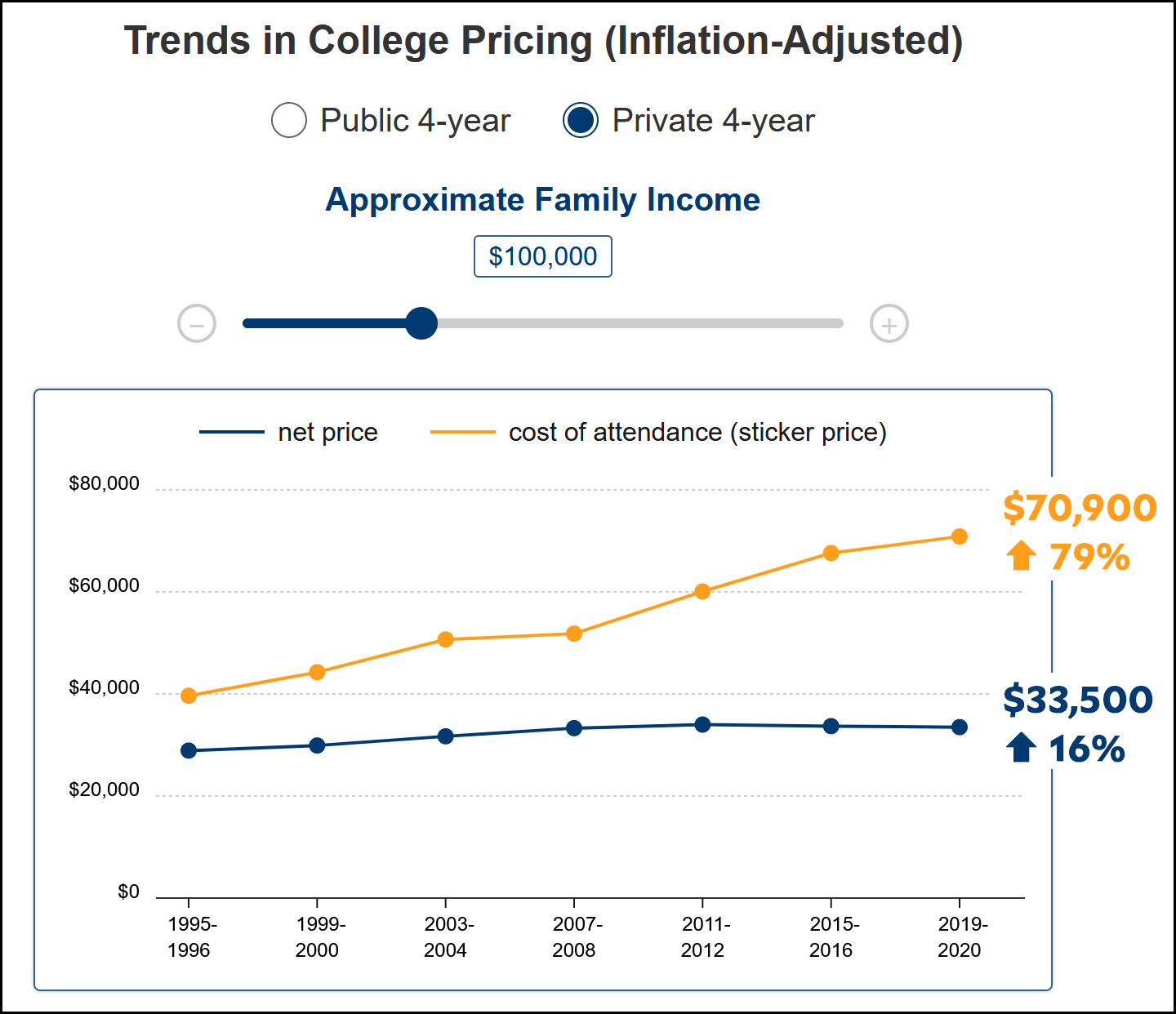

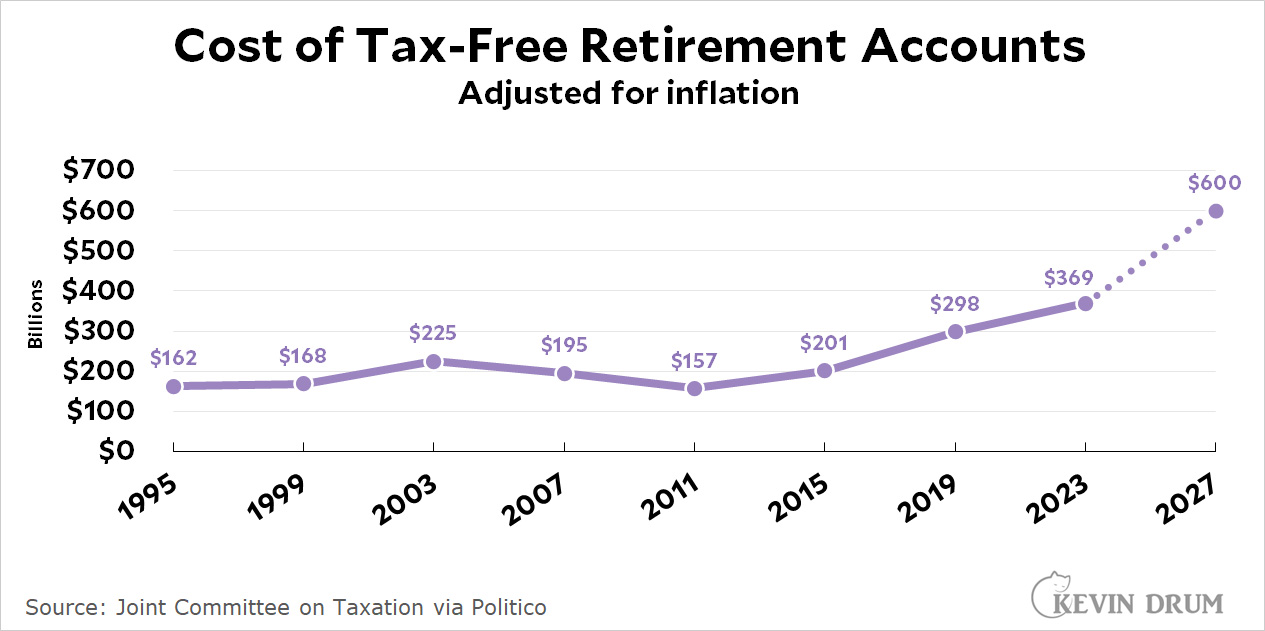

....The cost of retirement tax expenditures to the government is expected to nearly double in just four years from $369 billion in 2023 to $659 billion [nominal] in 2027.

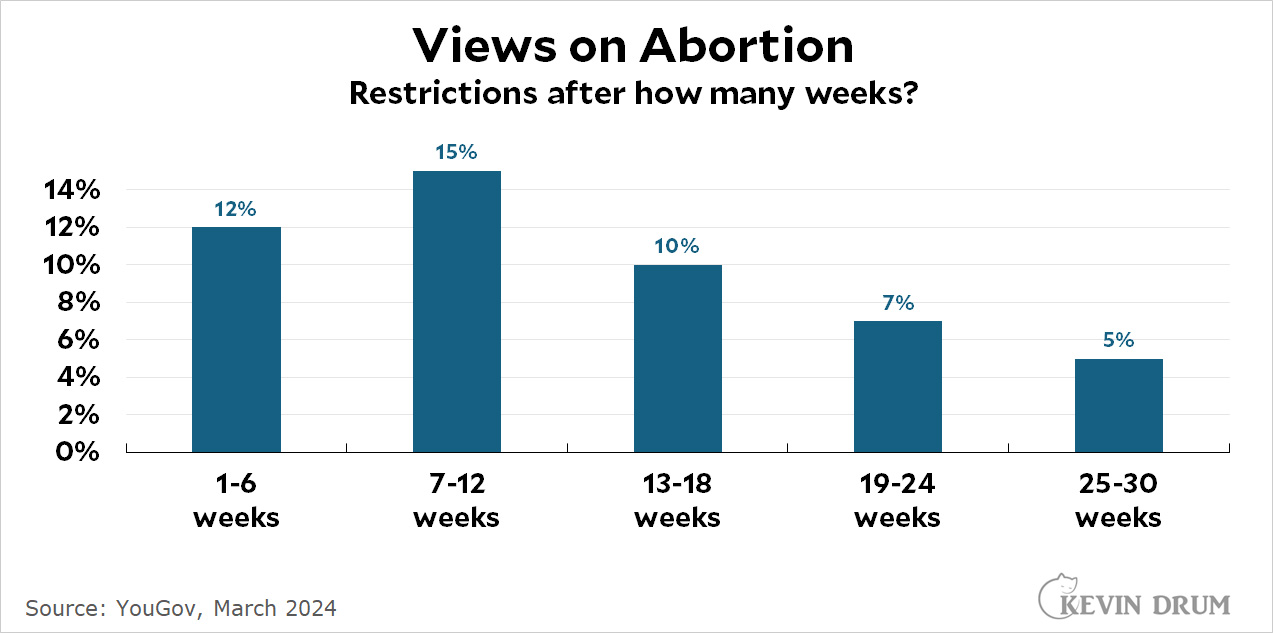

Social Security is progressive: it replaces most of your income if you're poor but only a fraction if you're higher income. Tax-free retirement accounts are just the opposite: they benefit the rich more than the poor, and that inequality has grown over time.

And they're expensive. Adjusted for inflation, the cost to the federal government has soared from $162 billion in 1995 to an estimated $600 billion in 2027:

It's notable that the change from 2015 to 2027—about $400 billion—is equal to the projected shortfall in Social Security starting in 2034. In other words, if this money had instead been committed to Social Security, it would be solvent forever.

It's notable that the change from 2015 to 2027—about $400 billion—is equal to the projected shortfall in Social Security starting in 2034. In other words, if this money had instead been committed to Social Security, it would be solvent forever.

But it wasn't. Instead all the talk is about increasing the retirement age and reducing Social Security's inflation adjustment, both things that would disproportionately harm the poor. But the retirement industry doesn't care much about that. After all, they don't make any money off the poor, do they?