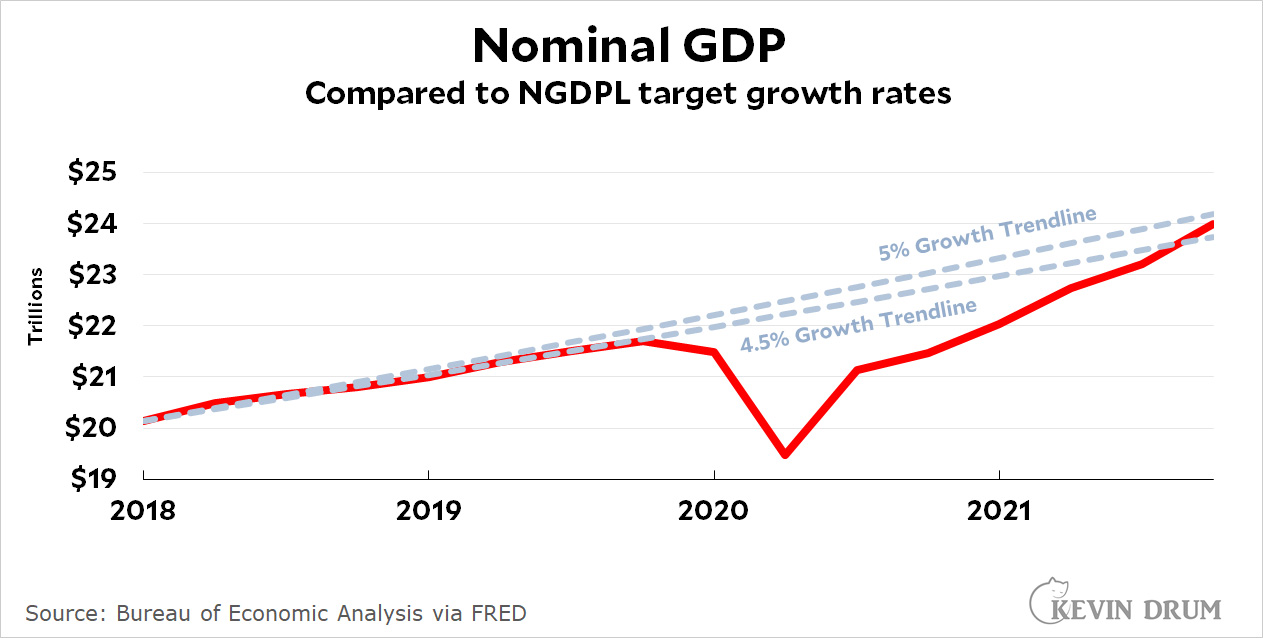

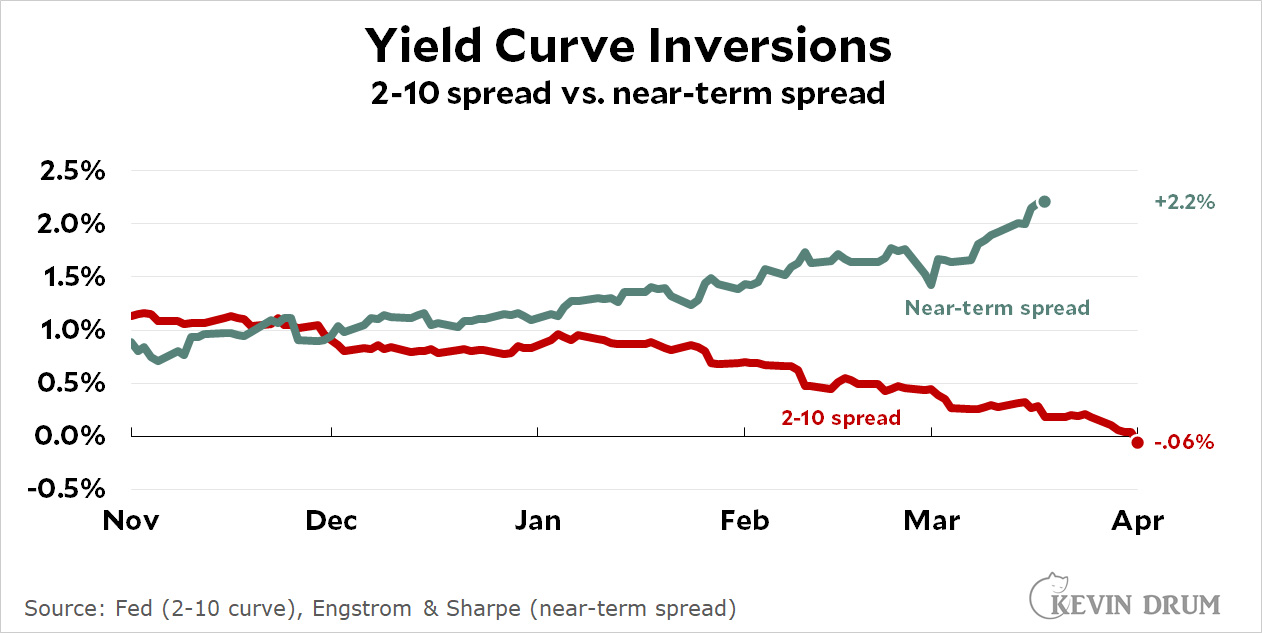

Yesterday the yield curve inverted: interest rates on 10-year Treasuries were lower than rates on 2-year Treasuries. This upends the normal order of the universe, in which you have to offer higher rates to investors to get them to buy long-term bonds. This has long been taken as a sign that we're in an economic twilight zone and are about to enter a recession.

But the the Fed says fuggedaboutit. The conventional 2-10 yield spread is useless as a recession indicator. Instead we should look at the near-term yield spread, which is currently extremely healthy:

The near-term spread was created a few years ago by a couple of Fed economists looking for a better predictor of recessions. They came up with a "more intuitive" metric that "gauges the slope of the Treasury term structure":

The near-term spread was created a few years ago by a couple of Fed economists looking for a better predictor of recessions. They came up with a "more intuitive" metric that "gauges the slope of the Treasury term structure":

[This] be interpreted as a measure of the market’s expectations for the trajectory of conventional near-term monetary policy. When negative, it indicates market participants expect monetary policy to ease on net over the next several quarters, presumably because they expect monetary policymakers to respond to the threat or onset of a recession. [Thus, when positive, it means investors think the Fed isn't worried about a recession. -kd] The predictive power of our near-term forward spread indicates that, when market participants expected—and priced in—a monetary policy easing over the next 18 months, their fears were validated more often than not.

The authors doubled down on their prediction here. More importantly, earlier this week Fed Chair Jerome Powell himself sang the praises of near-term spreads:

On Monday, Powell cited the steepening gap between the forward-implied rate on three-month Treasury bills versus the current three-month level as a tell-tale sign that the bond market has actually given an economic all-clear. Powell’s message at the National Association for Business Economic was unmistakable: the Fed has plenty of room to aggressively jack up rates to fight inflation without choking growth.

Let me get this straight. When the near-term spread is positive, it means that investors think the Fed isn't worried about a recession. Fed chair Jerome Powell then suggested this means the Fed shouldn't be too worried about a recession.

That sounds a little circular to me, but what do I know? In the meantime, I'll point out a problem: The 2-10 spread is easily available on a daily basis. Conversely, the near-term spread is based on a complicated calculation and is only available when someone decides to calculate it. This means that news outlets can obsessively keep track of the 2-10 spread but they generally have no idea of what the near-term spread is. Until that changes, no one is going to pay attention to it.