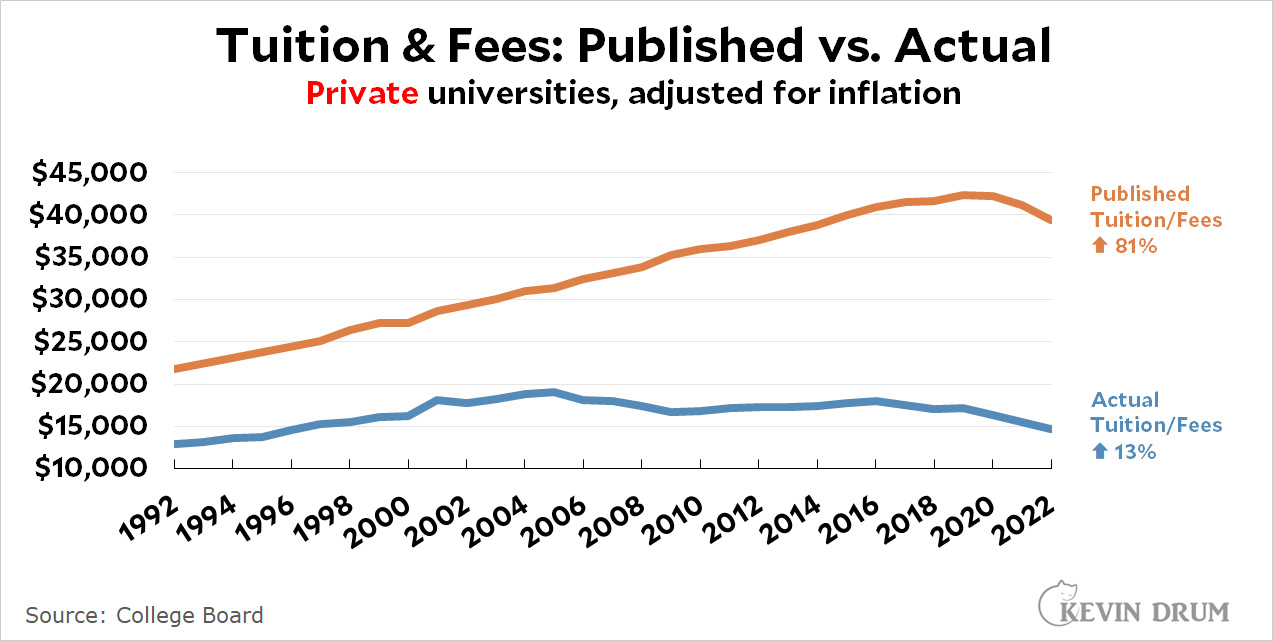

I have had my mind blown. Over at National Affairs, Dan Currell says that college tuition hasn't actually gone up over the past few decades:

In the late 1980s and early 1990s, colleges discovered that the appearance of high tuition was good for marketing. Positioning one's school as "almost as expensive as Harvard" created a sense of exclusivity and, somewhat contrary to economic theory, resulted in increased applications.

....Of course, almost nobody was willing to pay Harvard-level tuition for a middling college education. Colleges resolved this problem by canceling out their high sticker prices with "institutional scholarships" that had no money behind them; they were simply the discounts a school had to offer to convince students to enroll....Throughout the 1980s, colleges kept publishing ever-higher tuition numbers. Meanwhile, the tuition students actually paid rose only slightly.

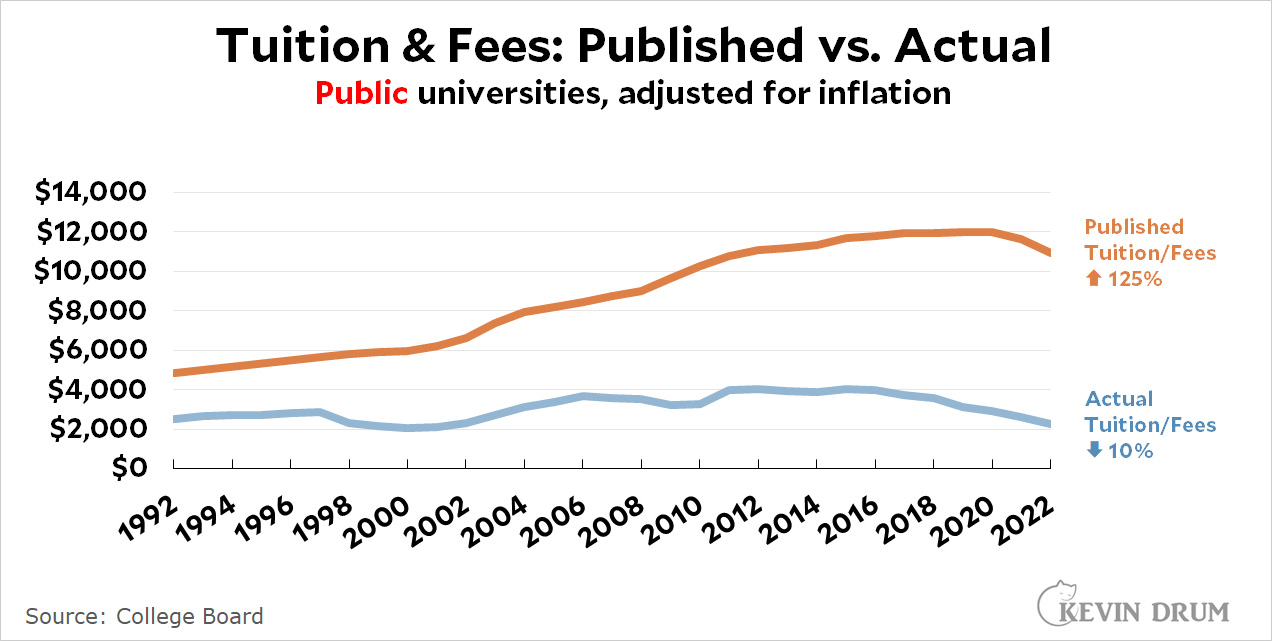

Naturally I was skeptical. But sure enough, every year the College Board publishes a report called "Trends in College Pricing," and right out there in the open it lists both the sticker price as well as the actual tuition that the average student pays. Here it is for public and private schools:¹

Now, some students do pay the full list price, but this is mostly limited to affluent kids going to the very top schools (Harvard, Yale, etc.). The vast majority of students pay far less than the published price thanks to "grants" and "scholarships" that are actually just routine discounts from the list price.

Now, some students do pay the full list price, but this is mostly limited to affluent kids going to the very top schools (Harvard, Yale, etc.). The vast majority of students pay far less than the published price thanks to "grants" and "scholarships" that are actually just routine discounts from the list price.

And once you account for that, the real-life price of college has barely changed over the past three decades. Since 1992, private school tuition has increased 13% while public school tuition has decreased 10%.²

This is so contrary to everything I've read and heard my entire life that I'm not sure I believe it. But the numbers are right there. In terms of what the vast majority of families actually pay, college costs no more today than it did in 1992.

¹The 1992-2005 figures are from the 2007 report, adjusted to 2022 dollars. The 2006-2022 figures are from the 2022 report and are also in 2022 dollars.

²Keep in mind that this is solely for tuition and fees. It doesn't count either books or room and board, both of which have increased at a higher rate.